PAYDOC

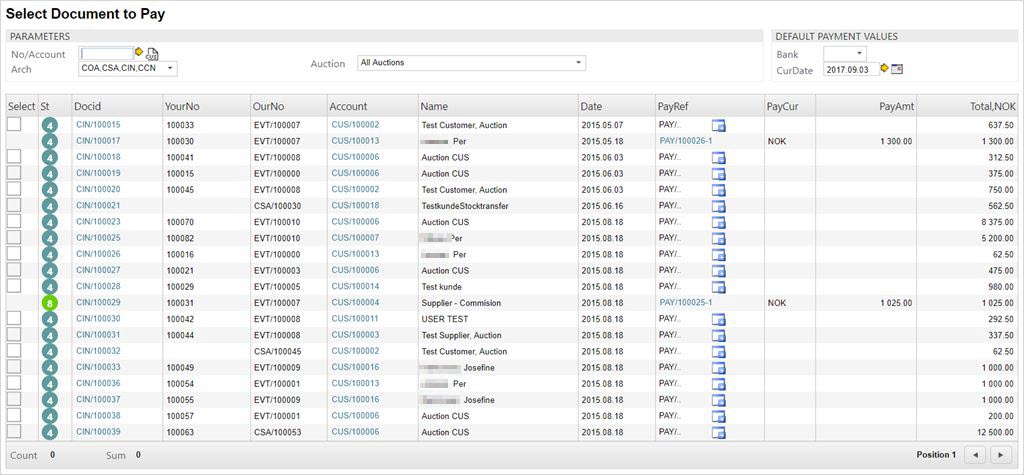

The PAYDOC application provides an easy way to register payments on basis of bank list including several payments in a certain bank, or a banknote including a payment from a certain customer.

To start the application, write PAYDOC in the program field and press ENTER.

The application lists documents that can be object of payments.

Filter by document in the Arch field.

COA: Sales orders are be paid in advance.

CIN: Sales Invoices are paid on, or nearby due date.

CCN: Sales Credit Notes can be object to reimbursement to customers.

Filter by customer account in the No/Account field.

Type some of the numbers follow by a wild-card (*) in the customer account number and click the yellow arrow icon. You can also click the customer icon to look up the current customer.

If you are searching by BidderNo, you can add a "B" as a prefix to filter only BidderNo-related items.

Filter by bank in the Bank field.

Choose account registered in the BANK register from the dropdown selection box.

Filter by due date in the CurDate field.

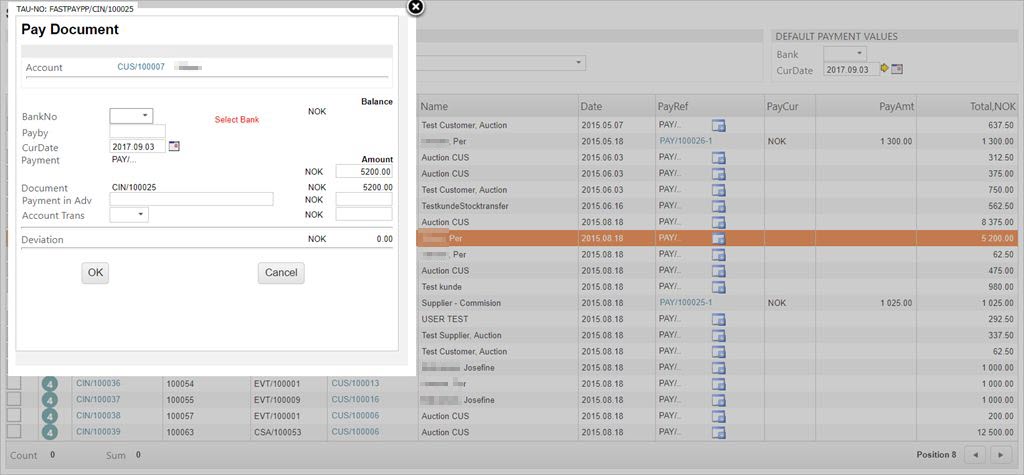

Pay document

Highlight any document in ST:4 in the menu and press ENTER to inspect details.

If the documents are filtered by bank in the PAYDOC application, the field BankNo is pre-selected. Otherwise you have to enter the bank account the payment has been deposited to.

If there is a deviation in the payment (that is that the deposited amount differs from the one registered on the financial document), the deviation has to be routed against a payment in advance on the customers account, or against a ledger account to hold the deviation.

Enter text in the Payment in Adv field, and enter the deviation amount in the corresponding field. If the deposited amount is larger than the invoice amount, a payment in advance is registered on the customer account (positive sum in the amount field). If the deposited amount is lower the the invoice amount, a owing amount is registered on the customer account (negative sum in the amount field).

Choose the ledger account to handle the deviation in the Account Trans field.

Click the OK button to continue.

The CIN is set to status 9 and a PAY document is created in status 4.