Norwegian VAT accounting in connection with import of goods

In the example that follows, the high VAT rate is being used.

a) Register the supplier invoice from a foreign supplier

Follow the standard procedure for registration of supplier invoices based on goods receptions.

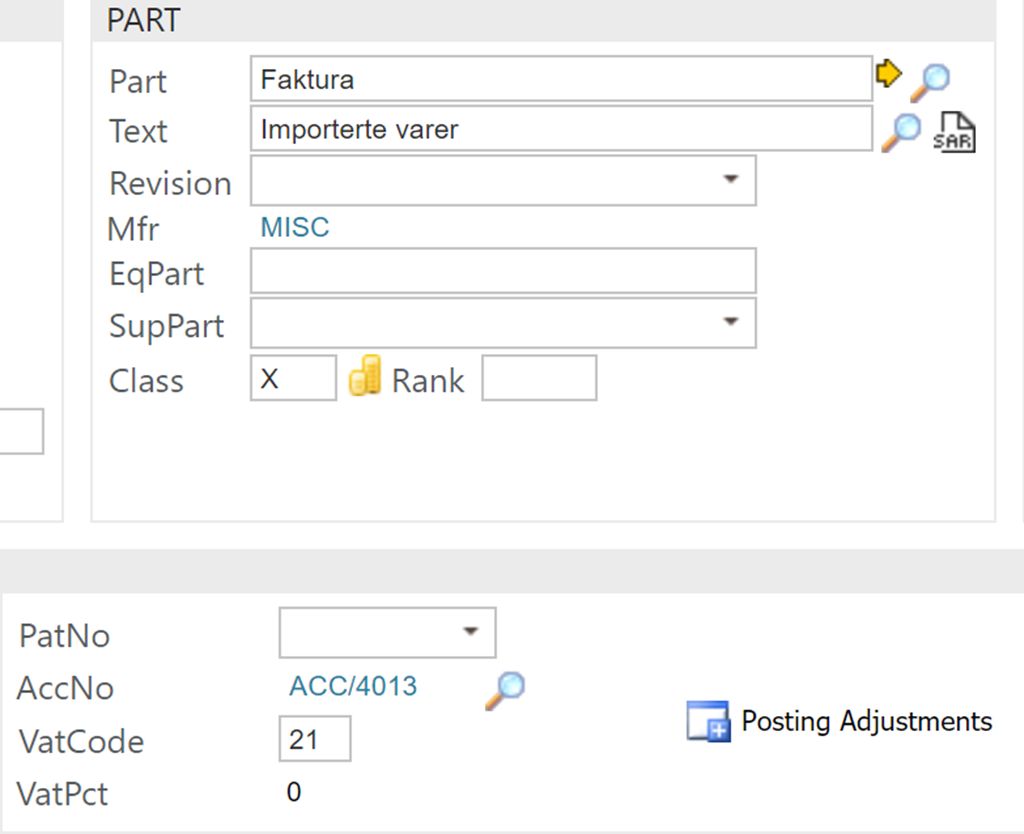

In this invoice, create a new item line and add the invoice's net amount.

Use the correct General Ledger (GL) account (e.g. account number 4013).

Use the correct VAT code. For example code 21. This code is a standard code used for VAT accounting related to import of goods.

Register the invoice.

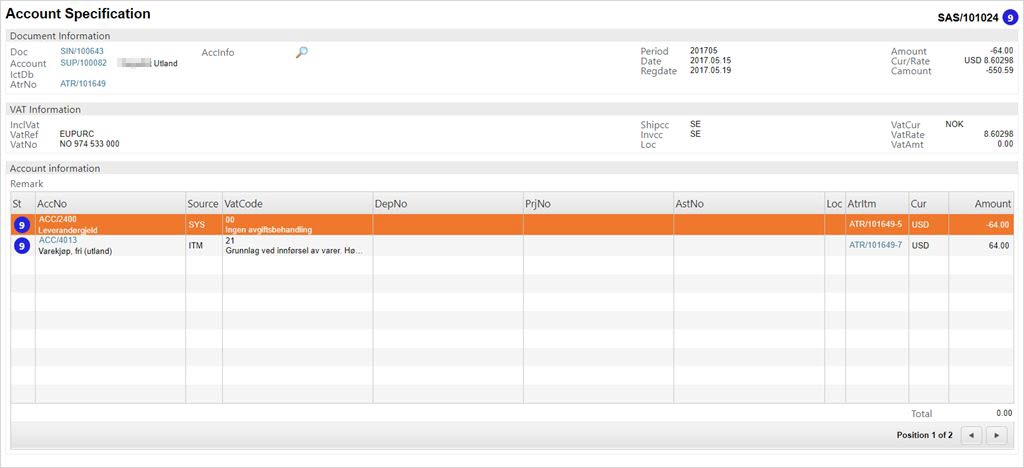

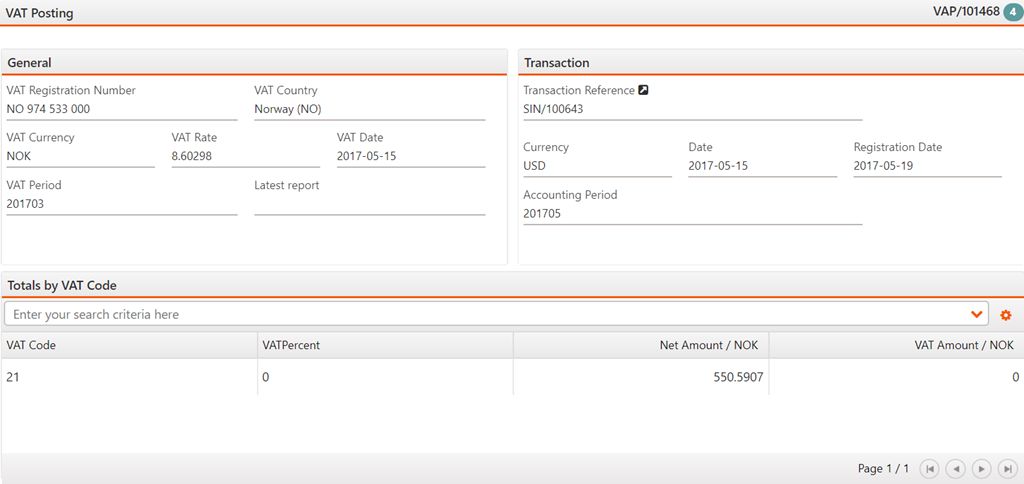

In the GL, the net amount is posted as an accounts payable with the counterpart entry on a cost account. No VAT will be calculated on this invoice, but the net amount will be registered at VAT code 21. In the VAP register it will look like this:

b) Register a supplier invoice based on information from the customs declaration (the VAT invoice)

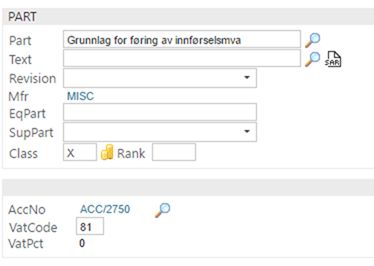

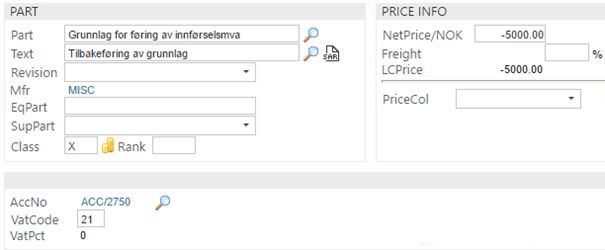

In order to utilize the functionality in RamBase, it is advisable to create a product (ART) with class X and LOC:XXX, and a supplier (SUP) used for VAT accounting purposes only. In Norway the supplier could for example be called Merverdiavgift, Innførsel.

Use these when handling invoices connected with import of goods or services. This will give a good overview of the details in the invoices connected to the VAT accounting in RamBase, and it will make it easier to separate the invoices connected to the import: Invoices based on costs/goods, and VAT invoices. Register a new supplier invoice based on the received customs declaration.

Use the supplier you have created for VAT accounting purposes.

On item line 1, book the invoice amount against a current liability account, numbered close to the tax liability accounts or similar in the GL.

Use VAT code 81 (high rate).

Add a new item line.

To ease traceability, write a short description in the Text field.

On item line 2, add the invoice's negative net amount so the total amount on the invoice becomes 0.

Book against the same account number (ACC) as item line 1.

Use VAT code 21.

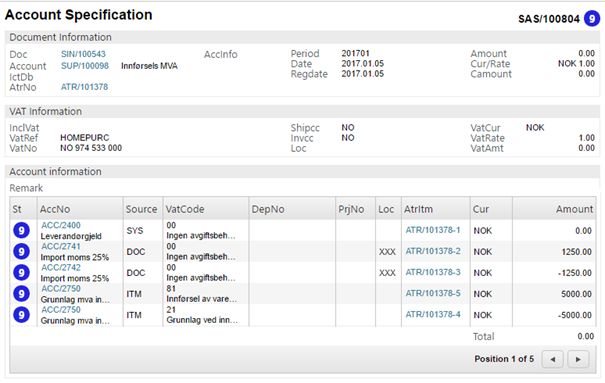

Register the invoice. In the GL it will look like this:

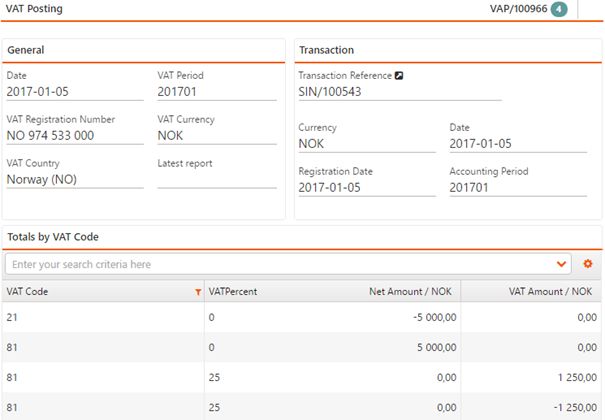

There will be a reverse charge procedure for the inbound- and outbound VAT on the invoice.

In this example the amount is 1250,-

A credit is booked against ACC/2750 with VAT code 21.

A debit booked against ACC/2750 with VAT code 81.

This will not affect the booked value, but the VAT amount will be moved from the VAT code 21 to VAT code 81. Both outbound- and inbound VAT has been booked against VAT code 81.

In the VAP register it will look like this:

c) Reconciliation and control of deductible import

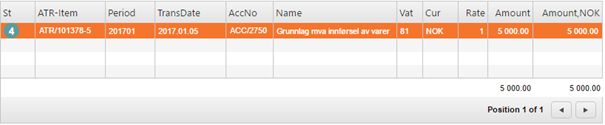

When the invoice based on goods reception (supplier invoice) is booked, the accounting item, posted with VAT code 21, will become a debit amount of NOK 5000,- in the GL. This indicates that a purchase of imported goods, where the VAT has not been calculated yet, has been booked.

In this example the second line in the picture below.

When the invoice based on the Customs declaration (VAT invoice) is booked, the accounting item, posted against ACC/2750 with VAT code 21, will become a credit amount of NOK 5000,- in the GL.

In this example; the first line in the picture above:

The amount on the VAT code 21 will then be 0,-

The counterpart entry to the VAT invoice with VAT code 21 is also booked against ACC/2750, but with VAT code 81.

This will not have any financial impact, but the invoice amount will be moved to VAT code 81, which is the tax code for the reconciliation of the invoice amount and the VAT.

Posting the supplier invoice to VAT code 21, and the VAT invoice to VAT code 81, helps you to keep track of which purchases you have registered VAT for, and not.