Automated bank reconciliation (BST)

Initiate a bank reconciliation

To open the Pay management (PAM) application, find Finance in the RamBase menu and then Cash management. Click Inbound payments to enter the Pay management (PAM) application.

Select the Bank Statements folder in the Payment management (PAM) application to initiate a bank reconciliation.

The Bank Statements folder lists all bank statement documents. These documents are based on the files imported from the bank(s).

To go directly to Bank statement (BST) enter Finance, then Cash management and then Bank statements

Import a new file from the bank

Start in the Bank Statements folder in the Pay management (PAM) application.

Press F12 to open the action menu and choose the Import Bank Statements from file option.

Select the bank you want to import the file from.

Click the Next button.

Browse to the bank statement file and click the Upload button. A progress bar will appear. This process might take a while.

This can also be done directly in the Bank statement (BST) application:

Start in the Bank statement (BST) application.

Open the Context menu and choose the Import bank statements... operation.

Choose a format.

Click the Next button

Browse to the bank statement file and click the Upload button. A progress bar will appear. This process might take a while.

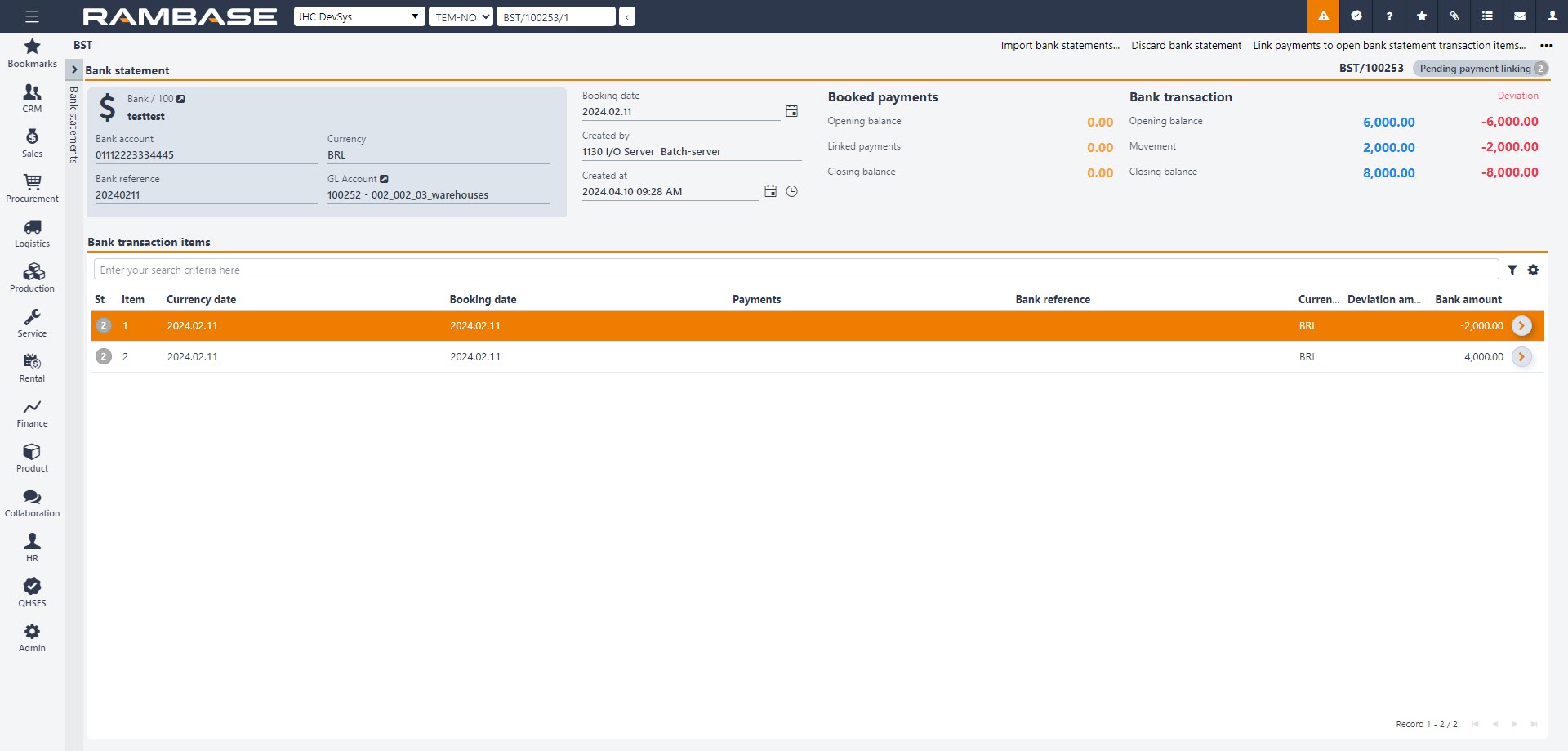

When the import is finished, one or several Bank statement (BST) documents are created. One Bank statement (BST) document is created for each transaction date. All transactions on the same date will appear as items on the relevant Bank statement (BST) document. The recently generated Bank statement (BST) documents will be listed in the Bank Statements folder in the Pay management (PAM) application with Status 2. This means that they are registered into RamBase and are ready for reconciliation. If the Bank statement (BST) documents are not listed in Status 2, there is a deviation.

From the Bank statements folder in the Pay management (PAM) application, you may import bank statement-files from a bank and initiate an automated bank reconciliation. The reconciliation will be performed automatically on a regular basis if the Company setting (CSV) ‘Reconcile bank statement automatic’ is activated. Manual bank reconciliation can be triggered from each Bank statements (BST) document in Status 2 or from the Bank statement (BST) menu.

Import bank statements from bank integration

The Company setting (CSV) 'Activate Bank Integration' setting must be activated to import bank statements from bank integration manually.

Import bank statements from bank integration through the Pay management (PAM) application

Start in the Bank Statements folder in the Pay management (PAM) application.

Press F12 to open the action menu and choose the Import Bank Statements from Bank Integration option.

In the popup, select a bank in the Bank field and dates in the From Date and To Date fields.

Click the OK button.

Import bank statements from bank integration through the Bank statement (BST) application

Click the Import bank statement from bank integration... option in the Context menu

Fill out Bank account, From date, To date fields in the popup.

Click Confirm. (When batch is finished, Bank statement (BST) in Status 1 is created.

When the import is finished, one or several Bank statement (BST) documents are made. One Bank statement (BST) document is made for each transaction date. All transactions on the same date will appear as items on the relevant Bank statement (BST) document. The recently generated Bank statement (BST) documents will be listed in the Bank Statements folder in the Pay management (PAM) application with Status 2. This means that they are registered into RamBase and are ready for reconciliation. If the Bank statements (BST) documents are not listed in Status 2, there is a deviation.

Import bank balances from bank integration

This will happen automatically, but it is possible to trigger it if you want to start the job manually.

Start in the Bank statement (BST) application.

Click the Context menu and choose the Import bank balances from bank integration option.

The Bank statement (BST) document will be listed with Status 2 after the import is done. This means that they are registered into RamBase, and are ready for reconciliation.

Start a bank reconciliation

Start in the Bank Statements folder in the Pay management (PAM) application.

Press F12 and choose the option Start Bank Statement Reconciliation Job. The reconciliation compares the bank transactions against the Payment (PAY) documents registered in RamBase.

If RamBase finds a match between a Bank statement (BST) item and a Payment (PAY) document, the Bank statement (BST) document will be put to Status 8. This means that the automated reconciliation was successful. A Bank statement (BST) document in Status 8 can be confirmed as reconciled.

If RamBase finds a partial match, that is a match with minor deviations, the Bank statement (BST) document is put to Status 3.

If RamBase does not find a match, the Bank statement (BST) document will be put to Status 2.

Bank statement (BST) documents in Status 1 indicates file error.

It can be also done directly in the Bank statement (BST) application:

Start in the Bank statement (BST) application.

Open the Context menu and click on the Start bank statement reconciliation job option.

BAQ is completed and is set to Status 9.

Bank statement (BST) documents put to Status 2 and Status 3 have to be reconciled manually. Open every document and highlight the item line with Status 2 or Status 3 and press ENTER. The next action depends on the status on the item line. Regardless of the items initial status, you should end up with a successful reconciliation and a Bank statement (BST) document in Status 8.

Repeat this reconciliation procedure until all Bank statement (BST) documents are in Status 8.

Reconcile an unmatched transaction (Status 2)

Start in the Bank Statements folder in the Pay management (PAM) application.

Select a Bank statement (BST) document in Status 2.

On the Bank Transaction item lines, all transactions for that specific date Bank statement (BST) items will be listed. The list is sorted by status code, putting transactions with Status 2 on top.

Select an unmatched transaction Status 2.

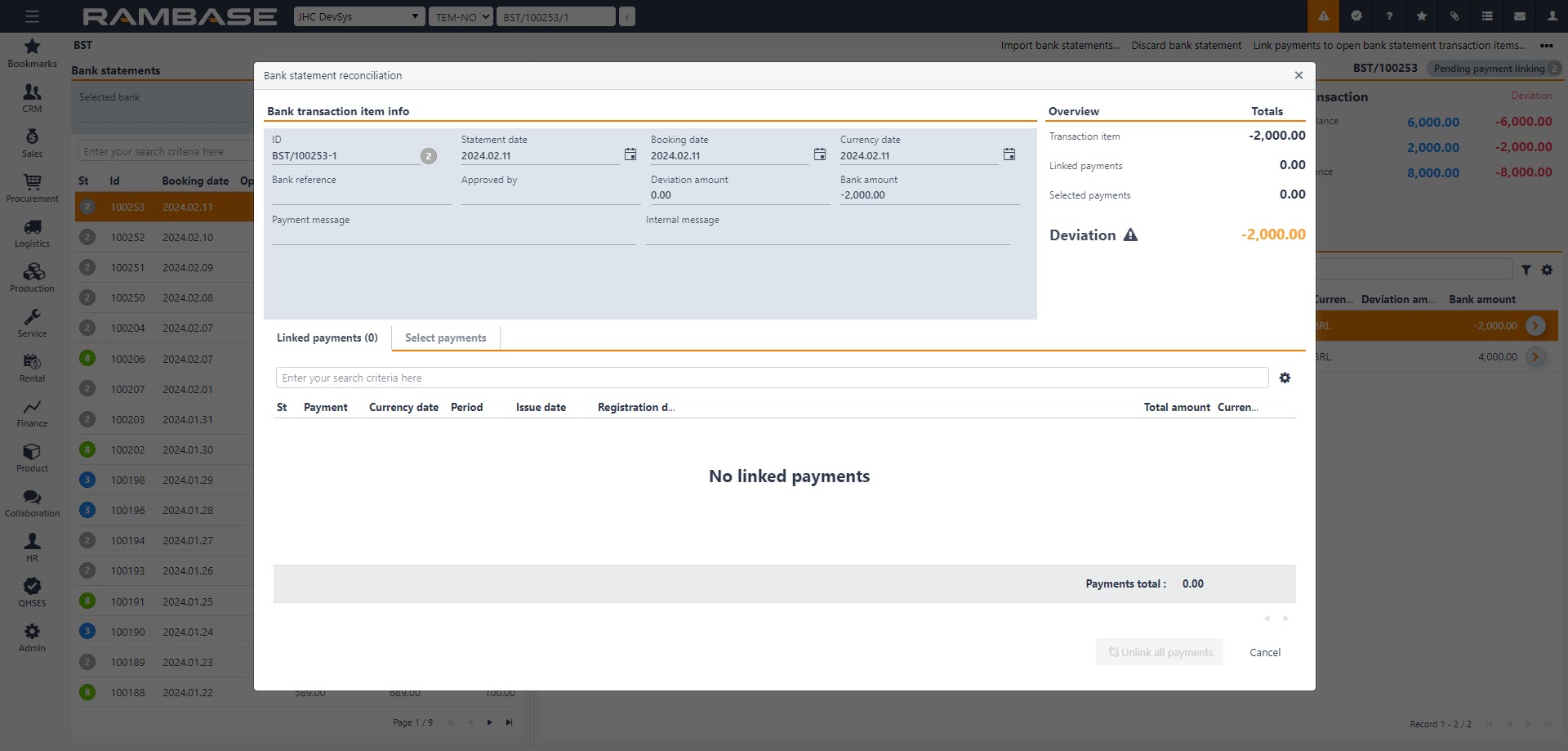

Click on the Arrow symbol. The Bank Statement Line popup will appear.

The Linked Payments section displays Payment (PAY) documents that correspond to the Bank statement (BST) item.

In the Select Payments section, users have two options:

Users can initiate the selection process by clicking on the relevant status symbol associated with each Payment (PAY) document and then click on Link selected to BST item.

Alternatively, users can utilize the filter options to refine their search, and then click on Link filtered payments to BST item to link all displayed payments to the Bank statement (BST) item.

Note the default value in the Date from and Date to fields. Change them if necessary. Users may also use the Amount (minimum) and Amount (maximum) fields to limit the number of possible documents.

Select the matching Payment (PAY) document. Note: If no Payment (PAY) document matches, a payment has not been registered yet. If so, follow this procedure:

Inspect the bank statement.

Create a new Payment (PAY) document based on the information in the bank statement by clicking on the Create new payment button.

Click the Approve bank statement item option. If the transaction Bank statement (BST) item is set to Status 3, it has to be approved. In such cases, follow this procedure:

Click the Context menu

Choose the Approve bank statement item option to reconcile the transaction.

When the last Bank statement (BST) item on this document is reconciled, all Bank statement (BST) items and documents will be put to Status 8.

Reconcile a partial matched transaction (Status 3)

Start in the Bank Statements folder in the Pay management (PAM) application.

Users may also go directly to the Bank statement (BST) application to choose bank statements to reconcile.

Select a Bank statement (BST) document in Status 3.

Press ENTER. All transactions for that specific date will be listed. The list is sorted by status code, putting transactions with Status 3 on top.

Select a partial matched transaction.

Click on the Arrow symbol. The Bank Statement reconciliation popup will appear.

Inspect the invoice, the bank statement, and the Payment (PAY) document, and compare the amounts.

If the deviation is due to errors when punching the Payment (PAY) document manually, do as follows:

Click on the Unlink this payment or Unlink all payments for this bank statement buttons on the line of the incorrect Payment (PAY) document/documents. It will disappear from the list.

To choose selected Payment (PAY) documents by clicking the Arrow icon.

Do not select it by ticking the check box, but click on the PAY link. The PAY links then opens the Payment (PAY) application

Select the same Payment (PAY) document by ticking the check-box to the left on the line.

Click the Link selected payments to BST item button. Users can also filter out Payment (PAY) documents that need to be linked and use the Link filtered payments to BST item button. It opens a popup with the numbers of Payment (PAY) that will be linked.

If there are more Bank statement (BST) items in Status 3, the recently reconciled Bank statement (BST) item will be put to Status 3. Repeat the procedure until all Bank statement (BST) items in Status 3 are reconciled. When the last Bank statement (BST) item is reconciled, all the Bank statements (BST) items and documents will be put to Status 8.

To complete the bank reconciliation, the Bank statements (BST) must be confirmed. There are two ways of doing it either confirming all Bank statements (BST) for one bank at the same time or confirming each Bank statement (BST) document individually.

To do that, users can click the Confirm bank statements based on bank account and date... option to confirm multiple bank statements for one bank with the To date field filled and the Confirm bank statement (operation just for one BST).

Confirm all bank statements for one bank

Start in the Bank Statements folder in the Pay management (PAM) application.

Select a Bank statement (BST) document in Status 8 from the relevant bank.

Press F12 and choose the Confirm All Bank Statements for this Bank option.

Confirm a single bank statement

Start in the Bank Statements folder in the Pay management (PAM) application.

Select a Bank statement (BST) document in Status 8 and press ENTER.

Click on the Context menu and choose the Confirm Bank Statement option

When the reconciliation of a Bank statement (BST) document is confirmed, the connected Payment (PAY) document will be put to Status 9. This indicates that it is reconciled and there is no need for further handling. Unreconciled Payment (PAY) documents will remain in Status 4.

Deviation

If there is a deviation between the value in the Amount field in the Bank Totals-section and the total amount of the item lines, the Bank statement (BST) document will be in Status 1, and you will not be allowed to proceed.

Click the Context menu and select the Create new item from deviation amount option.

A new item line with the amount of the deviation will appear, the Bank statement (BST) document will be in Status 2, and you can continue the bank reconciliation procedure.

Create a Payment (PAY) directly from a Bank statement (BST) document

Click on the Arrow icon in the Bank statement (BST) item.

Click the Create new Payment button.

Check the payment information and make necessary changes.

Click F12 to open the action menu and choose the Register Payment option.