Make posting adjustments

When making posting adjustments you allocate the costs on account dimensions like department and project. Posting adjustments will make the cost accounting as accurate as possible.

Posting adjustments may be performed on both Supplier Invoices (SIN) and Sales Invoices (CIN).

Posting adjustments are to be performed on item level. Only items with a set account can be posting adjusted.

Make posting adjustments

To open the Supplier invoices (SIN) application, find Finance in the RamBase menu and then Payables. Click Supplier invoices to enter the SIN application

To make a posting adjustment on one item:

Highlight the specific item in the Items tab and press ENTER to open the Supplier invoice item (SINITEM) application.

Click on the + icon nest to the Posting adjustment plan field.

Repeat the procedure for each item.

In the Adj.% field the percentage of the total amount to be adjusted may be edited. The value in this field calculates the value in the Adj.amount field.

Enter the amount to be adjusted in the Ajd.amount field. The value in this field calculates the value in the Adj.% field.

In the Split field, enter how many splits the invoice item should be split into.

Press ENTER. The splits and their amount will be listed below.

Press the magnifying glass for each split to enter dimension(s).

Use menu option Register Account Adjustment Plan to register it.

The period adjustment plan is forwarded to Status 4 if the invoice is not registered or Status 8 if the invoice is registered.

An overview of the GL posting appears on the invoice under the Accounting tab and the Adjustments sub-tab.

Inspect Supplier/Customer Posting adjustments

Open the Period adjustment plan popup for the chosen invoice. The invoice must be registered. Press the magnifying glass in the upper right corner. The pop-up Supplier/Customer Posting Adjustment menu opens and displays the period adjustment documents (SPA/CPA) for the chosen invoice.

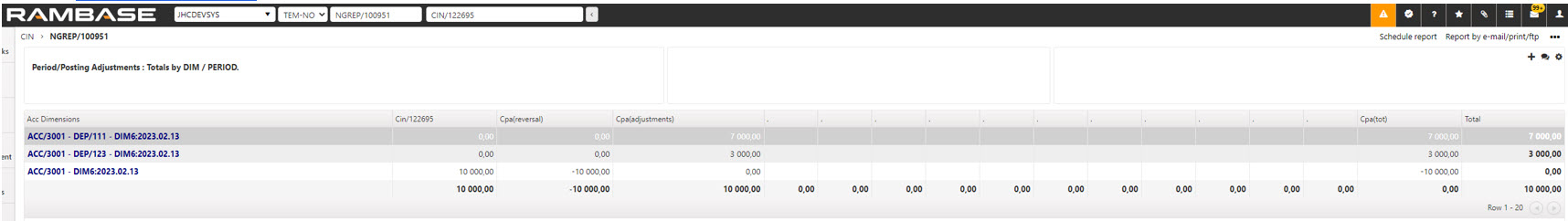

Overview of the invoice's posting adjustments

REP/100951 with filter on the SIN/CIN can be used for follow-up/control. The filter should then be REP/100951;CIN/XXXXXX or REP/100951;SIN/XXXXXX

How to make a period adjustment on a general ledger posting

Use the Make period adjustments option in the action menu on a manually created General ledger (ATR) posting in Status 4. This will give you the possibility to make a period adjustment to a cost without an invoice.

Select the period in the FromPeriod and ToPeriod fields and click the OK button to make the period adjustments.

For an overview of the period adjustments, use the menu option and select the Show period adjustments option.