Norwegian VAT accounting in connection with procurement of services abroad

Follow the standard procedure for registration of supplier invoices from costs.

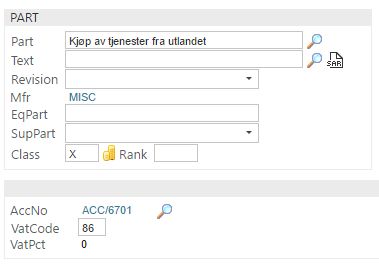

Use the correct General ledger (GL) cost account. For example ACC/6701.

Use the correct VAT code. For example VAT code 86 which is the SAF-T standard.

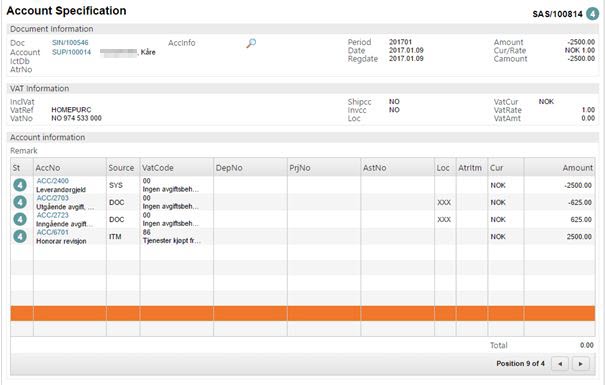

Forward the invoice to register (St:4) and it will be posted like this in the GL:

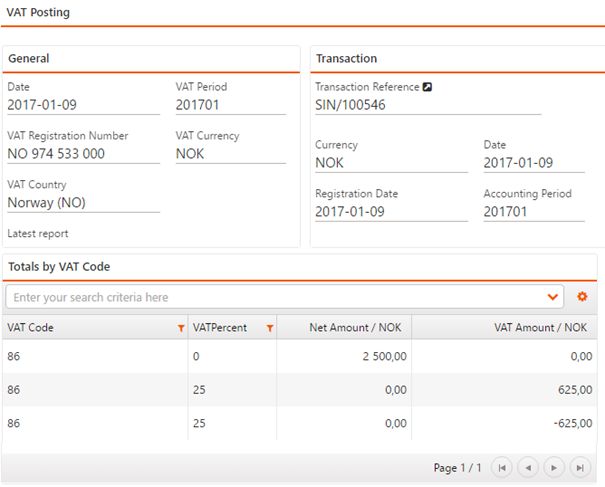

Posting to VAT code 86 calculates both inbound- and outbound VAT. You will find the VAT accounting details in the VAP register.

In this example; the invoice amount is NOK 2500,- and the VAT code is 86. This results in both a credit post and a debit post of NOK 625,-