Advance invoicing

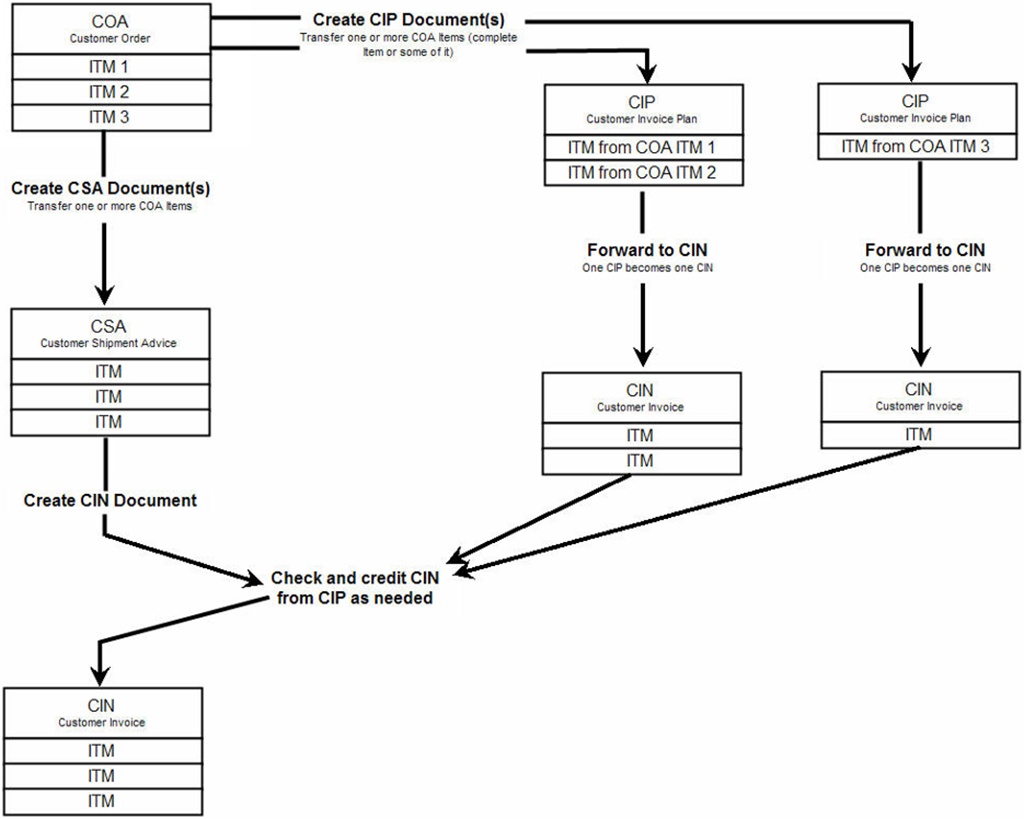

Advance invoicing is used to create a Sales Invoice (CIN) based on a Sales Order (COA), before the goods is shipped to the customer. This could be done when there is an agreement with the customer that parts of the COA will be invoiced before the goods is shipped, depending on events instead of on delivery of goods. This could be agreements on specific dates, or based on a specific process that is completed. In RamBase, advance invoices could be produced from an Advance Invoice Plan (CIP) that is created from the COA.

When advance invoicing is done, delivery dates for the goods will be scheduled on the COA items, as normal. The Shipping Advice (CSA) that is used to ship the goods to the customer will also be created as normal, but the final CIN created from the CSA will be adjusted so that the advance invoices will be credited. This means that the final CIN created from the CSA will be adjusted with the totals that is invoiced from the invoice plan. Each CIN item from the advance invoices will appear on the final CIN, but with a credit amount. The final CIN will then be for the total of the COA, adjusted by the credit amount from the advance invoices.

It is also possible to issue a final invoice after the delivery of goods without creating a new order line. When such a final invoice is created, the VAT for this invoice is calculated independently of the goods delivery, ensuring correct VAT handling for invoices issued after shipment.

To be able to produce advance invoices before goods is shipped from a COA, an invoice plan has to be created from the COA. An invoice plan can be created from all items on the COA, but it is also possible to create an invoice plan from some selected items. A COA item can be scheduled to create one or more advance invoices from the invoice plan, based on a fixed amount or a percentage of the amount on the COA item. The invoice plan consists of one or more Advance Invoice Plan Element (CIP) documents, and all CIP documents created from the same COA will be the invoice plan for that COA.

Advance invoices created from the invoice plans will have 100% gross margin and there will be no cost of goods. The final CIN created from the CSA will have the real cost from the goods that are shipped, while the items made to credit advance invoices will have no cost of goods.

For Customer invoice plans (CIP), a separate General Ledger default account assignment (ACD), Total amount from Advance Invoice Plan after shipment, is used for CIP invoice amounts that should not be included in the settlement upon delivery. CIP amounts created after shipment are posted to this account together with Accounts receivable, and the final invoice re-posts these values from the CIP account to the relevant sales account.

Both the CIN created from the invoice plan and the CIN created from the CSA will be posted to Account Receivables in General Ledger. The final CIN for the CSA will be posted to a sales account, while the advance invoice will be posted to a settlement account that could be set up by the user.

Invoicing plans also indicate which invoices are tied to delivery, and users can filter or report on invoices issued before, at, or after delivery. Full audit trails track all CIP stages and VAT handling for improved transparency.

Data flow

A Sales Order (COA) is created.

Since there can be quite an extensive period of time between ordering and delivering goods on manufacturing orders, RamBase has a possibility to create Advance Invoice Plans (CIP) from a COA. When there are created Advance Invoice Plans from a COA, the COA is flagged as CIPORDER. There is no calculation of VAT on a Sales Invoice (CIN) made from a CIP document.

A CIN is produced from each CIP document. This is done manually.

Upon time of delivery, a Shipping Advice (CSA) is issued.

The final CIN is created based on the CSA issued upon time of delivery. When the CIN is made from a COA marked with CIPORDER, there is a settlement between the final CIN and the CINs made from the CIP documents. The final CIN always holds the VAT outgoing tax for the total COA amount.