The Supplier invoices (SIN) application

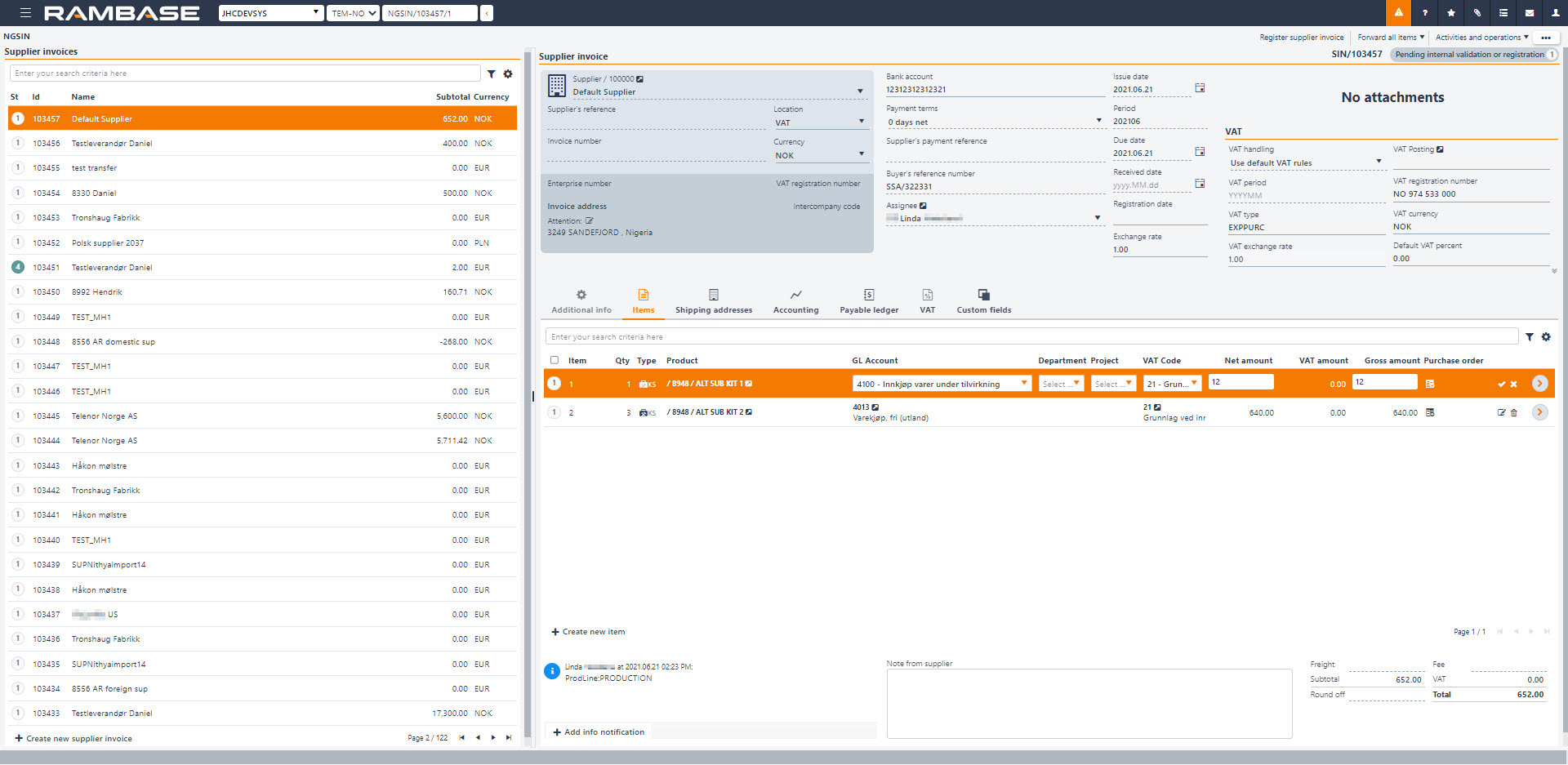

Select an invoice in the Supplier invoices area to view, add and change information about the invoice by selecting the tabs and sub-tabs on the right.

Use the search field to find your invoices or click the Predefined filters icon next to the search field to select a predefined filter. There are three predefined filters: Invoices with info notification, My invoices and Pending registration.

The attachments to the selected Supplier invoice (SIN) is available in the top right corner of the application. Click the Preview icon to preview the attachment or download it with the Download file icon. The preview option is only available for PDFs.

The Supplier invoice area

This area contains info about the selected Supplier invoice (SIN). Here is an explanation about all the fields:

Supplier / xxxxxx – This is the RamBase supplier identifier.

Supplier’s reference - Supplier/sellers reference. Usually a person.

Location – Location identifier.

Invoice number – Suppliers/sellers reference number. Typically to an external system.

Currency – Suppliers currency. Three character code following the ISO 4217 standard.

Enterprise number, VAT registration number, intercompany code and invoice address will be added from the selected Supplier (SUP).

Bank account – Account number used to identify the bank account.

Issue date – Date when the document was issued.

Payment terms – Terms of payment. Default value is retrieved from the supplier.

Period – Accounting period identifier.

Supplier’s payment reference – Sellers reference to identify the object. In Norway this is typically a KID-number.

Due date – Date the object is due to be paid.

Buyer’s reference number – Buyers reference number.

Received date – Date when the document was received.

Assignee – User identifier.

Registration date – Date of registration.

Exchange rate – The exchange rate used in conversion.

VAT handling – Specifies how value added tax (VAT) should be calculated.

VAT period – Accounting period this VAT posting belongs to.

VAT registration number – A unique number assigned by the relevant tax authority to identify a party for use in relation to VAT.

VAT type – Type of VAT.

VAT currency – VAT currency. Three character code following the ISO 4217 standard.

VAT exchange rate – Rate between transaction currency and company VAT currency. VAT rate should be used to calculate VAT amount in company VAT currency.

Default VAT percent – VAT percent.

Default VAT code – Code that determines VAT rules used for VAT calculations.

VAT date – Date of VAT posting. Currency rate calculation use this date.

VAT country – Country name of VAT entity.

Adjusted VAT amount – Adjusted VAT amount.

The Items tab

The Items tab displays all items added to the selected Supplier invoice (SIN) and it is possible to edit, delete and add more items here.

All notifications will be visible in this tab and it is possible to add any info notifications with the Add info notification button.

The Inspect approval tab provides a detailed view of the approval process for the selected invoice. When clicked, it opens a breakdown of:

Who has approved or rejected the invoice.

The current status of the approval workflow.

Any pending approvals and their respective approvers.

The Create auto approval rule is used to define automatic approval rules for specific products or invoices. Auto approval rules streamline the process by automatically approving invoices that meet predefined criteria.

The amounts are visible in the bottom right corner. There you can see the freight, fee, subtotal, VAT, round off and total amount.

It is possible to edit the item directly in the Items tab. You can edit the GL Account, Department, Project, VAT Code, Net amount and Gross amount fields. Highlight the item and press F2 or click on the edit icon to the right on the item line. When you are done, press Ctrl+s or click on the checkmark to save it.

Highlight an item and press ENTER or click the arrow button to the right to open the Supplier invoice item (SINITEM) application. This is a more detailed overview of the selected item and it is possible to edit or add more information here.

Add info notification

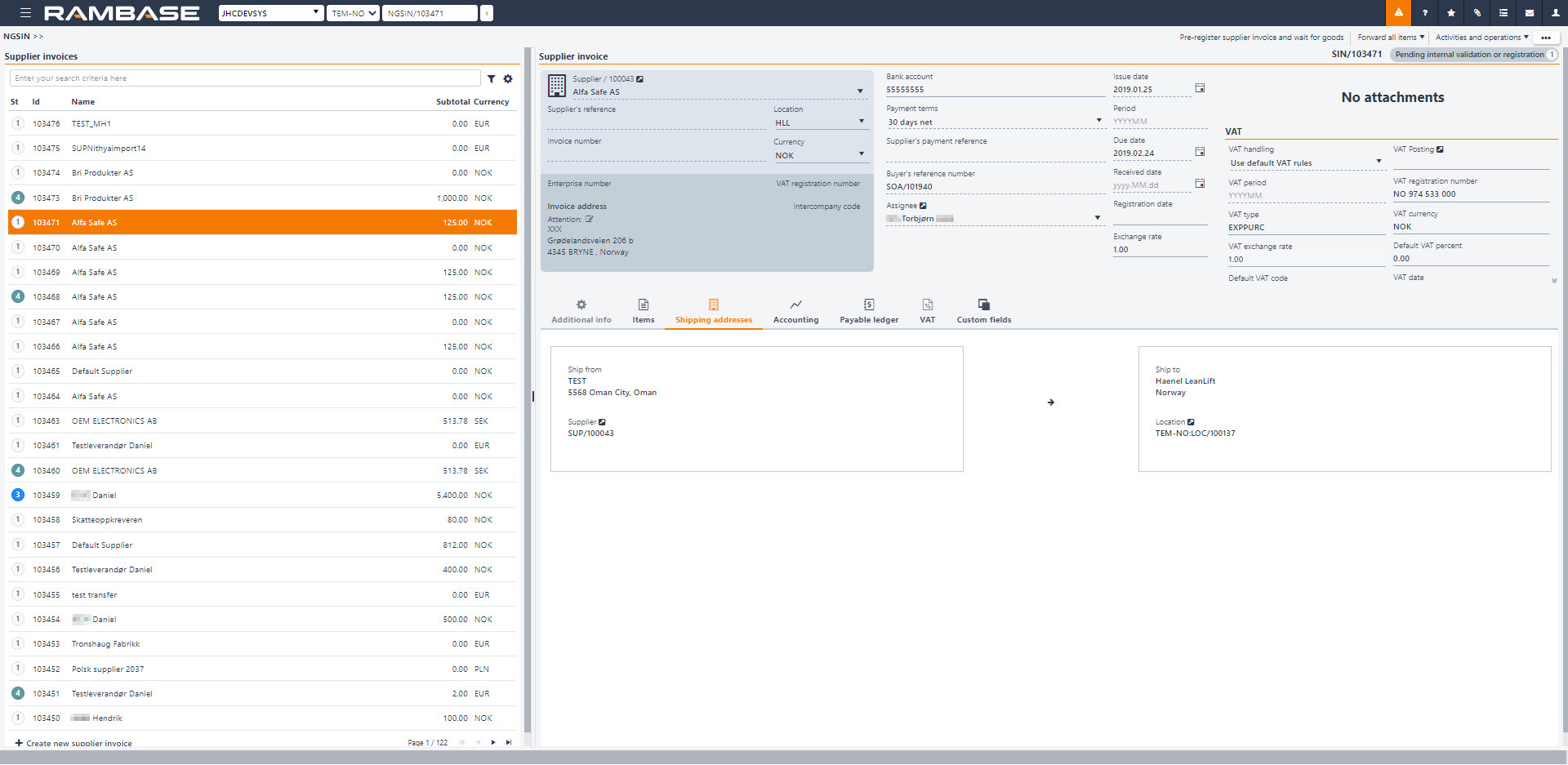

The Shipping addresses tab

The Shipping addresses tab displays where the items are shipped from and to where.

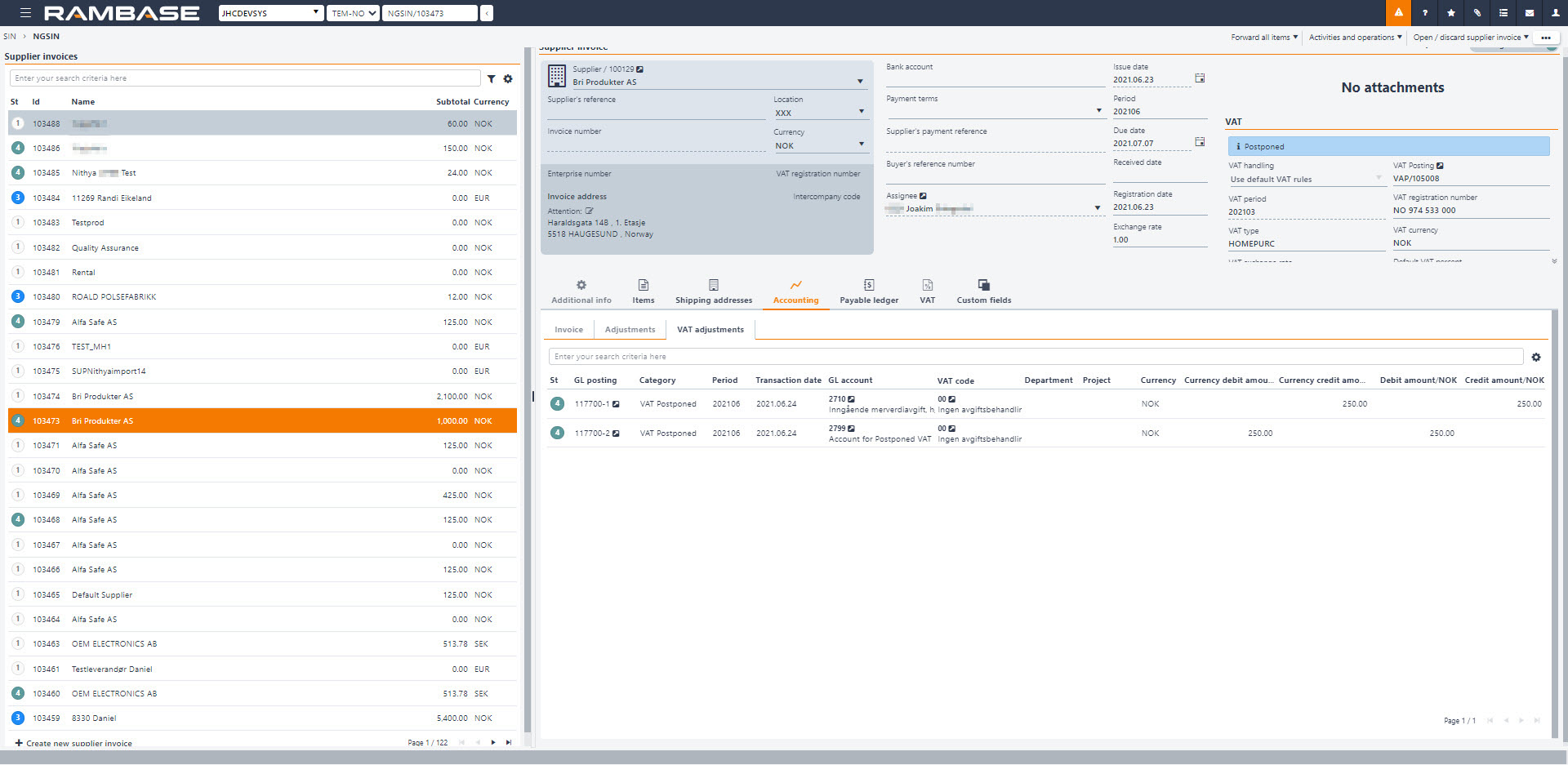

The Accounting tab

The Invoice tab shows how the invoice is posted, with link to the Payable journal entries (SAS) and General ledger posting (ATR).

You can make/edit/view the period adjustment plan for the selected SIN by clicking on Adjustments. You can read more about it in the Make period adjustments for Supplier invoices (SIN) topic.

All the VAT adjustments is displayed in the VAT adjustments tab. Click on the arrow icon in the GL posting column to enter the specific General ledger posting. You can postpone and repost VAT with the context menu options: Postpone VAT and Repost VAT...

The Payable ledger tab

Use the Payable ledger tab to see the specific payable information for this SIN. It displays the Payable transaction document, registration date, due date, currency, amount, link to the Payment (PAY) document when it is paid and payment date.

The VAT tab

The VAT tab shows a detailed overview of the VAT information about the selected SIN.

The Custom fields tab

The Custom fields tab displays all the available custom fields selected by your company.