Reconcile deviations between the GL and the cash management module

As a part of the preparation for period closure, a bank reconciliation must be performed either automated via BST or manually via RECPAY. A bank reconciliation performed prior to period closure matches the bank transactions with the Payment (PAY) documents recorded in the cash management module in RamBase. A bank reconciliation performed during the period closure (Bank Reconc folder in PAR) validates that all PAYs are registered in the general ledger.

It is important that the bank reconciliation from BST and RECPAY are performed prior to period closure in PAR to avoid major deviations.

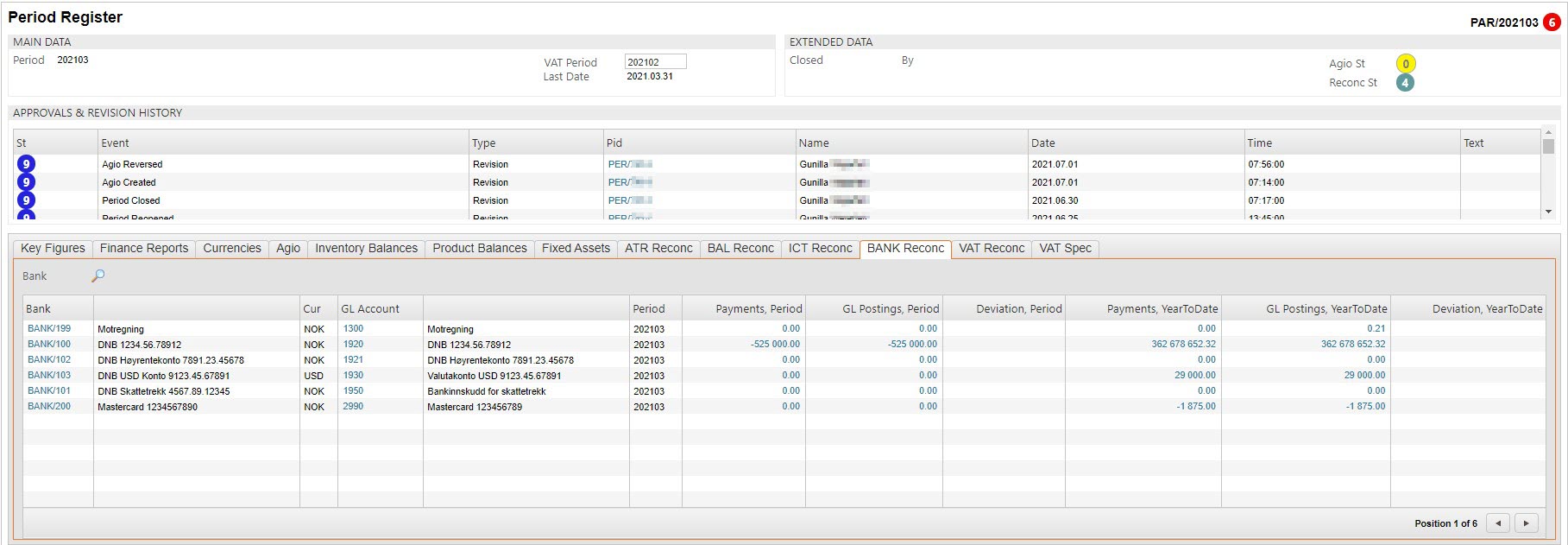

To open the Period Account Register (PAR) application, find Finance in the RamBase menu and then General ledger. Click Accounting periods to enter the PAR application.

Highlight the relevant period and press ENTER.

Select the BANK Reconc folder.

This folder lists the recorded balances for the bank accounts in the General Ledger, the balances for PAYs reconciled with the bank statements. These two balances should match for each account, if not, the deviation will be displayed in the Deviation,YearToDate column to the very right of the table.

If there is a value in the Deviation,YearToDate column, it must be reconciled.

Highlight the line for the account with deviation and press ENTER to see more details about the deviation.

Identify the problem and correct it.

When all deviations are reconciled, press F12 to open the action menu and choose the option Approve Bank Reconciliation.

Optionally, make a comment.

Click the OK button.