Fixed assets (FAR) - Making adjustment to depreciation plan

When a Fixed asset (FAR) is registered and depreciation has started, there are two options in the action menu that could be used to make changes to the depreciation plan:

Close earlier Depreciation and handle in this Period

Make Adjustment to Depreciation Plan

Close earlier Depreciation and handle in this Period

This option could be used if fixed asset depreciation has not been performed in one or more previous periods, and the total of the depreciation left behind should be added to the current period.

This action menu will be available in a Fixed assets (FAR) document when a future depreciation line (depreciation line in Status 0) is highlighted. All depreciations from earlier periods which have no GL postings for depreciation, will then be closed and added to the planned depreciation amount for current (highlighted) period.

Both the depreciation lines that are closed, and the one for the current period, will get a description in the NOTE field. This note will include the date when this adjustment was done and a text explaining what changes that have been made. The depreciation lines for earlier periods that are closed will then go from Status 0 (planned) to Status 9 (closed). The Context menu option Close Fixed Asset (St=9) opens a popup to enter a VALIDTO period and close the FAR in Status 9.This new operation is available on FAR in Status 8 and with no depreciation (DEPR=”N”).It will create an adjustment line with 0 in amount and balance. The Current investment amount will be set to 0. Balance on main level of the FAR document will be blank.

Make Adjustment to Depreciation Plan

This action menu could be used if the investment amount, and then also the balance and depreciation amount, should be adjusted after depreciation have been started. This option could be used to remove the total balance for the asset, e. g. because the asset was sold, or to increase or decrease the value of the asset.

When the balance is cleared out the depreciation plan for future periods will be removed, and the Fixed assets (FAR) document for the asset will be set to Status 9 (discontinued), while an increase or decrease in the value of the asset will lead to a change in the deprecation plan for future periods.

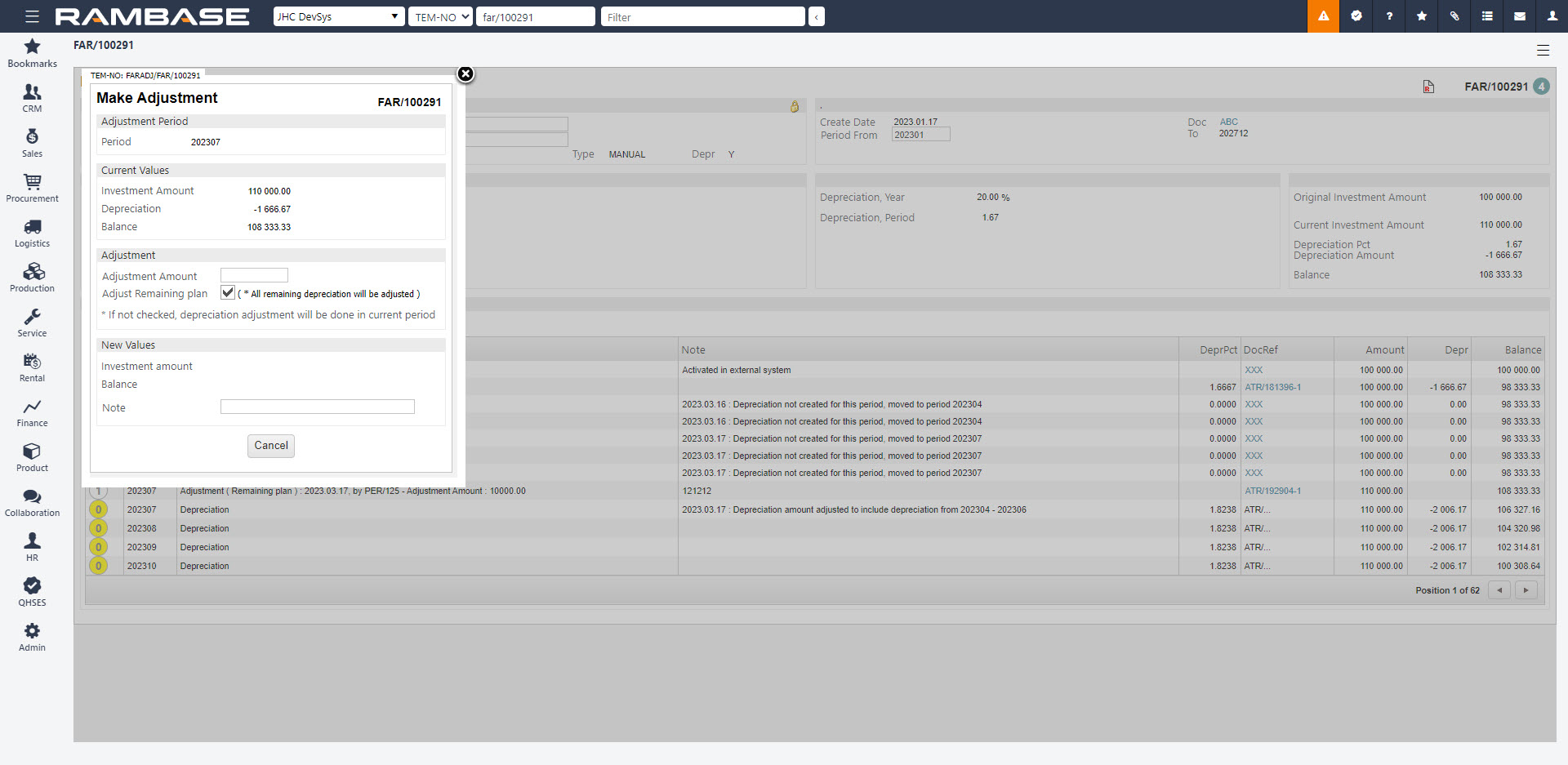

The action menu Make Adjustment to Depreciation Plan will show a popup where adjustment amount and note can be entered, and method for handling the adjustment could be selected before adjustment is created.

The following methods are used for calculation of depreciation after adjustment:

Adjust Remaining Plan - The revision of the asset affects future depreciation schedules.

Current Period - The depreciation of the asset to date is re-evaluated based on revised values, and any variance between the newly calculated depreciation and the previously posted depreciation is recorded in the present accounting period.

When an adjustment line is created, the adjustment line will show in the depreciation plan with a date, reference to user who created it, and amount for adjustment. A GL posting will be created for the adjustment amount, and the link to the GL-posting will appear in the DocRef field in the Depreciation plan. This GL posting will have 1 item for the adjustment amount for the assets balance account, and the user need to add an item for the opposite side and register the GL posting so that the balances in General Ledger are updated.

This table will give you an overview how adjustments, done with methods Adjust Remaining Plan or Current Period, will affect depreciation plan:

Description | Value | Calculation |

|---|---|---|

Investment amount | 12 000.00 | |

Asset lifetime | 12 periods | |

Depreciation amount, period | 1 000.00 | |

Depreciation period2 | 2 | |

Total Depreciation amount | 2 000.00 | |

Balance | 10 000.00 | |

Adjustment amount | 2 000.00 | |

New Balance | 12 000.00 | |

Adjust Remaining Plan | ||

Next depreciation amount | 1 200.00 | = 12 000 / 10 |

Current Period | ||

New Investment amount | 14 000.00 | = 12 000 + 2 000 |

Next Depreciation amount | 1 166.67 | = 14 000 / 12 |

Adjusted Depreciation amount | -333.33 | (1 000 - 1 166.37) * 2 |

If an adjustment was incorrect, you can reverse the General ledger (ATR) and then enter the Fixed assets menu (FAR) document and mark the adjustment line. Here you will have a menu option called Reverse Adjustment and Regenerate Depr- Plan. When using this menu option, the adjustment item on the Fixed assets menu (FAR) document is removed and Balance on the Fixed assets menu (FAR) document is recalculated.