Intercompany trade

Intercompany trade is the processes done between companies within a group with the same parent company. From a finance perspective, this usually refers to invoicing, payments and reporting.

Output from the Intercompany trade process

Intercompany invoices that are registered and reconciled.

Intercompany payments that are registered and reconciled.

Report consolidation.

Internal invoices are created.

Automating the finance processes between companies strengthen the overview of them. Ledger postings from within the group are automatically registered with an internal trade dimension, which makes it possible to consolidate and summarize reports on the group level.

Tasks in the Intercompany trade process

Intercompany invoicing - There are two ways to carry out intercompany invoicing: Sales invoices sent from one company to another company within a group, will be copied to the other company's system. Sales invoices for expenses sent from one company to another company within a group are copied to the other company's system. Automated intercompany Supplier invoices (SIN) copied from Sales invoices (CIN) will include a PDF copy of the Sales invoice (CIN).

Intercompany payments - Intercompany payments give an overview of the corporate incoming and outgoing payments that are connected to your company. If payments are missing in your company's system, they can be created from the intercompany payment application.

Report consolidation - Financial data can be accumulated from all of the companies in a group. Reports created in the finance report editor can be consolidated across this group. One company's account structure can be defined as the report master. Report consolidation can also be carried out by using dedicated consolidation reports. These reports list the intercompany transactions and simplifies the process of creating consolidated accounts. Based on the initial intercompany system setup, all intercompany transactions can be automatically registered in the general ledger with a dedicated account dimension. This makes it possible to report on all intercompany transactions, and on the company related to each of the transactions.

Internal invoicing - Internal invoicing is about invoicing within one company, e.g. from one department to another department. How to carry out internal invoicing depends on your company's requirements for cost accounting.

Setup for internal invoicing of costs

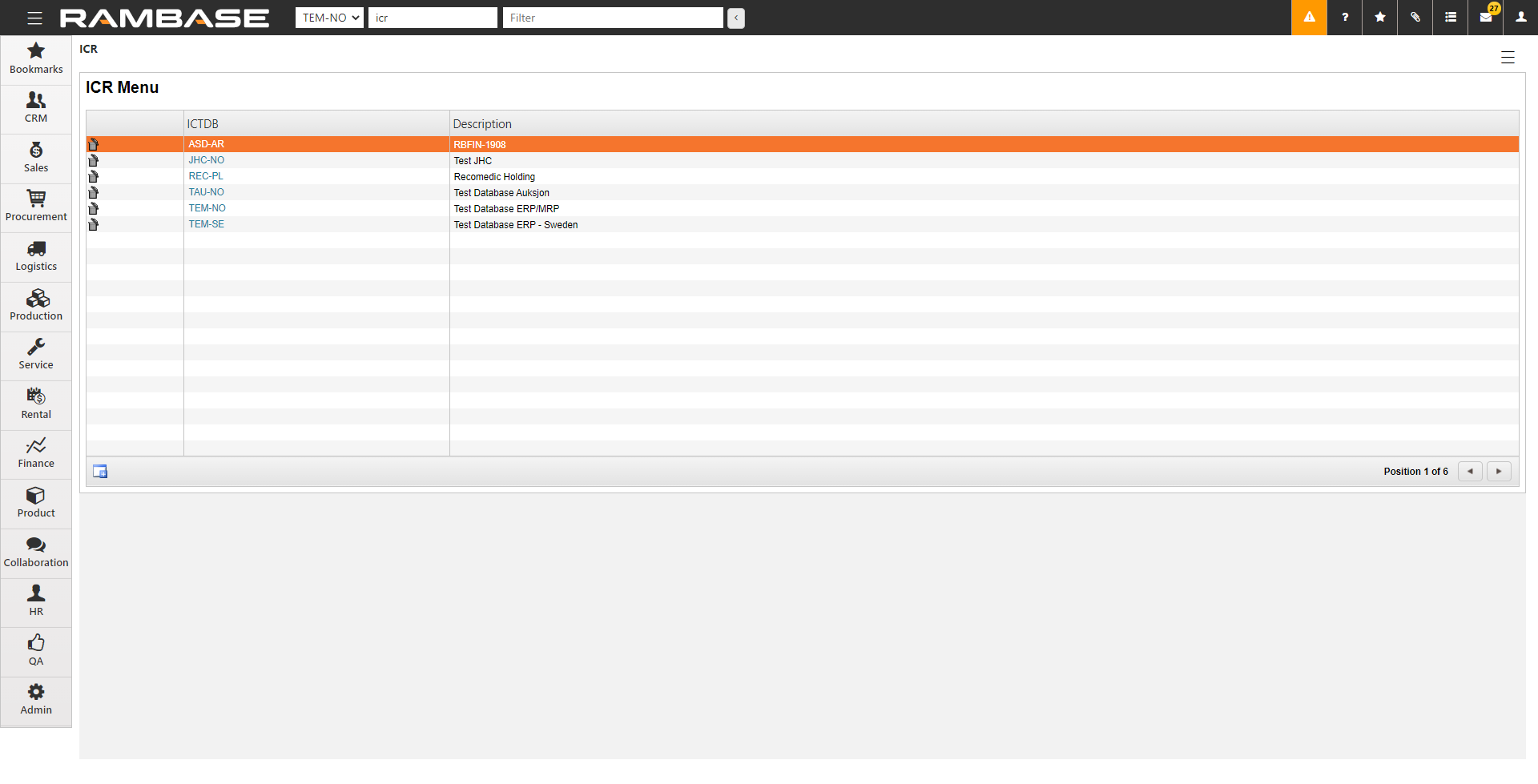

Enter ICR in the Program field and select the Enter Key to open the ICR menu.

Tip

If the company using RamBase is part of a corporation, you can set up the other companies in the corporation in the ICR archive. The companies set up in ICR does not have to use RamBase.

The value set up in ICR consists of three letters as an abbreviation for the company and then 2 letters for the country where that internal company is situated. For example XXX-NO for a Norwegian company.

The value set up in ICR is then chosen for the CUS/SUPs (field Intercompany code) that are set up for the internal companies. Documents such as orders/invoices for these internal CUS/SUPs will be marked with the respective Intercompany code.

If relevant GL accounts are set up with Intercompany code = Required/Optional this value will be brought into the General ledger (GL) and the user will be able to pull up reports based on intercompany code. Also, in the Period closure register (PAR), there will be a reconciliation between the internal companies.

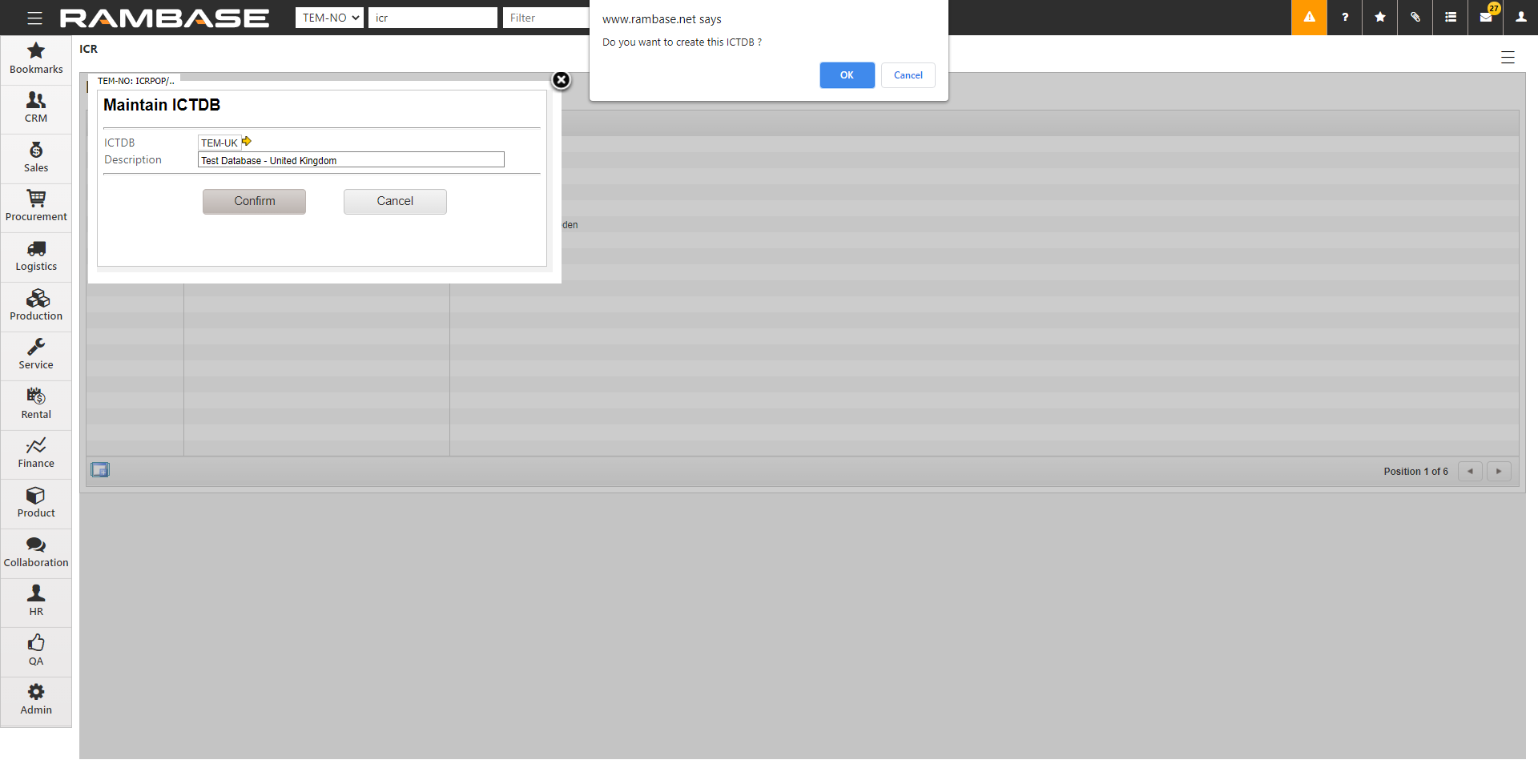

To create a new database, click the Create new button.

In the ICTDB field, enter the database abbreviation for the other company. This allows you to mark the Customer (CUS) and Supplier (SUP) in the respective database with an inter-company code. You can select the inter-company code in the Customer (CUS) and Supplier (SUP) applications under Settings, then Finance.

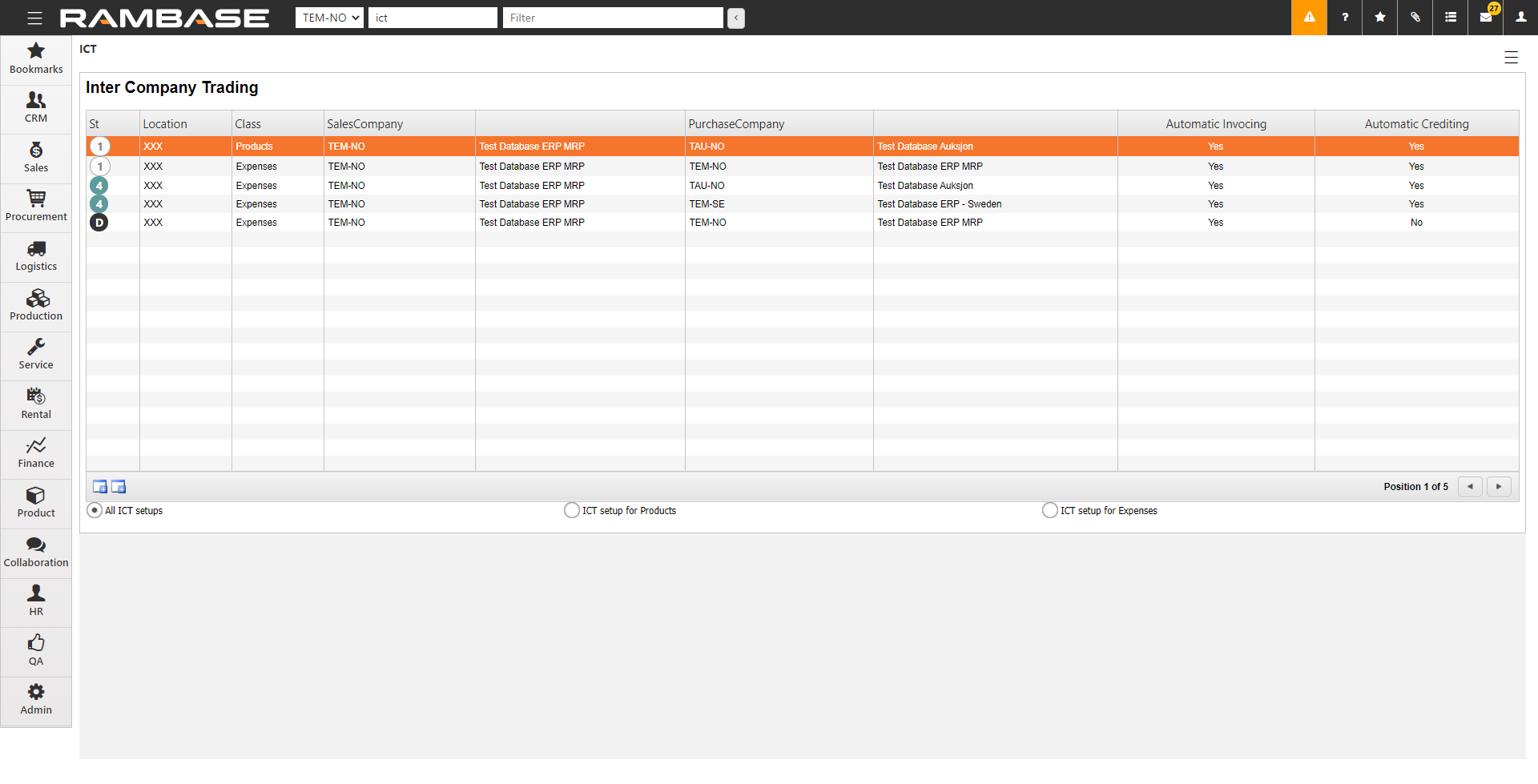

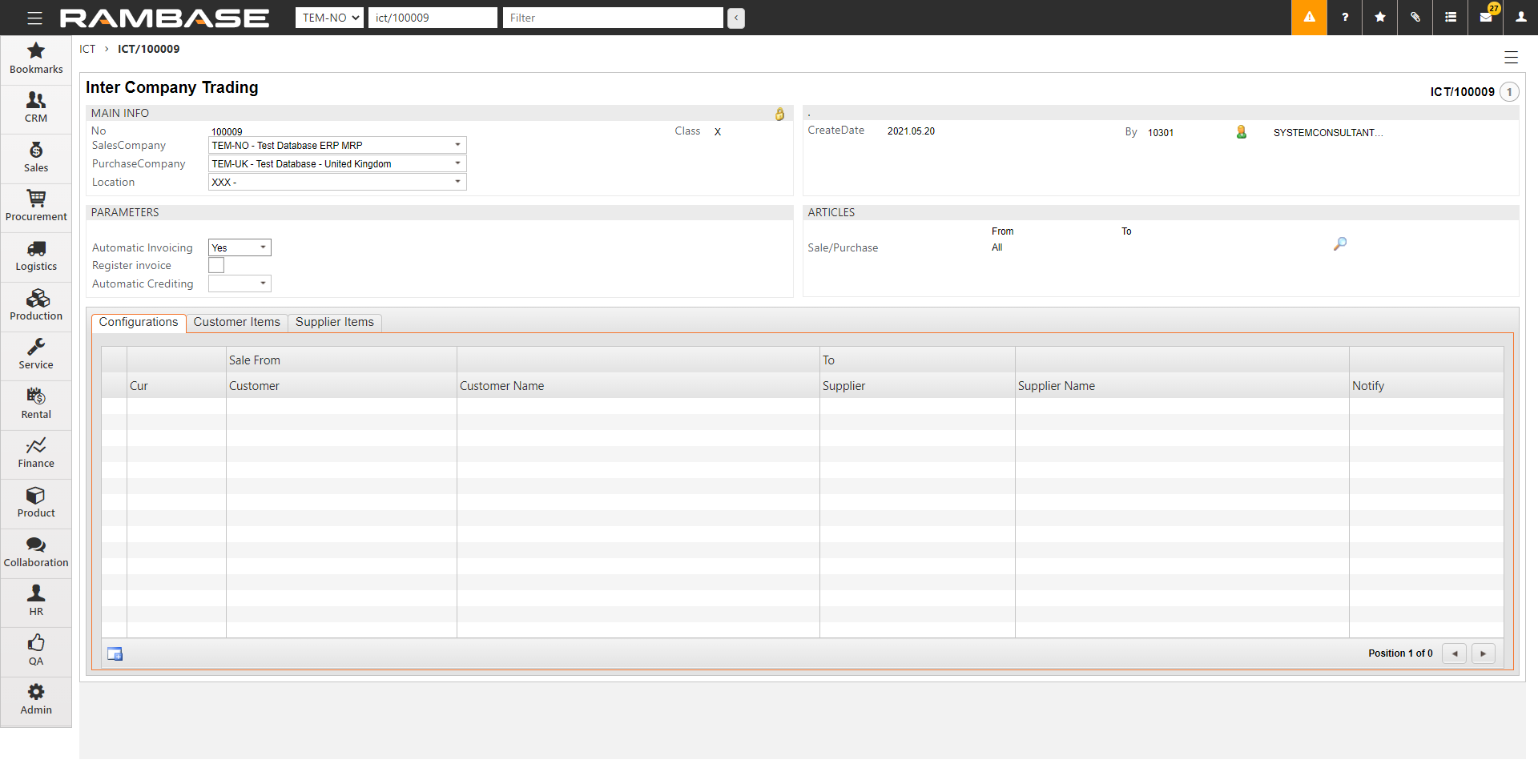

Enter ICT in the Program field and select the Enter key to open the Inter Company Trading (ICT) application.

Tip

If the company using RamBase is part of a corporation, it is possible to set up that outgoing cost invoices, created in one company, should be created as an ingoing invoice in the other company. Companies set up in the ICT archive must use RamBase.

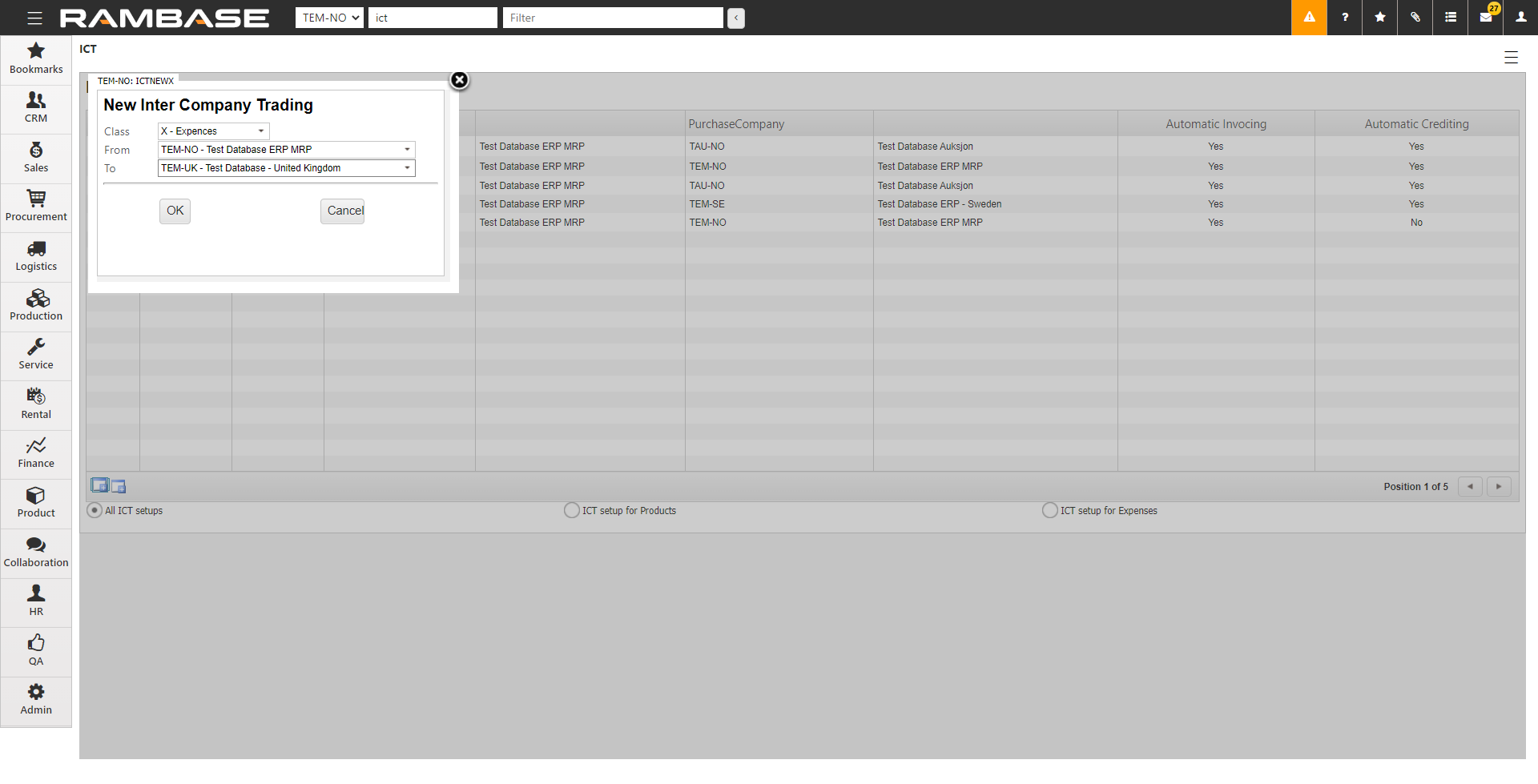

Select the icon on the left, Create ICT setup for Expenses.

Select the two applicable databases in From and To and select OK

Set Automatic invoicing to Yes.

To register the Supplier invoice (SIN) automatically to Status 4 without approval, clear Register invoice. If Register invoice is selected, the Supplier invoice (SIN) remains in Status 1, even if an approval is not required.

Set Automatic Crediting to Yes if inter-company credit should be created automatically.

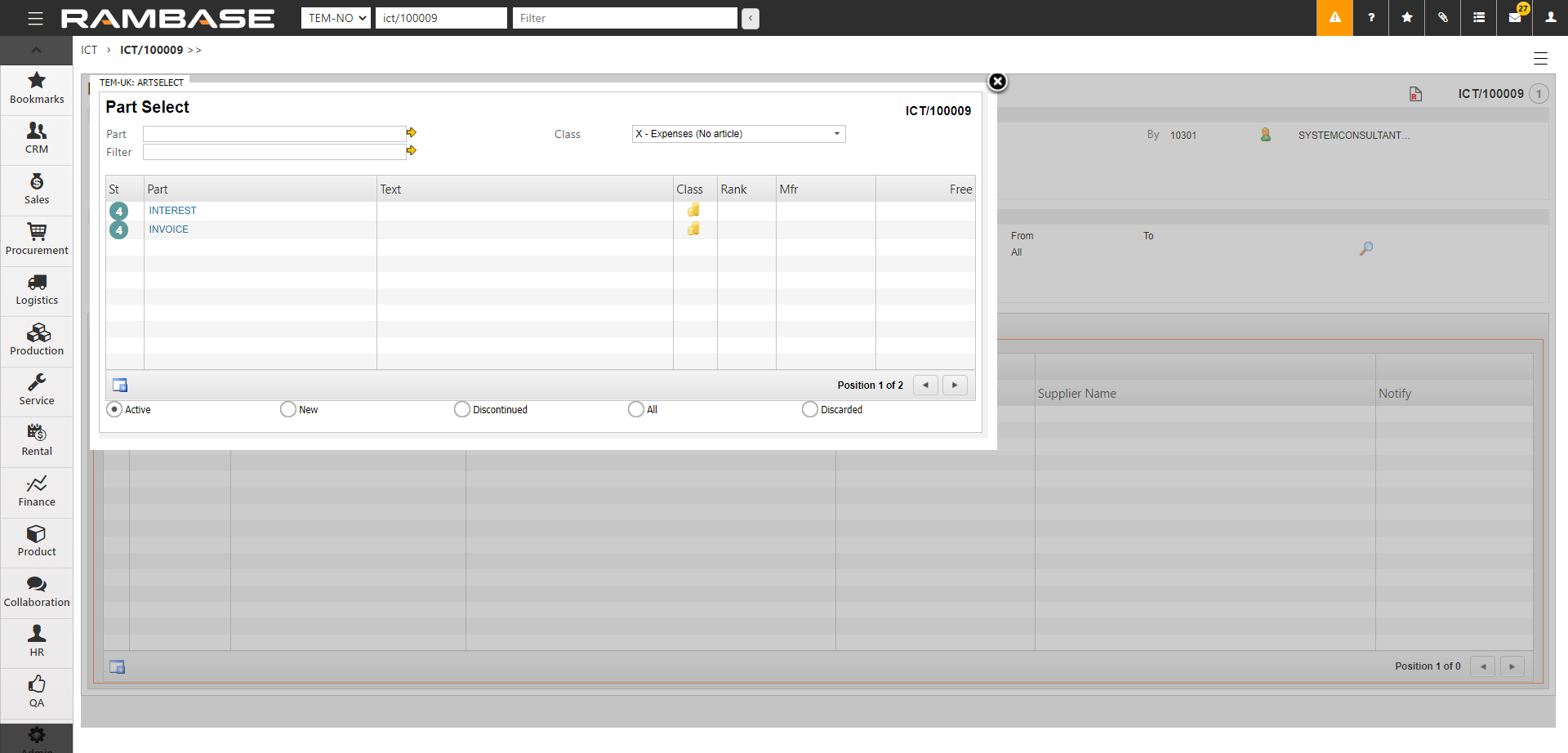

In Articles, select

and specify the article used for nnvoices. This is the article used in the incoming invoices.

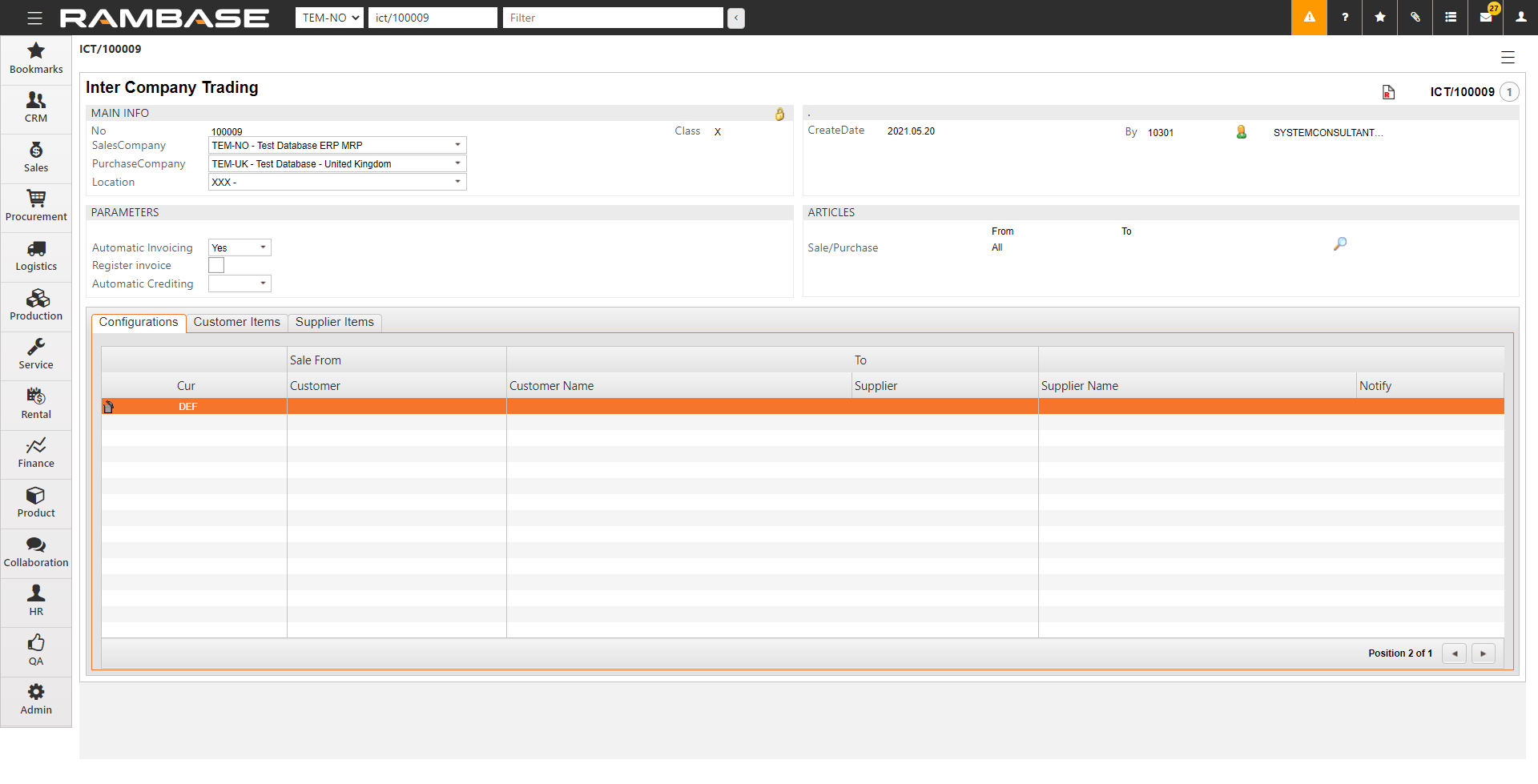

In Configurations, select the DEF-line and press the Enter key.

Specify the Customer (CUS) and Supplier (SUP). The correct customer or supplier appears if you have marked them with the inter-company code. If you have not marked the customer and supplier with the inter-company code, do that first.

Set up a Notify PID to specify the user to receive an internal message when a new incoming invoice is created.