Manage the Chart of accounts (ACC)

The chart of accounts provides the structure for the general ledger. Adapting of the chart of accounts is necessary to make the book-keeping system fit the economic activity of the business. The chart of accounts is unique for each company, but there are substantial similarities, so it is possible to import a standard chart of accounts when starting up your business accounting. A chart of accounts contains an overview of your ledger accounts.

The Chart of accounts (ACC) application can be used to both adapting the chart of accounts, and to examine the values and underlying transactions posted to each account.

Together with a very flexible use of Account groups (ACG), a RamBase Chart of accounts (ACC) fits into most fiscal structures.

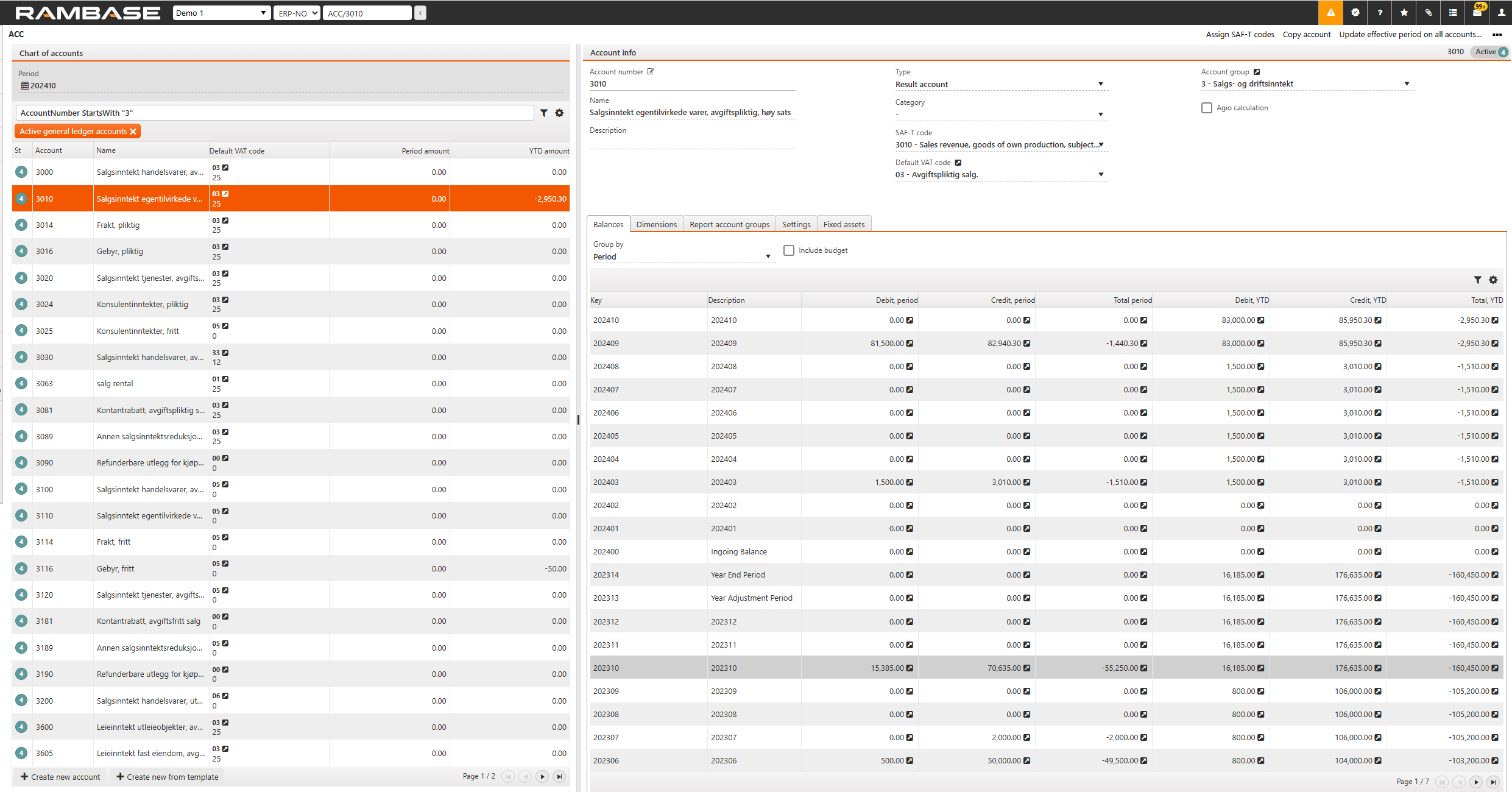

The Chart of accounts (ACC) application

To the left of the application is a list of all the accounts in the selected database. The period selected in the Period field will guide the amount displayed in the list. Use the Search field and/or the Filter builder icon above the list to filter the accounts.

Account info area

To the right is a more detailed information about the selected account. In the Account info area are some general information about the account.

Account Number - The account number.

Name - Name of the account.

Type - Define if the account is going to be a Result, Profit and Loss (P&L) or Off-balance account.

Category - Bank is mandatory for Bank accounts. Provisions and Prepayments is mandatory if you would like to use more accounts for provisions and prepayments then the one which is set up in ACD/SPATOT (supplier period adjustments total) or ACD/CPATOT (customer period adjustments total). Other values are optional.

SAF-T code - Set the standard account in the SAF-T code field if your company uses SAF-T financial for exchanging accounting data. The SAF-T code field is the basis for the account number reported in the SAF-T file.

Default VAT code - Select the correct VAT code.

Account group - The general ledger account group identifier.

Agio calculation - Use the checkbox if the balances posted to this account should be agio calculated.

Parent account number - Add the parent account in this field. This setting will only be shown if your company has activated a Company setting (CSV) for using the chart of account’s tree structure.

Control account - Use the checkbox if the account is a control account. This setting will only be shown if your company has activated a Company setting (CSV) for using the chart of account’s tree structure.

The Balances tab

The Balances tab will display the balance of the selected account. To improve the view, use the Group by field. The transactions can be grouped by:

Period

Department

Finance project

Asset

VAT code

Transaction type

Transaction date

Currency, amounts in local currency

Currency, amounts in foreign currency

Intercompany code

Warehouse location

Year

It is also possible to filter by custom dimensions (DIM4-10) in the Group by field.

Use the Include budget checkbox if you have uploaded a budget to the database and want to see the budget numbers in the Balances tab.

The Dimensions tab

The Dimensions tab defines the dimension parameters to be required, not used or optional. In addition to the dimensions set in the Dimensions (DIM) application, Location (LOC) and InterCompany Database (ICTDB) are also used as dimensions. LOC refers to different warehouse/stock locations, ICTDB refers to transactions between companies within a corporation.

LOC - The parameter is set (Required) for accounts regarding flow of goods, if you want to differentiate the expenses of stock for various stock locations. The values of the LOC dimension are fetched from the LOC application in RamBase.

ICTDB - The parameter is set (Required) for accounts regarding Sale, Purchase and other financial transactions between internal companies. If not set, the accounts receivable and accounts payable will show incorrect values from a corporate point of view.

DEPNO - The parameter is set if you want to connect postings on the account to a certain department. If set to Optional or Required, there is a possibility to set a default department for the general ledger account.

PRJNO - The parameter is set if you want to connect postings on the account to a certain project.

ASTNO - The parameter is set if you want to connect postings on the account to a certain asset (for example a building or a truck).

Other dimensions - The parameter is set if you want to connect postings on the account to other dimensions created in the Dimensions (DIM) application.

The Report account groups tab

The accounts belongs to certain Report account groups (ACG). The use of account groups is usually governed by a set of rules and standards in accordance with financial statement reporting. This tab is used to connect the account to one or more account groups. Note that report account groups are usually managed from the Report account group (ACG) application.

Use this tab to set up and inspect Report account groups (ACG) linked to this account. Use the Link to report account group button to link the account to a new account group.

The Settings tab

The settings tab displays general settings for the selected account. Click on the name of the fields to see a description about that field.

Department - The possibility to set a default department.

Effective period - The accounting period for the account to be valid from.

Expiration period - The accounting period for the account to be valid to.

Last GL posting period - The accounting period for the last posting period of the account.

Budget account - The possibility to set the budget account to be compared with the account.

Use the blocking checkboxes to prevent transactions being posted from different registers and/or documents. For example, you can prevent postings to a sales account from the General ledger (ATR) to ensure postings is generated from invoices only. It is possible to block the account from postings generated by:

Sales invoices

Sales credit notes

Sales posting adjustments

Supplier invoices

Supplier credit notes

Supplier posting adjustments

Payments

Manual GL postings

The Fixed assets tab

If the account is used for a Fixed assets document (FAR), it will be visible here. The balance account, depreciation account and amounts connected to the fixed asset will be shown.

Use the Forward to fixed asset field to specify how investments should be transferred into the fixed assets register.