Internal invoice in Poland (purchase from an EU country or a country outside the EU)

This is a routine for internal invoice in Poland when the purchase is from an EU country or a country outside the EU.

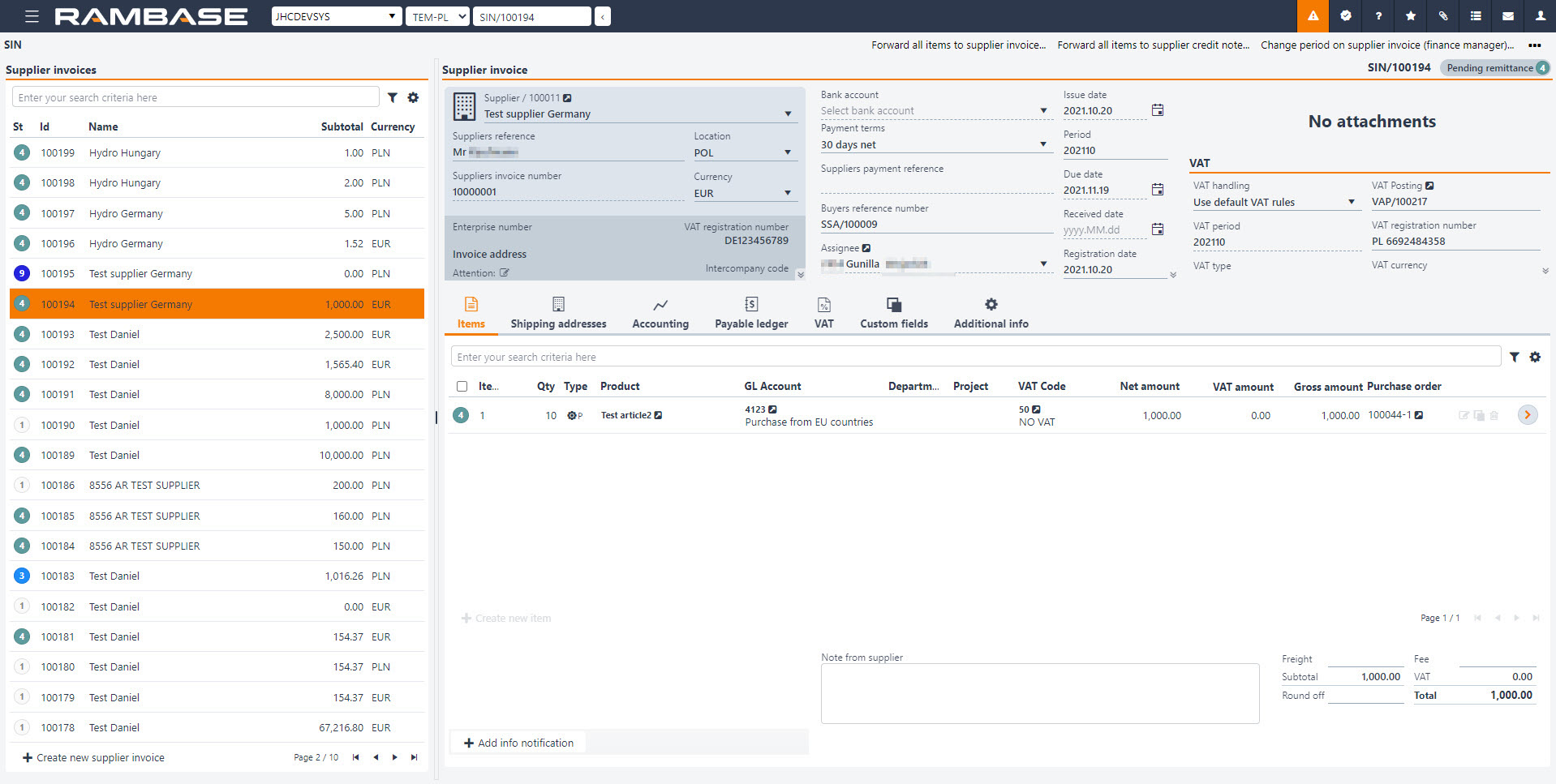

Transport the Purchase order (SPO), Purchase order response (SOA) or Goods reception (SSA) to a Supplier invoice (SIN).

Make sure the Supplier invoice (SIN) is posted against VAT code 50 (No VAT).

Set invoice date, period and other useful information such as suppliers invoice number and more.

Register the Supplier invoice (SIN) to Status 4 (Pending remittance). This invoice is for paying the Supplier (SUP).

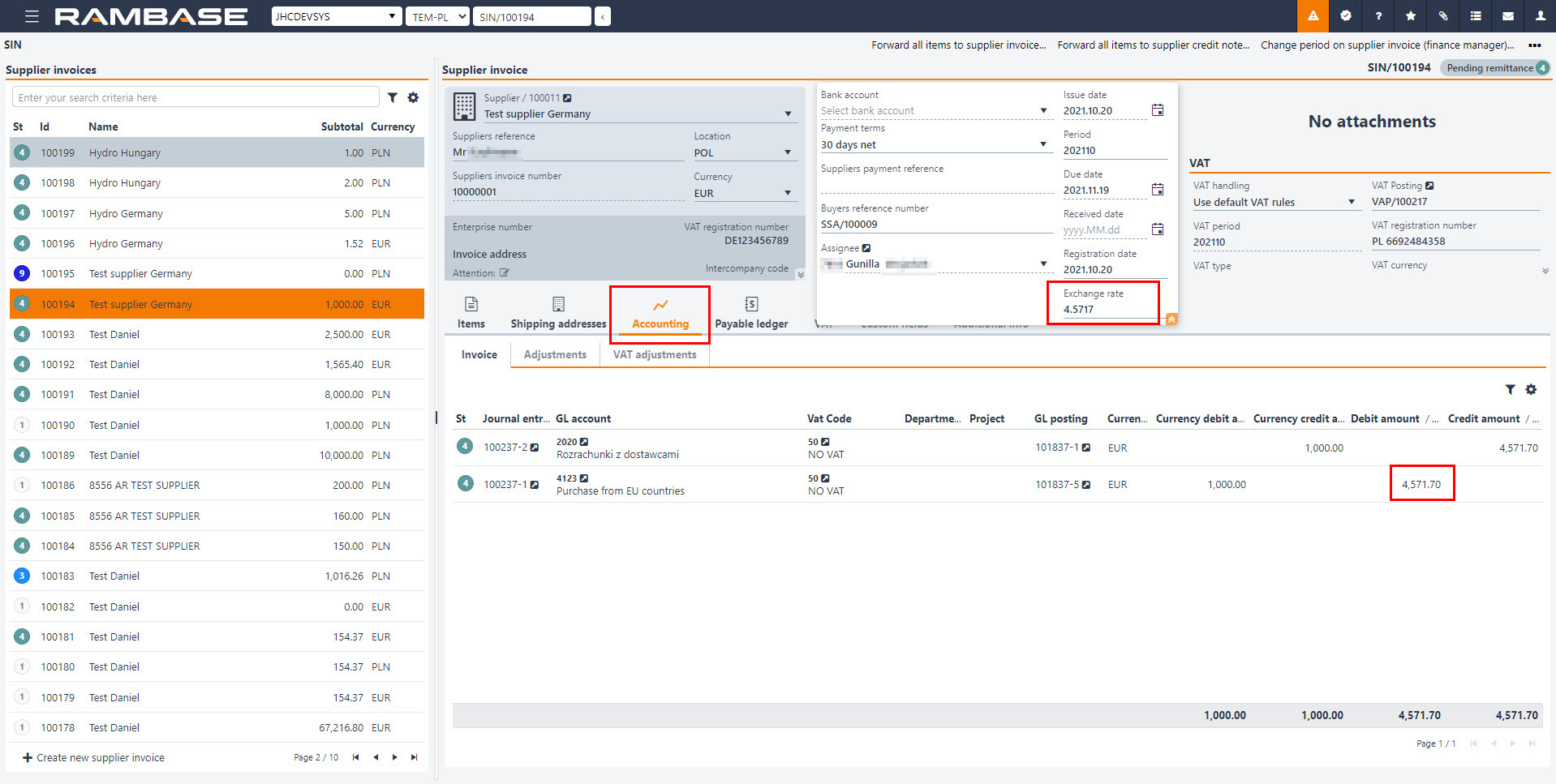

Go to the Accounting tab in the Supplier invoice (SIN) to find the value in PLN, calculated based on the currency used in the Supplier invoice (SIN).

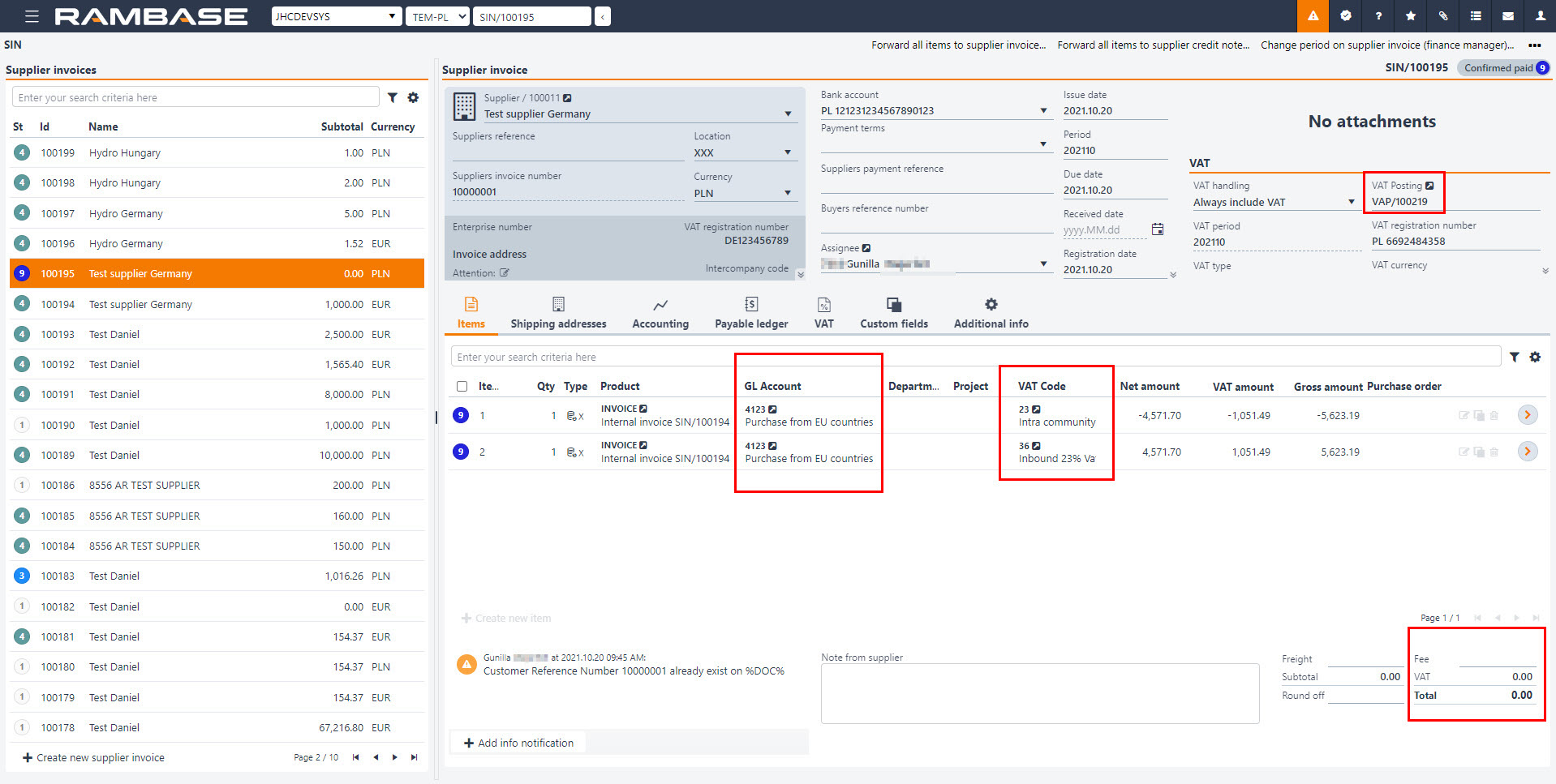

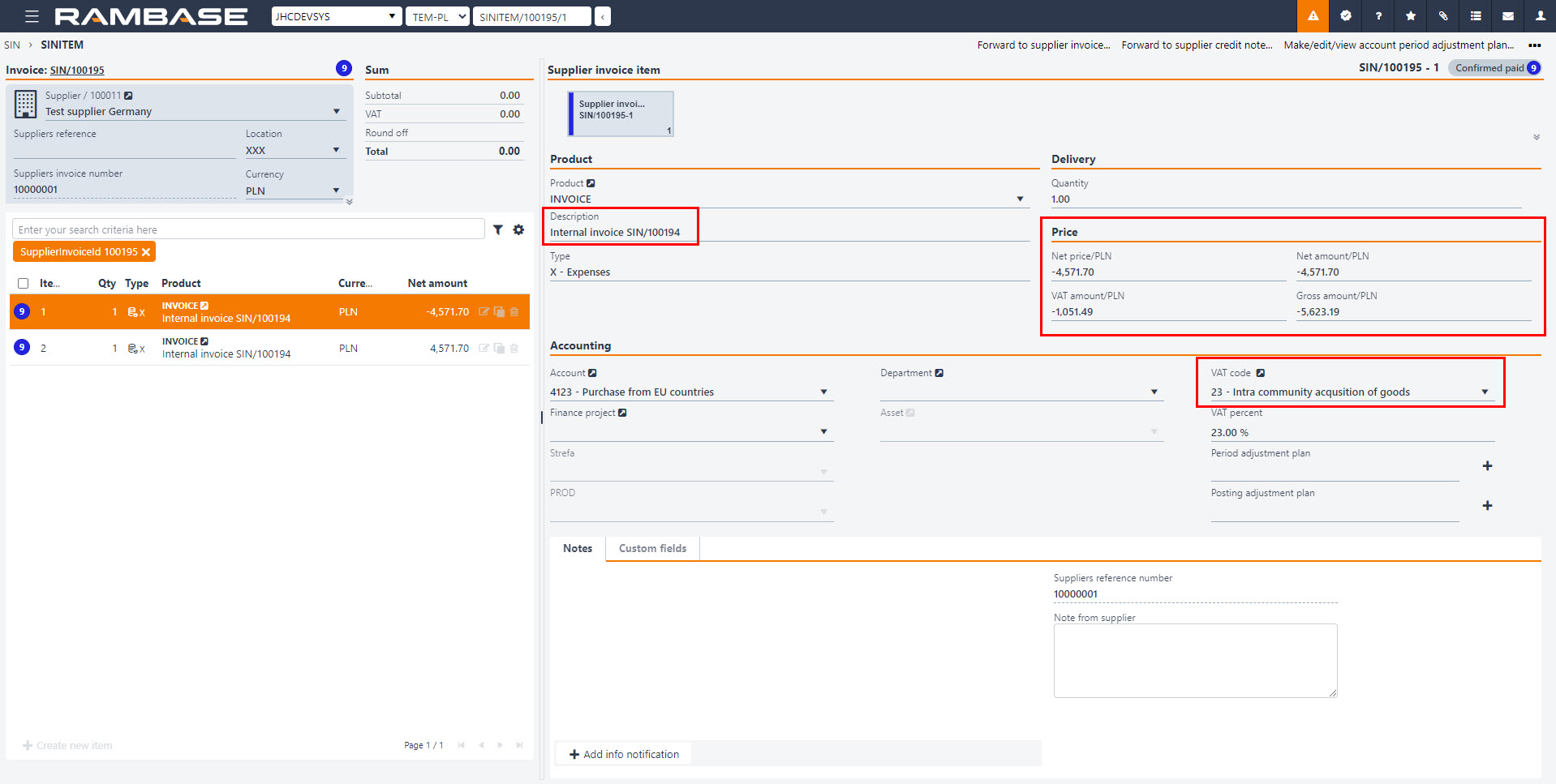

Create a new Supplier invoice (SIN) with the same Supplier (SUP) account, suppliers invoice number, date and period.

This Supplier invoice (SIN) should be in PLN, based on the PLN value of the first invoice.

Set Always include VAT in the VAT handling field.

Create item 1 on the Supplier invoice (SIN) with the Product (ART), INVOICE, or another dedicated Product (ART).

Add explanation/information in the Description field.

The amount on item 1 should be in credit (-).

Choose the same account as the first invoice and VATcode 23, 24, 25 or 26.

Create item 2 on the Supplier invoice (SIN) with the Product (ART), INVOICE, or another dedicated Product (ART).

Add explanation/information in the Text field.

The amount on item 2 should be in debit (+).

Choose the same account as the first invoice and VATcode 36, 37, 38 or 39 for purchases, or 45, 46, 47 or 48 for purchase of fixed assets.

Register the Supplier invoice (SIN) with the Register supplier invoice option in the context menu.

The sum of the second invoice should be 0, therefor the Supplier invoice (SIN) goes to Status 9 (Confirmed paid).

Main level:

Item level:

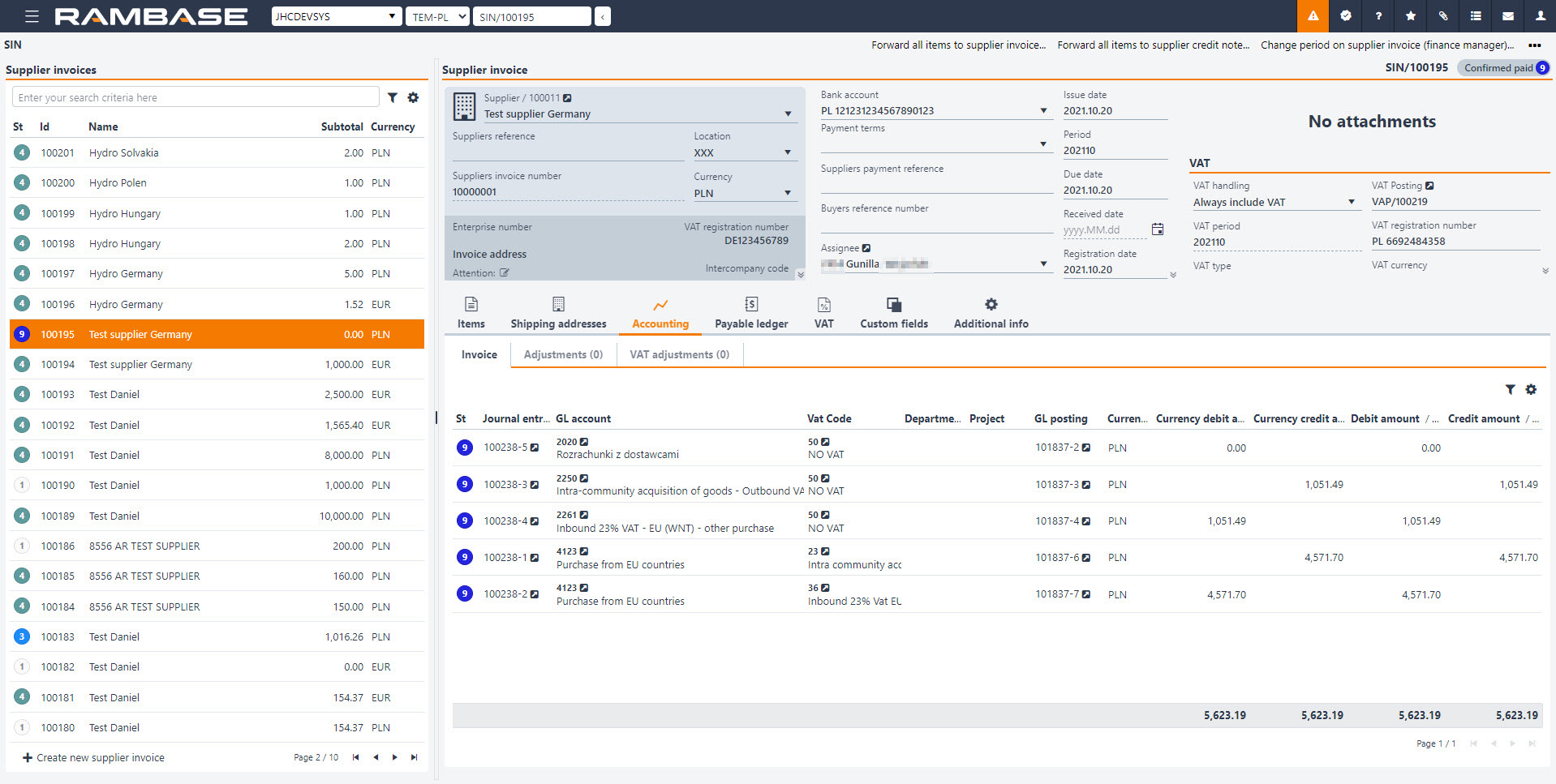

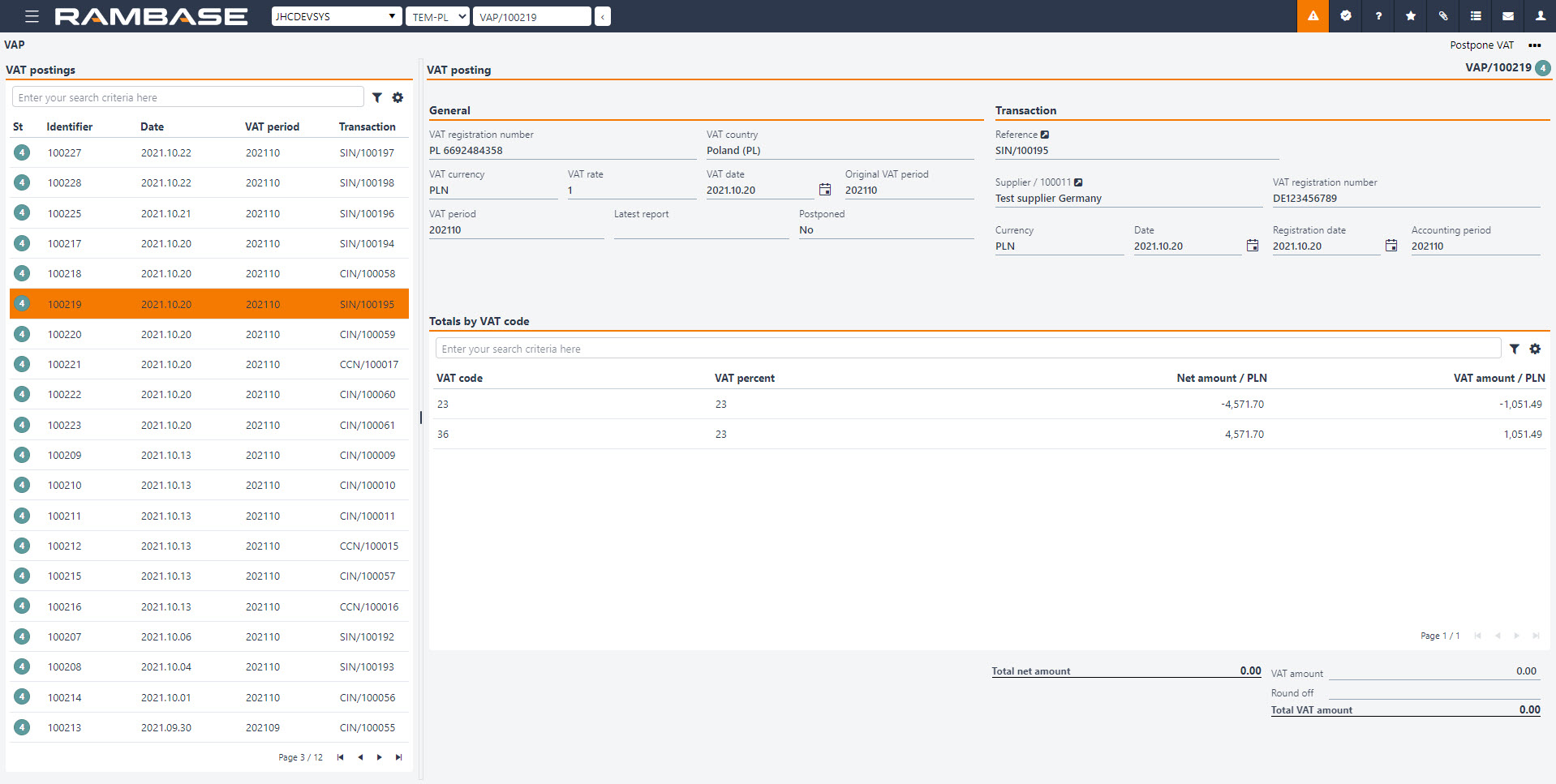

The VAT calculation is done in the VAT posting (VAP) document, but the total VAT amount is 0.

The posting to the general ledger for the internal invoice will look like this: