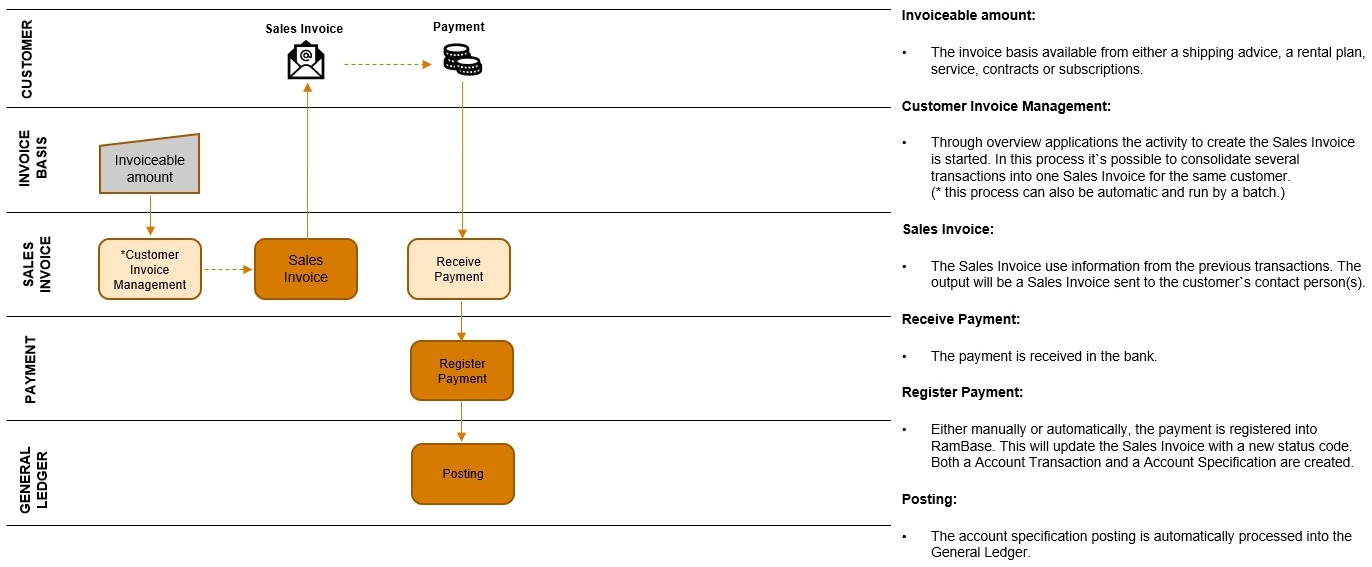

Receivables

The receivables are the company’s unrealized claim to the customers or the debtors. The receivables are accrued when goods or services are delivered, and a sales invoice has been issued. The receivables are connected to the General Ledger via a sub ledger called Accounts receivable. Accounts receivable gives an overview of all transactions between your own company and each customer and is used for keeping track of the settlement of open and closed posts in the General Ledger.

Output from receivables process

An updated overview of what the customers owe you.

An age distributed overview of the receivables.

Actions for settlement of the claims.

Tasks involved in this process

Sales invoicing - There are many ways to create an invoice, and it can be based on goods, costs, rental, contracts and subscription. Great tools will handle both yours and the customers’ preferences related to the transaction documents. Invoice consolidation and cash payments are other processes that are well cared for in the system.

Payments in advance and Advance Invoice Plans - Payment in advance is a common pay term for large orders because of the time span between ordering and delivery. It is also possible to create Advance Invoice Plans for milestone invoicing.

Follow up the receivables ledger - Follow up the receivables ledger is one of the most important finance processes. To get an overview of the customer's open posts and the customer cash flow help you to see if there is a need for resending invoices, sending a statement of account, sending dunning letters, or calculate interests. The information will help you decide if the customer should be allowed to place new orders before old orders are paid. It can be advisable to set a credit limit for a customer to decrease the risk of loss if the customer does not pay.

Credit handling - Sometimes you must credit a sales invoice. This can be because of damaged goods, disagreements about the price or terms of delivery.