Bank reconciliation

Before starting a bank reconciliation, the bank statements have to be imported from the bank into RamBase. When bank statements are imported, the transactions are matched with Payment (PAY) documents recorded in the cash management module in RamBase.

The reconciliation job can be initiated manually or carried out automatically on a regular basis to your company's setup. Regardless of how the reconciliation job is initiated, the reconciliations must be inspected and confirmed manually.

Bank reconciliation must be done prior to period closure.

Bank statements (BST)

The Bank statements (BST) application list all transactions for a account over a set period. The statement includes deposits, charges, withdrawals. as well as the beginning and ending balance for the period, along with any interests.

Bank statements list - Left side

The filtering options allow for easy organizing to the users' need.

The following areas are described in the sections below:

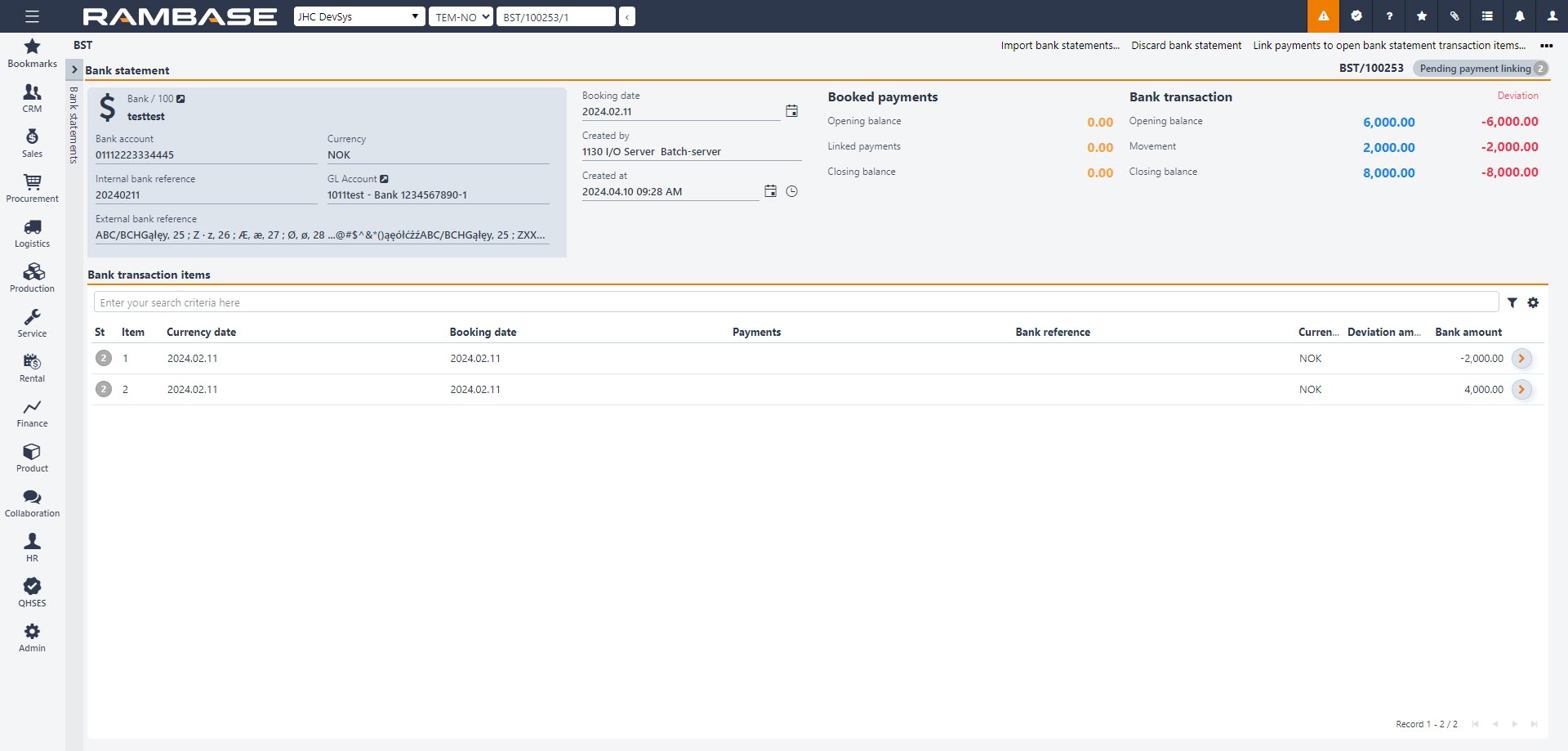

Bank statement area - Header right side

Bank transaction items area - Right side

Bank statement area - Header right side

The Bank statement area contains fields to help the user list only the intended Bank statement (BST).

Field | Icon | Description |

|---|---|---|

Bank field | Displays the Bank (BANK) identifier. | |

Bank account field | Bank account number | |

Currency field | Displays the currency selected for the bank account in the Bank (BANK) application. | |

Internal bank reference field | Sorting index of bank statement | |

External bank reference | ||

GL Account | Displays the name of General ledger account name |

Icon | ||

|---|---|---|

Booking date field | Displays the date the transaction was booked into the system. | |

Created by field | Either displays the identifier of the system batch job or the the Personnel (PER) identifier of the user who created the bank statement, including first and last name. | |

Created at field |

| Displays the date and time of creation |

| ||

Booked payments | Booked payments are figures which are imported from the Bank (BANK) application. After reconciling payments or confirming Bank statement (BST) items (when Bank statement (BST) goes to Status 8) these amounts are imported to Bank statement (BST). When status is < 8, Opening balance and Closing balance equals 0. | |

Opening balance | Balance at the beginning of the day, before Bank statement (BST) was created (it should equal Closing balance from the last day). | |

Linked payments | Sum of payments linked to Bank statement (BST). | |

Closing balance | Total amount of transactions for this bank, including created Bank statement (BST) - (Opening balance + Linked payments). | |

Bank transaction | Bank transaction shows amounts which are given when creating new Bank statement (BST), when Bank statement (BST) was created manually or imported from a file. When Bank statement (BST) is created using the Import bank statements from bank integration…operation, Bank statement (BST) is created automatically and amounts are imported from bank integration. They are visible when Bank statement (BST) < 8 and they are compared to Booked payments figures. | |

Opening balance | Balance at the beginning of the day, before Bank statement (BST) was created (it should equal Closing balance from the last day) | |

Movement | Sum of transactions in Bank statement (BST). | |

Closing balance | Total amount of transactions for this bank, including created Bank statement (BST) - (Opening balance + Movement). | |

Deviation | Booked payments – Bank transaction. |

Bank transaction items area - Right side

Columns | Description |

|---|---|

St | Status of bank statement |

Item | Transaction identifier of the bank statement |

Created at | Date and time of creation |

Currency date | Currency date of the bank statement transaction |

Booking date | Booking date of the bank statement transaction |

Payments | Displays the related payment document with a navigation link. If there is more than 1 PAY document related with current transaction, then clickable money bag icon is displayed with all related payment documents list. |

Bank reference | Reference from the bank |

Internal message | Internal message from the system |

Transaction reference | Our internal reference |

Payment message | Message from the payment |

Reconciliation Id | Reconciliation identifier of the bank statement |

Reconciliation method | Method of reconciliation |

Approved by | User identifier |

Currency | Currency used for the bank account |

Payment amount | Payment amount |

Deviation amount | Deviation amount |

Bank amount | Transaction amount |

Bank statement (BST) procedures

Automated bank statement reconciliation (BST)

The Bank statement (BST) application lists all bank statement documents. These documents are based on the files imported from the bank(s).

From the Bank statement (BST) application, you may import bank statement files from a bank and initiate an automated bank reconciliation. The reconciliation will be performed automatically on a regular basis if the Company setting (CSV) ‘Reconcile bank statement automatic’ is activated. Manual bank reconciliation can be initiated from each Bank statements (BST) document in Status 2 or from the Bank statement (BST) menu.

To go to Bank statement (BST) enter Finance, then Cash management and then Bank statements.

Importing a bank statement file manually

Start in the Bank statement (BST) application.

Click the Import bank statement... option in the Context menu.

Choose a format.

Click the Next button

Click the Select file button and browse to the bank statement file. Click the Upload button and a progress bar will appear.

When the import is finished, one or several Bank statement (BST) documents are created One Bank statement (BST) document is created for each transaction date. All transactions on the same date will appear as items on the relevant Bank statement (BST) document. The generated Bank statement (BST) documents will be listed in Status 2. This means that is and are ready for reconciliation. If the Bank statement (BST) document is listed in Status 1, there is a deviation. The deviation is typically between closing and opening balance between two dates or if the sum of Bank statement (BST) item does not match the sum of opening balance - closing balance for that specific Bank statement (BST).

Import bank statements from bank integration manually

The company using RamBase must have the bank integration active to import bank statements from bank integration manually.

Click the Import bank statement from bank integration... option in the Context menu.

Fill out Bank account, From date, To date fields in the popup.

Click Confirm. When import job is finished, one or several Bank statements (BST) in Status 1 is created.

When the import is finished, one or several Bank statement (BST) documents are created in Status 1. One Bank statement (BST) document is made for each transaction date. All transactions on the same date will appear as items on the relevant Bank statement (BST) document. The generated Bank statement (BST) documents will be listed in Status 1 until the opening and closing balance for the Bank statement (BST) is imported. When the opening and closing balance are imported, the Bank statement (BST) will be listed in Status 2. Bank statement (BST) in Status 2 means that it is ready for reconciliation. If the Bank statements (BST) documents remain in Status 1 after having imported the opening and closing balance, there is a deviation. The deviation is typically between closing and opening balance between two dates or if the sum of Bank statement (BST) item does not match the sum of opening balance-closing balance for that specific Bank statement (BST).

Import bank balances from bank integration

The company using RamBase must have the bank integration active to import bank balances from bank integration manually.

This will happen automatically, but it is possible to trigger it if you want to start the job manually.

Start in the Bank statement (BST) application

Mark the Bank statement (BST) in Status 1 and click the Context menu and choose the Import bank balances from bank integration option.

The Bank statement (BST) document will be listed with Status 2 after the import is done. Bank statement (BST) in Status 2 means that it is ready for reconciliation. If the Bank statements (BST) document remains in Status 1 after having imported the opening and closing balance, there is a deviation. The deviation is typically between closing and opening balance between two dates or if the sum of Bank statement (BST) item does not match the sum of opening balance-closing balance for that specific Bank statement (BST).

Start a bank reconciliation

From the Bank statement (BST) application, you may initiate a bank reconciliation. The reconciliation will be performed automatically on a regular basis if the Company setting (CSV) ‘Reconcile bank statement automatic’ is activated.

Manual bank reconciliation can be triggered from each Bank statements (BST) document in Status 2 by clicking the Reconcile this bank statement… option or from the Bank statement (BST) menu.

Start in the Bank statement (BST) application.

Open the Context menu and click on the Start bank statement reconciliation job option. The reconciliation tries to match the bank transactions in the Bank statement (BST) against the Payment (PAY) documents registered in RamBase.

If RamBase finds a match between a Bank statement (BST) item and a Payment (PAY) document, the Bank statement (BST) item will be put to Status 8. When all Bank statement (BST) items in one BST have a match against a Payment (PAY) document, the Bank statement (BST) will be set to Status 8. A Bank statement (BST) document in Status 8 can be confirmed as reconciled to Status 9 which is typically done at month end.

If RamBase finds a partial match, that is a match with minor deviations, the Bank statement (BST) item is put to Status 3.

If RamBase does not find a match, the Bank statement (BST) item is put to Status 2.

Bank statement (BST) documents in Status 1 indicates a deviation. The deviation is typically between closing and opening balance between two dates or if the sum of Bank statement (BST) item does not match the sum of opening balance-closing balance for that specific Bank statement (BST).

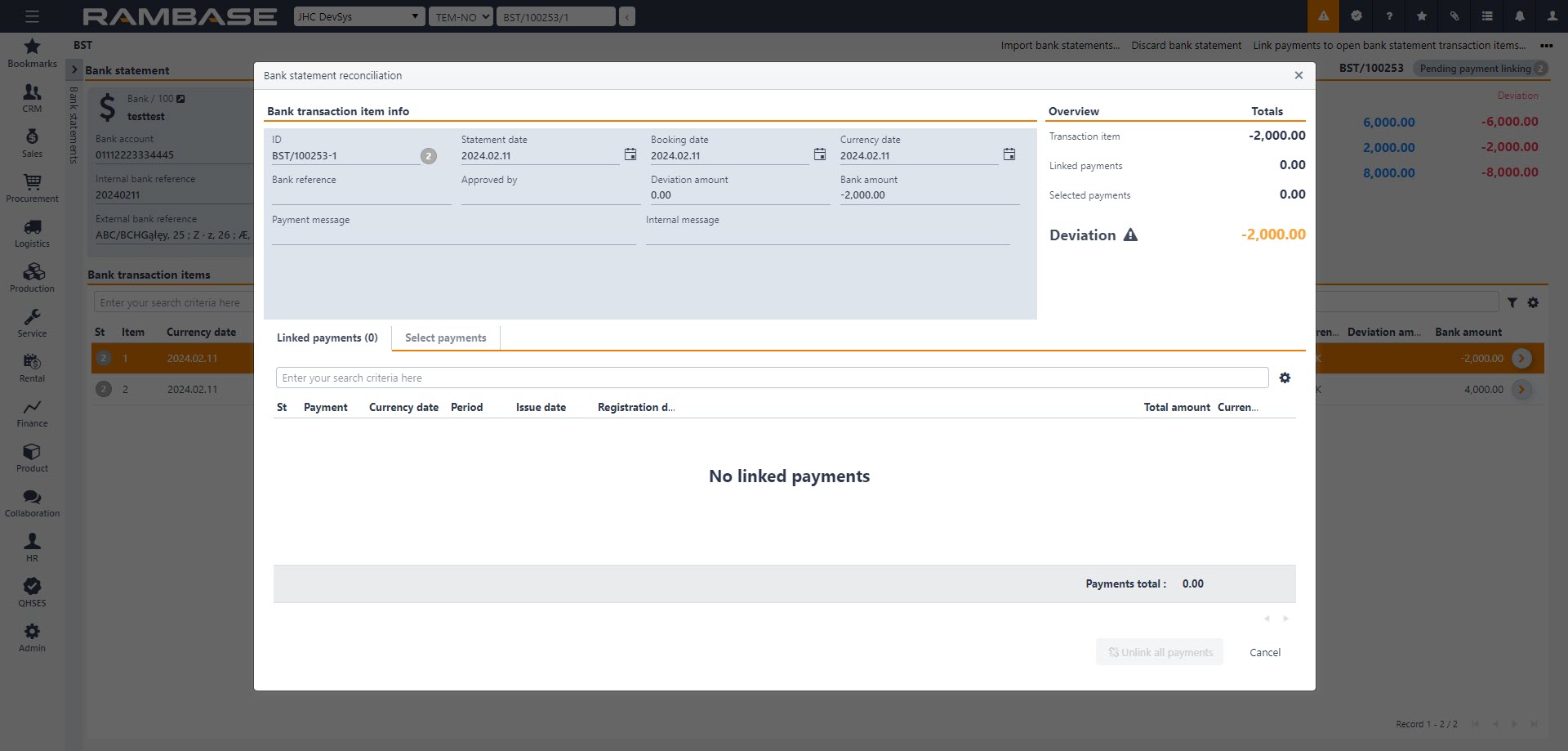

Reconcile an unmatched transaction (Status 2)

Start in the Bank statement (BST) application.

Select a Bank statement (BST) document in Status 2.

On the Bank Transaction item lines, all transactions for that specific date Bank statement (BST) items will be listed. The list is sorted by status code, putting transactions with Status 2 on top.

Select an unmatched transaction Status 2.

Click on the Arrow symbol. The Bank Statement Line popup will appear.

The Linked Payments section displays Payment (PAY) documents that correspond to the Bank statement (BST) item.

In the Select Payments section, users have two options:

Users can initiate the selection process by clicking on the relevant status symbol associated with each Payment (PAY) document and then click on Link selected to BST item.

Alternatively, users can utilize the filter options to refine their search, and then click on Link filtered payments to BST item to link all displayed payments to the Bank statement (BST) item. It opens a popup with the numbers of Payment (PAY) that will be linked.

Note the default value in the Date from and Date to fields. Change them if necessary. Users may also use the Amount (minimum) and Amount (maximum) fields to limit the number of possible documents.

Create a Payment (PAY) directly from a Bank statement (BST) document

If no Payment (PAY) document matches, a payment has not been registered yet. If so, you can create a payment manually or follow this procedure:

Click on the Arrow icon in the Bank statement (BST) item and select the Select payment tab.

Click the Create new Payment button. A Payment (PAY) document in Status 1 is created.

Check the payment information and make necessary changes.

Use the Context menu on the Payment (PAY) and click on the Register Payment option.

Reconcile a partial matched transaction (Status 3)

Start in the Bank statement (BST) application.

Select a Bank statement (BST) document in Status 3.

Press ENTER. All transactions for that specific date will be listed. The list is sorted by status code, putting transactions with Status 3 on top.

Select a partial matched transaction.

Click on the Arrow symbol. The Bank Statement reconciliation popup will appear.

Inspect the invoice, the bank statement, and the Payment (PAY) document, and compare the amounts.

If the deviation is due to errors when entering the Payment (PAY) document manually, do as follow:

Click on the Unlink this payment button on the line of the incorrect Payment (PAY) document/documents. The Payment (PAY) is no longer linked to the BST.

Make corrections on the Payment (PAY) and make sure to register the Payment (PAY) to Status 4 after the correction.

Go back to the Bank statement (BST) and enter the BST item. Link the corrected Payment (PAY) to the BST item manually or use the menu option Reconcile this bank statement for linking the corrected Payment (PAY) to the Bank statement (BST) item.

If there exists a deviation between the Bank statement (BST) item and the Payment (PAY) and if it’s not possible to correct the Payment (PAY), the Bank statement (BST) item remains in Status 3. The Bank statement (BST) item then must be approved. By highlighting the Bank statement (BST) item, using the Context menu and clicking on the Approve bank statement item option, the Bank statement (BST) item will be forwarded from Status 3 to Status 4.

If there are more Bank statement (BST) items in Status 3 on the same BST, the Bank statement (BST) remains in Status 3. Repeat the procedure until all Bank statement (BST) items in Status 3 are reconciled. All Bank statements (BST) items and the Bank statements (BST) document will be put to Status 8 when the last Bank statement (BST) item is reconciled.

Confirm bank statement to Status 9

To complete the bank reconciliation, the Bank statements (BST) must be confirmed to Status 9. There are two ways of doing it; either confirming all Bank statements (BST) for one bank at the same time or confirming each Bank statement (BST) document individually.

Before confirming the Bank statements (BST) to Status 9, the closing balance of the Bank statement (BST) of the last day of the month should be reconciled against the balance of the connected General Ledger account (ACC) for that specific accounting period.

Also, it is recommended to make sure that there are no unreconciled Payments (PAY) in Status 4, for the given accounting period and for the given bank account which is not linked to a Bank statement (BST). If there exists such a Payment (PAY), investigate why it is not linked to a Bank statement (BST) and/or if it is a duplicate.

Confirm a single bank statement

Start in the Bank statement (BST) application.

Select a Bank statement (BST) document in Status 8.

Click on the Context menu and choose the Confirm Bank Statement option.

Confirm all bank statements for one bank

Start in the Bank statement (BST) application.

Click on the Context menu and choose the Confirm Bank Statements based on bank account and date option to confirm multiple bank statements for one bank with the To date field filled.

When a Bank statement (BST) document is confirmed to Status 9, the connected Payment (PAY) document will be put to Status 9. This indicates that it is reconciled and there is no need for further handling.

Bank statement item missing on the BST causing deviation

If there is a deviation between the value in the Movement field in the Bank transaction-section and the total amount of the item lines, the Bank statement (BST) document will be in Status 1, and you will not be allowed to proceed.

If this deviation depends on a BST item missing on the Bank statement (BST) compared to the bank statement in the online bank, Click the Context menu and select the Create new item from deviation amount option.

A new Bank statement (BST) item line with the amount of the deviation will be created. The Bank statement (BST) document will be in Status 2, and you can continue the bank reconciliation procedure.

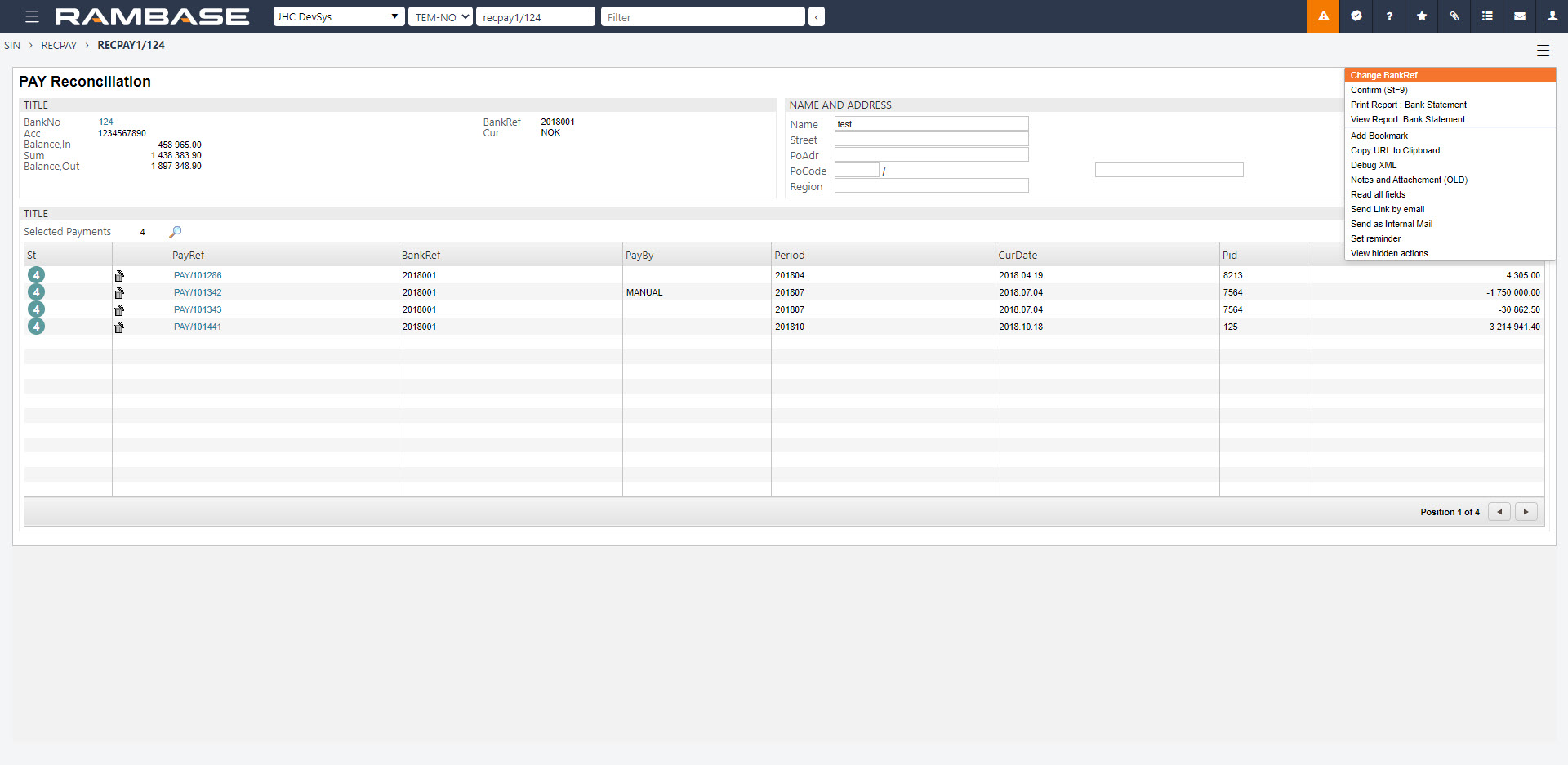

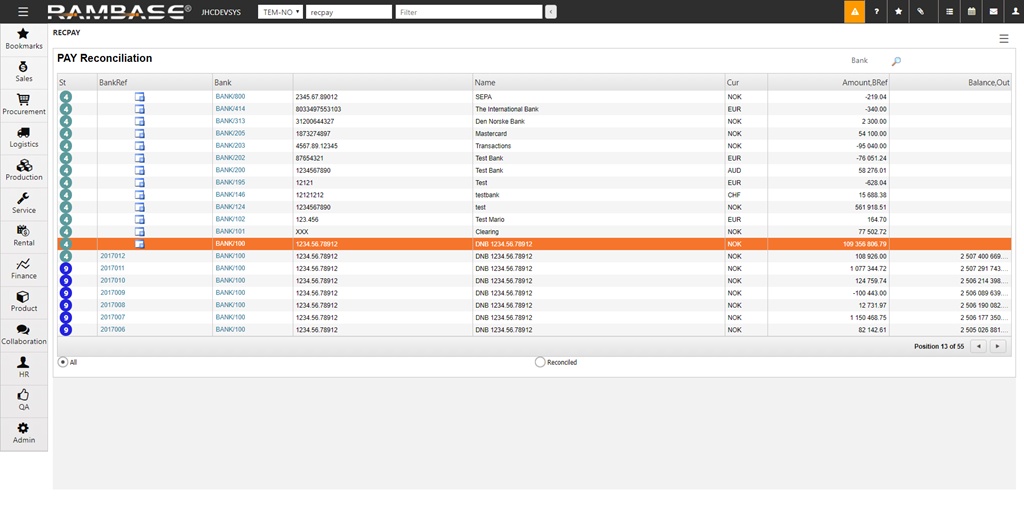

Manual bank reconciliation (RECPAY)

Sometimes the Bank reconciliation (RECPAY) must be done manually. Bank reconciliation (RECPAY) lists all banks registered in RamBase which have un-reconciled payment documents Status 4. Finished reconciliation jobs will also be listed in Bank reconciliation (RECPAY) Status 9.

To open the Bank reconciliation (RECPAY) application, find Finance in the RamBase menu and then Cash management. Click Manual bank reconciliation (RECPAY) to enter the RECPAY application.

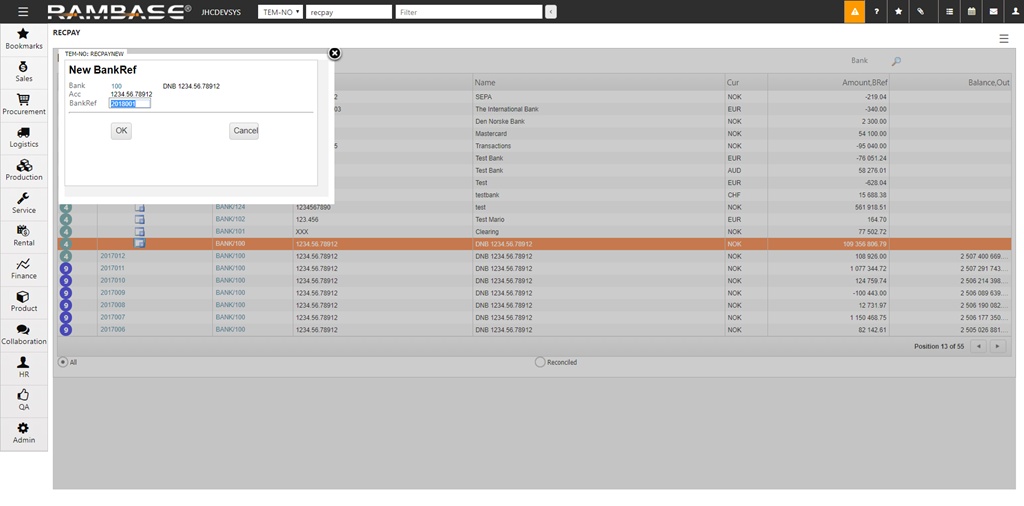

Click on the magnifying glass on the upper right of the screen to filter the bank to reconcile. Click on the + icon on the left of the document line.

To ease the traceability of this manual bank reconciliation, enter a reference to the reconciliation in the BankRef field. The reference should be a combination of year and date (yyyy.mm.dd), or a combination of year and serial number (yyyy.xxx). The year in the reference must reflect the year to which the payments in this reconciliation are posted. Therefore, do not mix payments posted in different years in the same manual bank reconciliation.

Click the OK button.

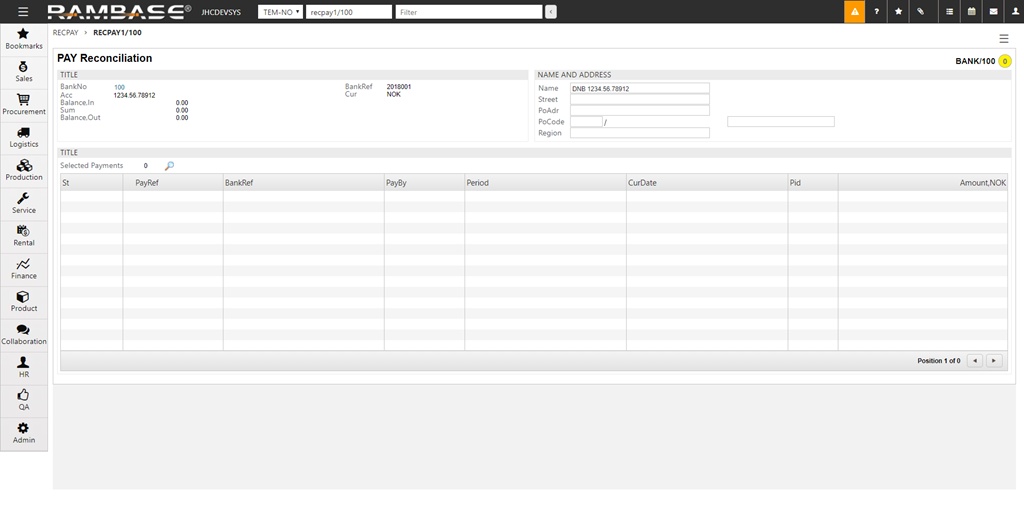

This is the main window for the reconciliation job. Note that the reconciliation is set to status 0 which indicates that this is a new reconciliation which is created by the system. A reconciliation job is not registered before there are PAY documents connected to it. In the upper left corner, there is information about Balance in and Balance out. Numbers in these fields should correspond with your bank statement.

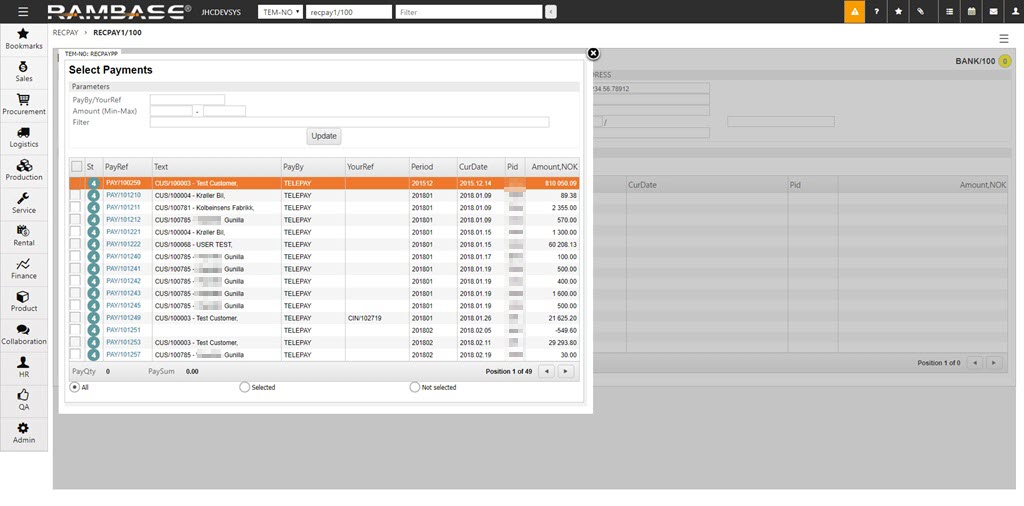

Click on the magnifying glass in the Title section to bring up the Select Payments popup and select the documents for this specific period.

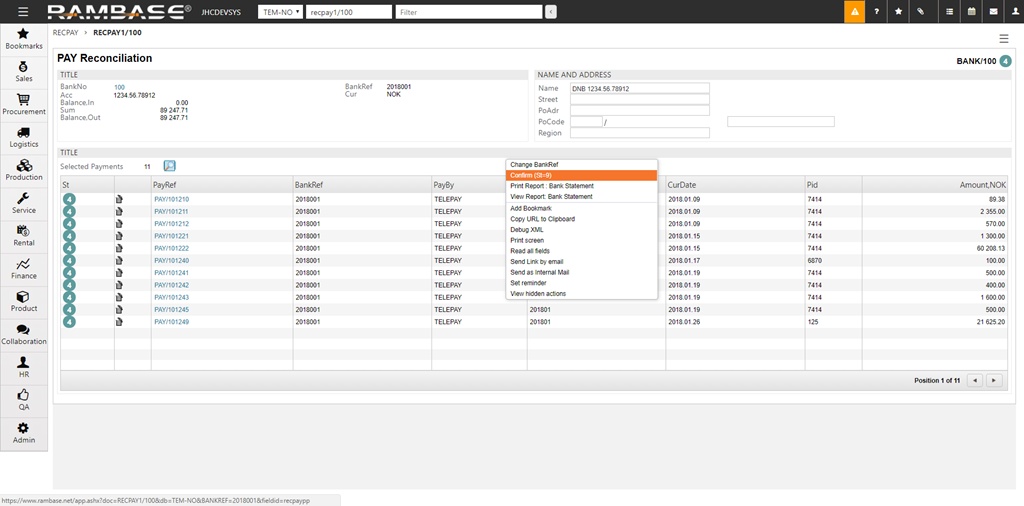

Press Esc.

Press F12 to open the action menu and choose the option Confirm (St=9). When the reconciliation of a BST document is confirmed (St:9), the connected PAY document will be put to status 9 too. This indicates that it is reconciled and there is no need for further handling. Unreconciled PAY documents will remain in status 4.

To change BankRef on a RECPAY you can click menu option Change BankRef. Please note that the RECPAY has to be in Status 4. If the RECPAY is in Status 9, it has to be reopened to Status 4.