Create VAP on a manually created general ledger posting

Create manual general ledger posting

To open the General ledger postings (ATR) application, find Finance in the RamBase menu and then General ledger. Click General ledger postings to enter the General ledger postings (ATR) application.

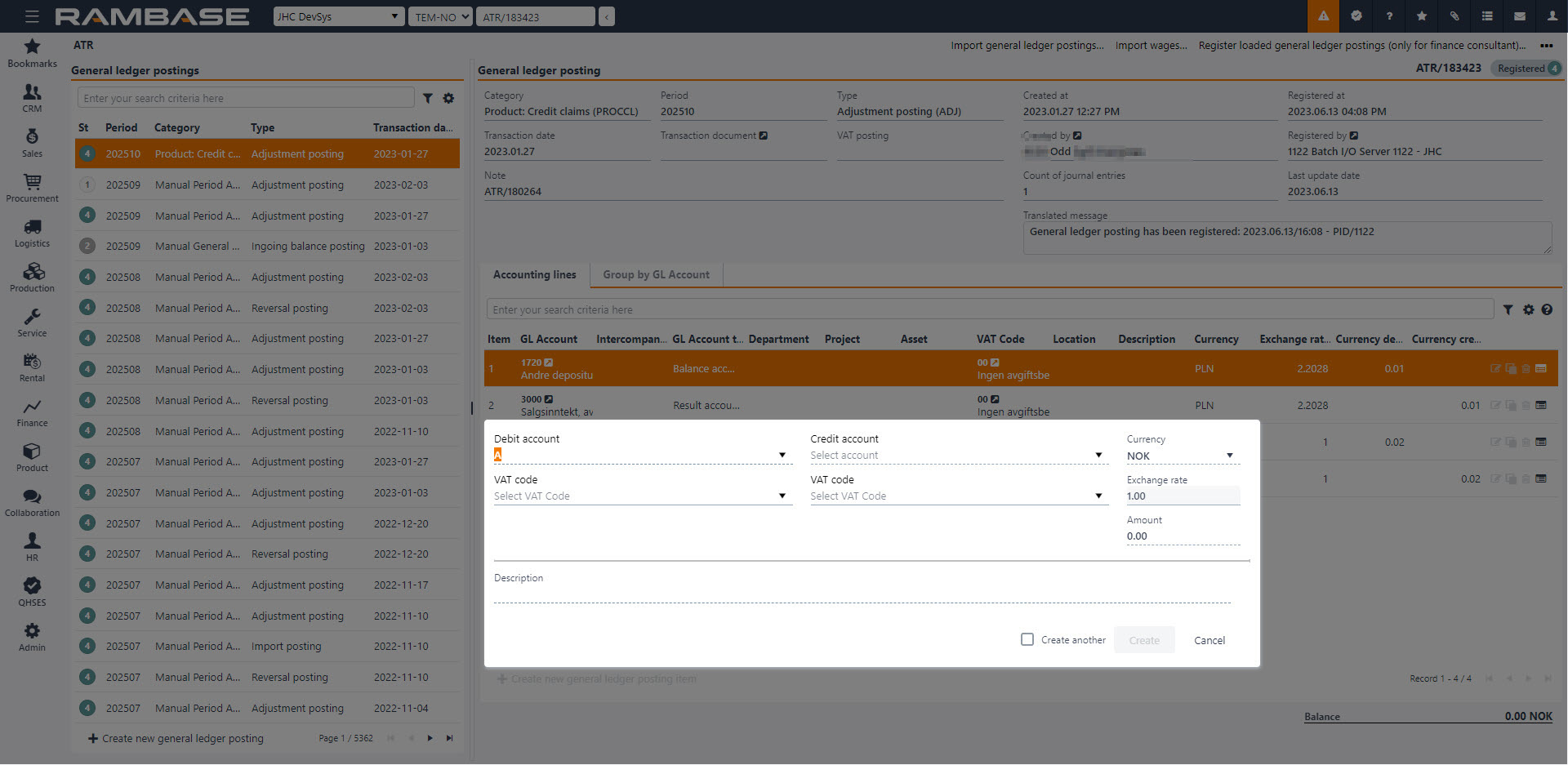

Click the Create new general ledger posting icon in the lower left hand corner.

Fill in the following fields in the popup:

Transaction date - Select the transaction date for the posting.

Period - Select the period for the posting.

Category- Select the category for the posting.

Note- Optional, add a note.

Click the Create button to create a general ledger posting document in Status 1.

Add a posting on both the debit and credit account or only on the debit or credit account in the popup.

Click the Create new general ledger posting item icon in the lower left hand corner to open the popup.

Add Account(s), amount and dimension(s).

Check Create another option to leave the popup open.

Click the Create button when finished to create new item.

After you have added all the general ledger entries, open the menu and click on the Register General Ledger Posting option.

Create VAP on a manually created general ledger posting

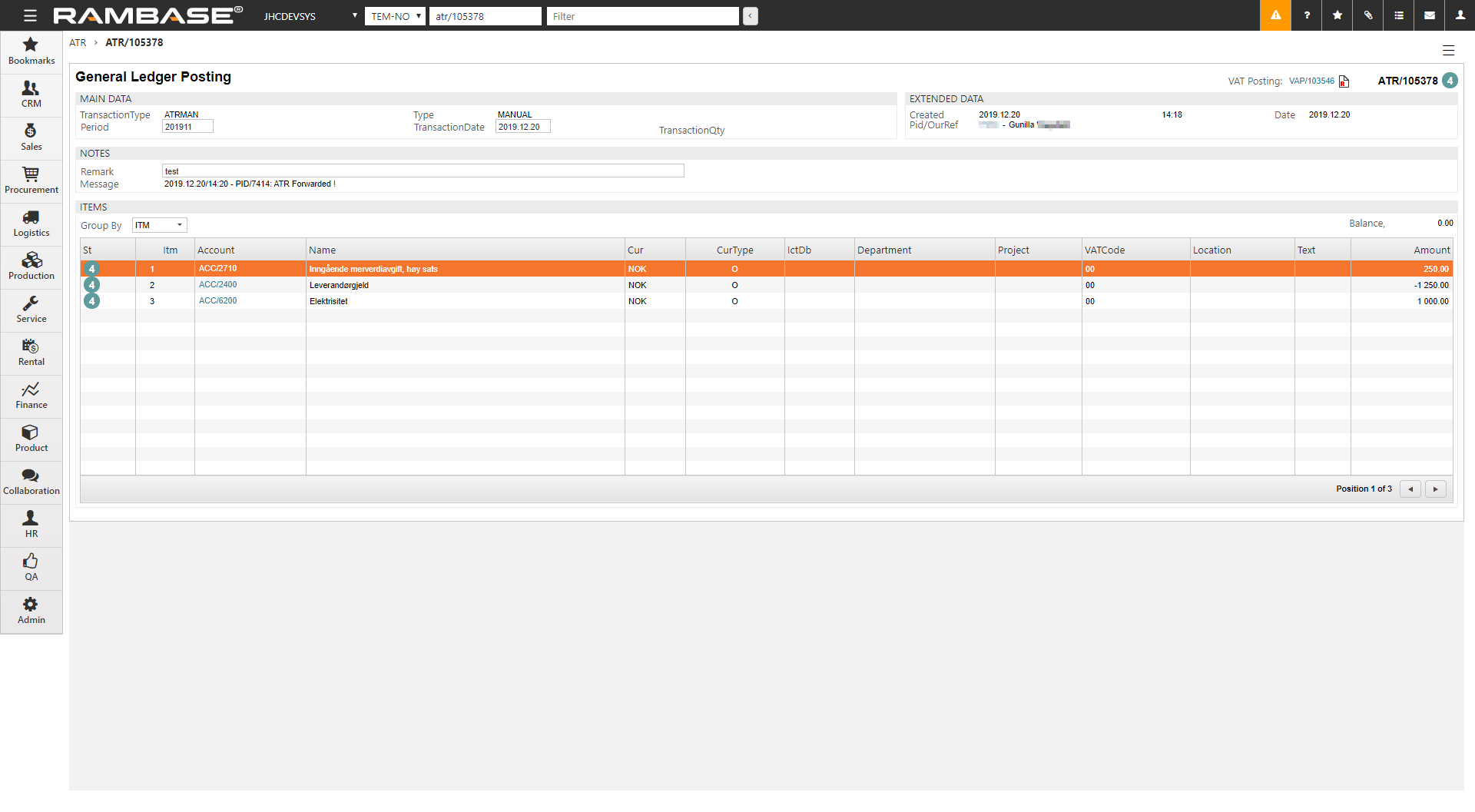

If you add a general ledger entry with a VAT code, then you also need to add a separate line of entry to the VAT account. The cost account must be entered with the correct VAT code and the net amount in the Amount field.

After registration, click on the Create VAT Posting from General Ledger Posting option. This is necessary in order for the VAT postings to be registered in the VAT return. This will give the ATR document a VAP document that is the basis for the VAT return.

The VAP document is visible in the upper right corner.

The reason why the VAP document is not created automatically, is that it allows you to create manual ledger entries where you can make corrections to the VAT accounts without affecting the VAT return. For example, in the case of differences between the general ledger and the VAT return.

ATR posting rules

Each ATR must have postings on both the debit and credit side.

You normally post with positive sign on both side.

For some countries it may be required to post with negative amount on the debit or credit side to keep all postings on one account on the same side. In RamBase it is possible to post negative numbers on both the debit and credit side. Please note that if you post an negative amount on the debit side, this will result in the same result as if you had done positive posting on the credit side and the other way around.

If an ATR only consists of debit postings or only of credit postings, the user will not be able to register to ATR. To be able to register to ATR, both a debit and a credit posting need to be added for the GL account set up in ACD/DEBITCREDITCLEARINGACCOUNT. The sum of the postings for ACD/DEBITCREDITCLEARINGACCOUNT will be 0.