Inspect gross margin calculations

Make sure that:

The gross margin (GM) in the customer billing report is equal to the result calculated in the general ledger.

Reconciliation of the GM is recommended for companies involved in selling of goods.

Inspect the balance in the customer billing report

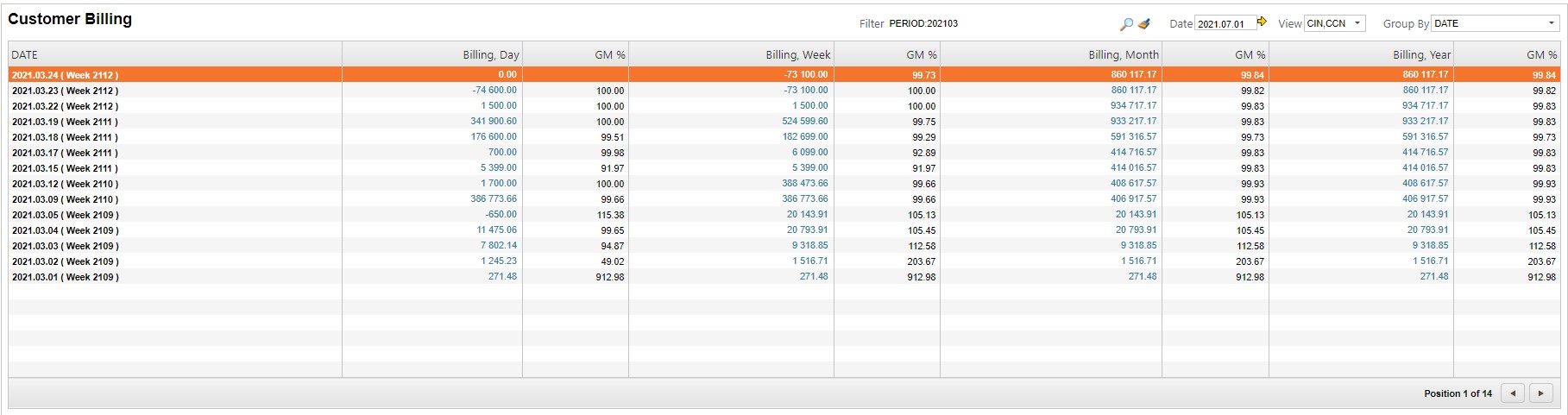

Write CUSBILL in the program field and press ENTER.

Write PERIOD:YYYYMM in the filter field and press ENTER.

Make sure to use Date as the value in the Group By field on the upper right side of the window.

Click on the link in the Billing, Year column on the item line with the most recent date, or the last date for the specific period.

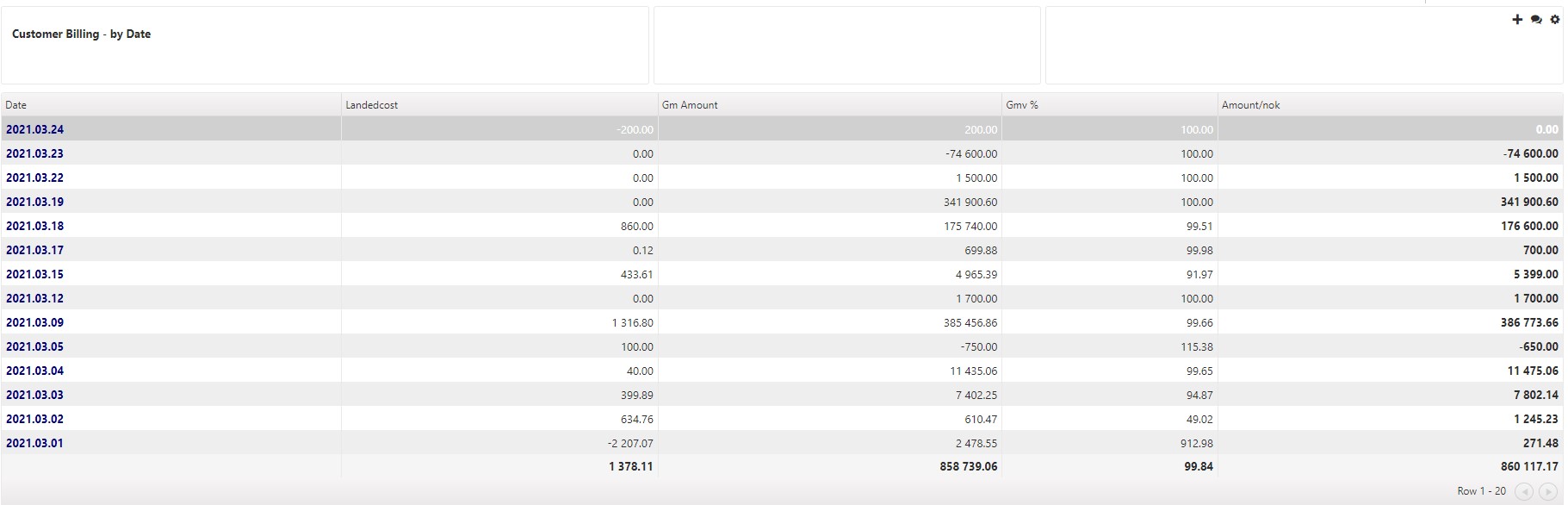

Note the amount on the bottom of the Landedcost column. This is to be compared to the balance of costs of goods sold in the financial report.

Note the amount on the bottom of the Amount/nok column. This is to be compared to the balance of income in the financial report.

Automated period adjustments (ASA) will not show in CUSBILL, this may be a reason for deviations.

Inspect the result of the financial report

Write FRP in the program field and press ENTER to open the financial reports. Enter the Profit & Loss report.

Compare the cost of goods sold (COGS) to the amount on the bottom of the Landedcost column in CUSBILL.

Compare the sales income to the amount on the bottom of the Amount/nok column in CUSBILL.

The customer billing report (CUSBILL) shows the total sale and cost of goods sold, based on invoices/credit notes and related shipping advice.

It is normal that there are minor deviations due to agio. Any manual entries to COGS-accounts in the GL will also generate deviations between the billing report and the GL.

If any deviation, see several possible scenarios under the topic: Deviation between gross margin calculations.