Inspect the value of work in progress (WIP)

Make sure that:

The balance of the value of WIP report is equal to the WIP account(s) in the general ledger.

The balance of the appropriation account(s) is 0 (zero).

During period closure, the account(s) connected to WIP is automatically reversed in the correct period which means that the balance of the appropriation account(s) shall be 0 (zero).

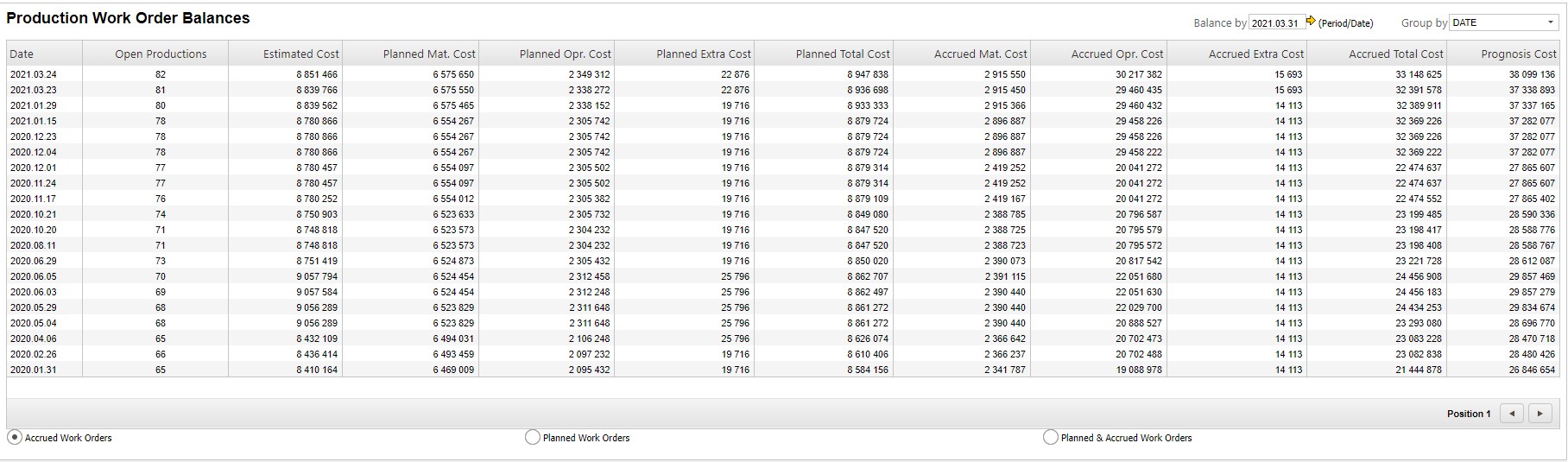

Inspect the balance of the work in progress report

Write PWBAL and the current period in the program field (PWBAL/YYYYMM) and press ENTER. Or enter PWBAL included with period filter directly from PAR by pressing the amount in the Balance column for transaction named INVPRO in the Inventory Balances folder.

Note the amount of the last day in the Accrued Total Cost column. This amount is to be compared with the balance of the WIP account(s) in the general ledger.

Note that it is possible to set up separate GL accounts for Material, Operations and Extra Cost instead of having all work in progress imported to one GL account. You could then reconcile by comparing the amounts in the columns Accrued Mat.Cost, Accrued Opr.Cost and Accrued Extra Cost in PWBAL.

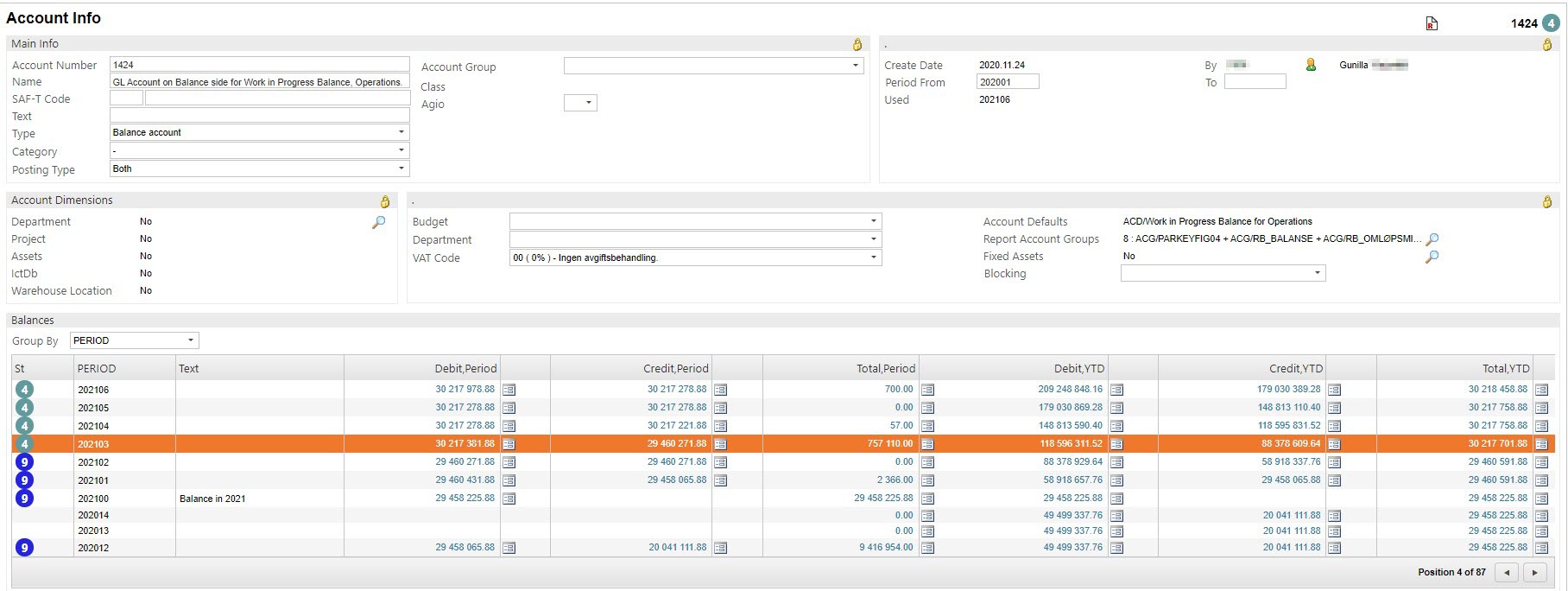

Inspect the balance of the work in progress account in the general ledger

Write ACC/1xxx in the program field and press ENTER or enter the GL account(s) directly from PAR by clicking on the link in the GL Account column in the Inventory Balances folder.

Highlight the item line presenting the correct period.

Note the amount in the Total, YTD column on this item line.

Compare this amount(s) to the amount(s) from the value of stock report (PWBAL).

If any deviation, see several possible scenarios under the topic: Deviation between the value of the inventory subledger and the GL inventory balances.