Review and validate VAT-included entries

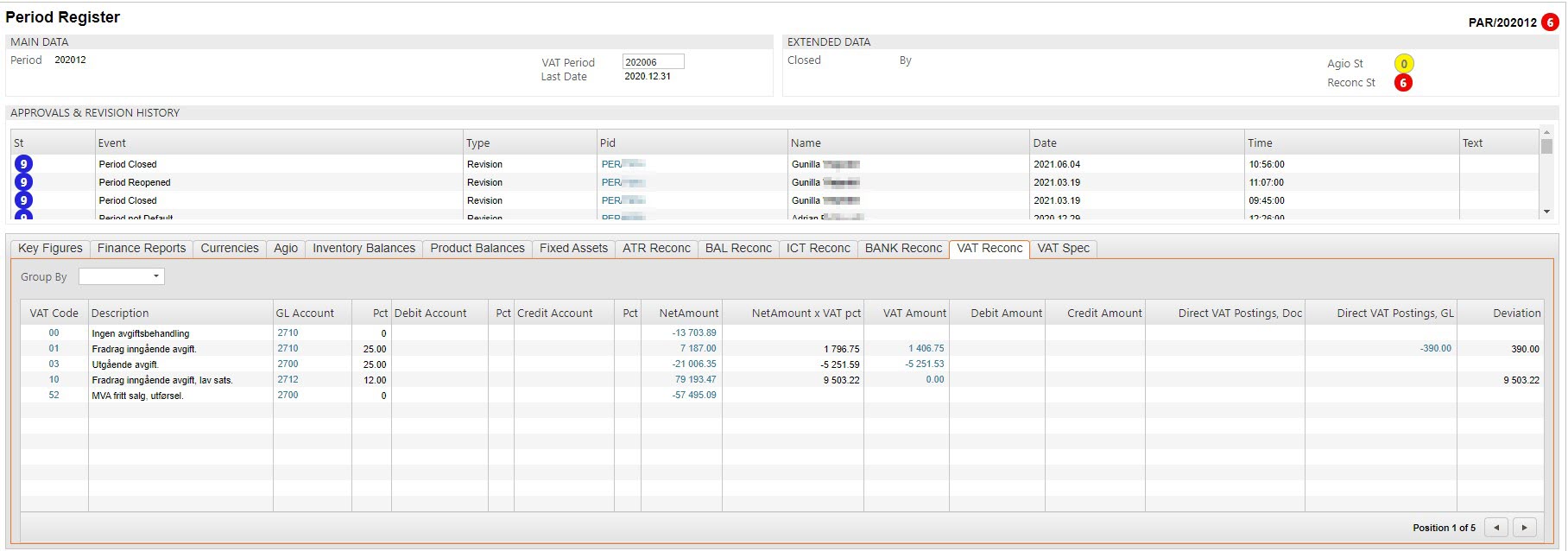

The VAT reconciliation validates that the VAT calculated from goods and services purchased and sold is identical to the VAT amount entered to the general ledger. Deviations are found when a calculated VAT amount (sales * VAT%) differs from the amount posted on the VAT accounts.

Manual entries made directly to the general ledger account linked to a VAT code will generate a deviation.

Inspect the VAT reconciliation

To open the Period Account Register (PAR) application, find Finance in the RamBase menu and then General ledger. Click Accounting periods to enter the PAR application.

Highlight the relevant period and press ENTER.

Select the VAT Reconc folder.

If there is any value in the Deviation column, highlight the line and press ENTER to view more details about the deviation.

It there is no deviation, press F12 to open the action menu and choose the Approve VAT Reconciliation option.

Optionally, make a comment.

Click the OK button.