Factoring in RamBase

The purpose of factoring is to improve cash flow by using your sales invoices (accounts receivable) as collateral for cash provided by a factor in a short-term loan.

Setup

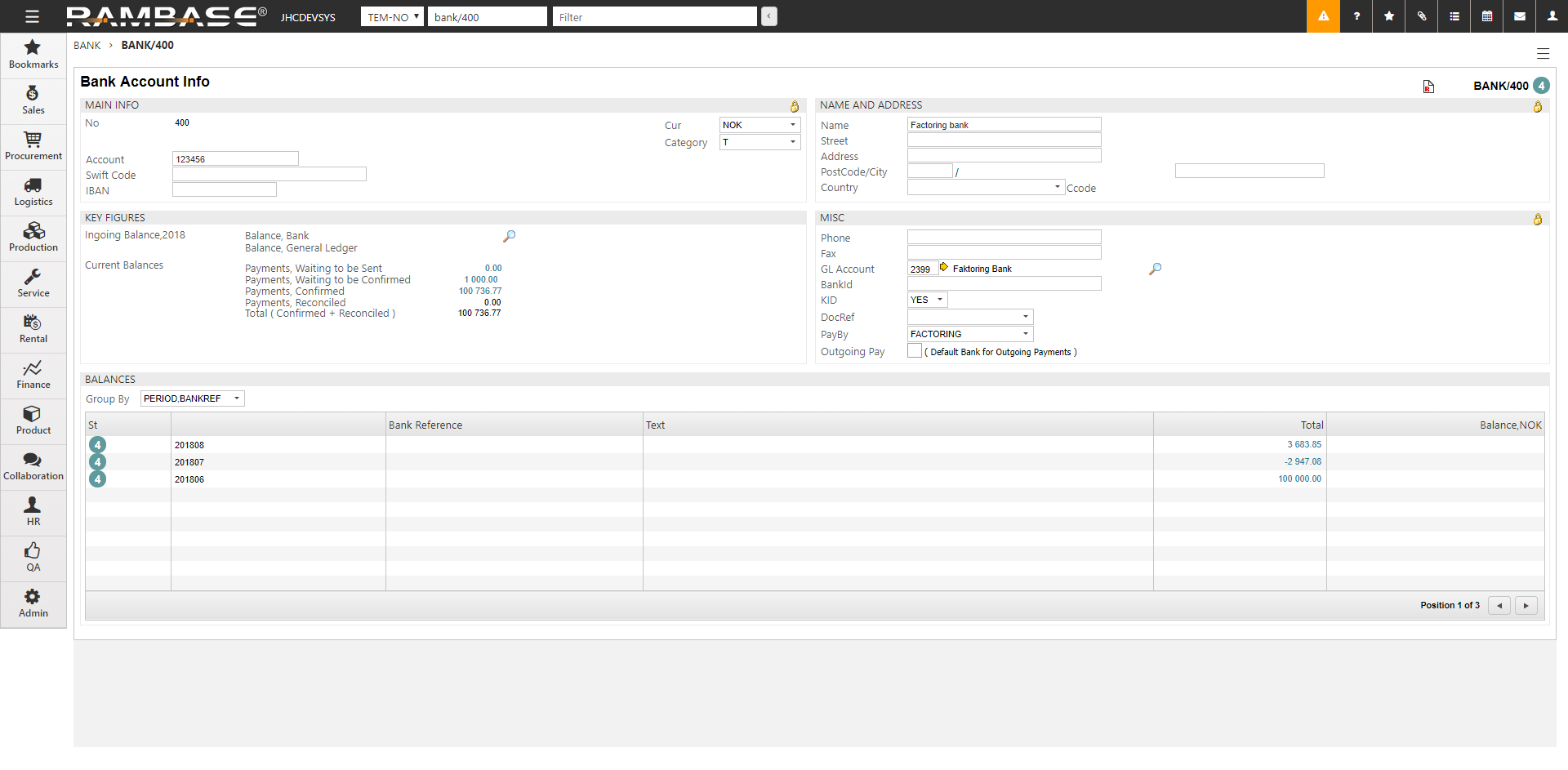

Set up the Bank (BANK) which will be used for factoring.

To open the Bank Accounts (BANK) application, find Finance in the RamBase menu and then Cash management. Click Banks to enter the BANK application.

Highlight the bank which will be used for factoring and press ENTER.

In the Bank Account Info, select Factoring in the PayBy field.

Use of Factoring - Used to activate functionality that will allow company to send Sales Invoices (CIN) to factoring.

Optionally, turn on this setting:

Factoring Invoice journal - This setting determines if the company should produce invoice journal (PDF) as an overview of invoices sent to the factoring company.

Only turn these four settings on, if your company uses SG Finance.

Customer file for SgFinance - This setting should be activated only if the customers uses SG Finance as factoring company. This setting allows the customer to create a customer file according to SG Finans'es file format.

Customer number at factoring company - Customer number. Used in the files to the factor to identify the sender.

Invoice file for SgFinance - This setting should be activated only if the customer uses SG Finance as factoring company. This setting allows the customer to create a invoice file according to SG Finans'es file format.

KID Format - KID format for Sales Invoices that should be sent to Factoring Company.

From the RamBase menu select Admin and then Print / email administration.. Click on the Output settings option to open the Output settings (OOS) application.

In the Output settings (OOS) application, click on the Output tab.

Click on the Select sub tab.

Click on the Finance drop-down menu and select CashManagement.

From here the user can setup all, or individually, the following options:

Factoring: Send payments file 1 - Invoices

Factoring: Send payments file 2 - Factoring Journal PDF (invoices)

Factoring: Send payments file 3 - Customers.

Work with factoring

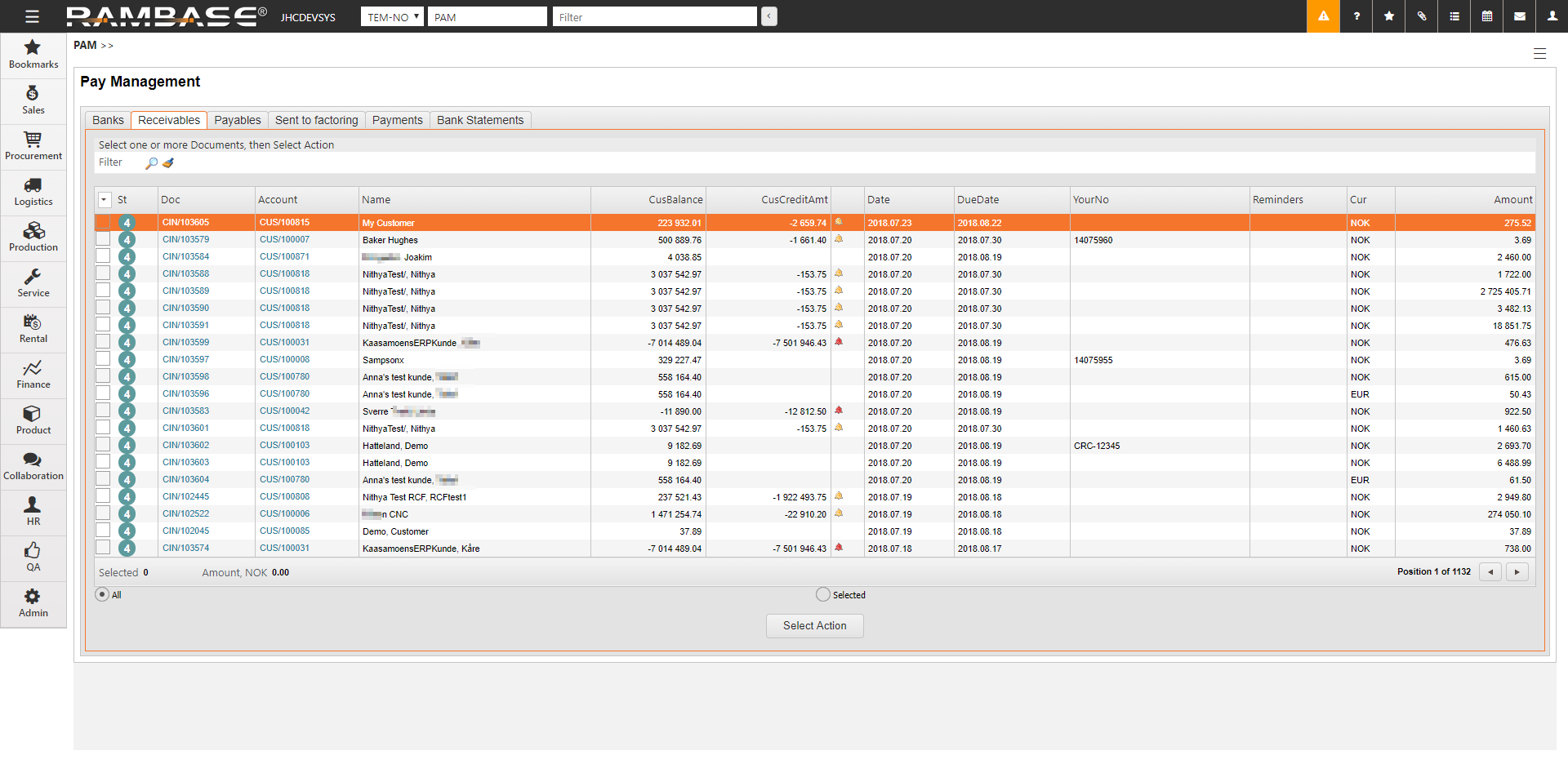

To open the Pay Management (PAM) application, find Finance in the RamBase menu and then Cash management. Click Inbound payments to enter the PAM application.

Select the Receivables folder.

Sales Invoices (CIN) and Sales Credit Notes (CCN) which are sent to factoring disappear from the list in the Receivables folder, but appear in the Sent to factoring folder for further handling. Invoice journal (PDF) will be generated and sent on mail to the person who initiated the process. If your company uses SG Finance, you will receive a customer file and a invoice file as well.

These files may be sent to the factoring company. The information within these files forms the basis for the factoring company's further actions.

Send sales invoices to factoring

If you have invoices in more than one currency, select one currency at a time. You have specific factoring banks for each currency.

Select CIN(s) for action.

It is possible to mark one, some or all of the CINs by using the check-boxes.

To view selected CIN(s), use the radio button. The CIN(s) may be un-checked if needed.

Click the Select Action button below the document list.

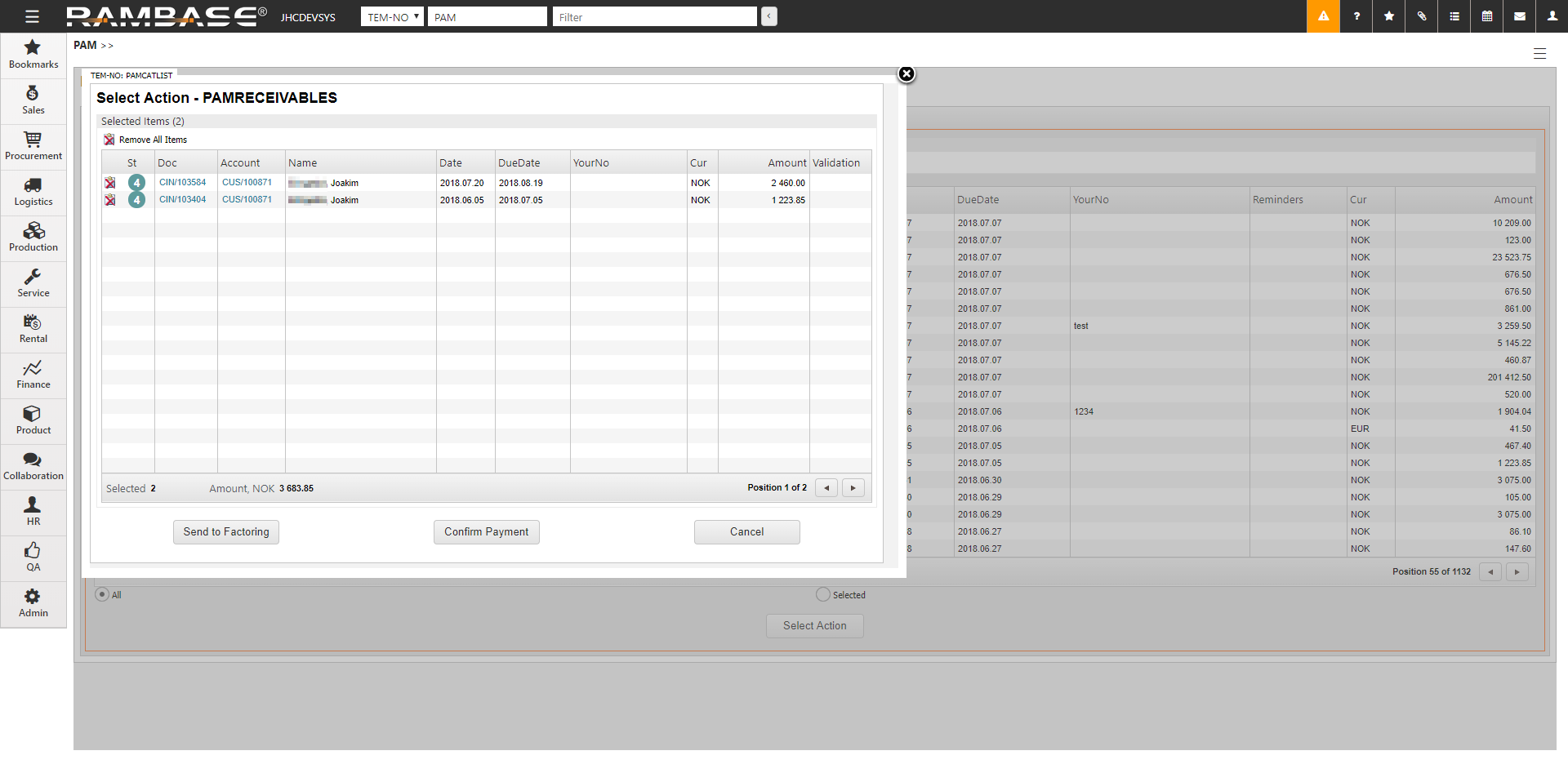

Verify that there is no extra CIN which might have been accidentally selected.

Click the Send to factoring button.

Click the Start Action button.

A progress bar appears. The Payments (PAY) will be set to St=3 and can be found in the Payments folder in PAM. The CIN will be set to St=8 and can be found in the Sent to factoring folder in PAM.

When the process is complete, a new window with information about the result of the process pops up and a PDF file are sent to you by email.

Send the file(s) to the factoring bank.

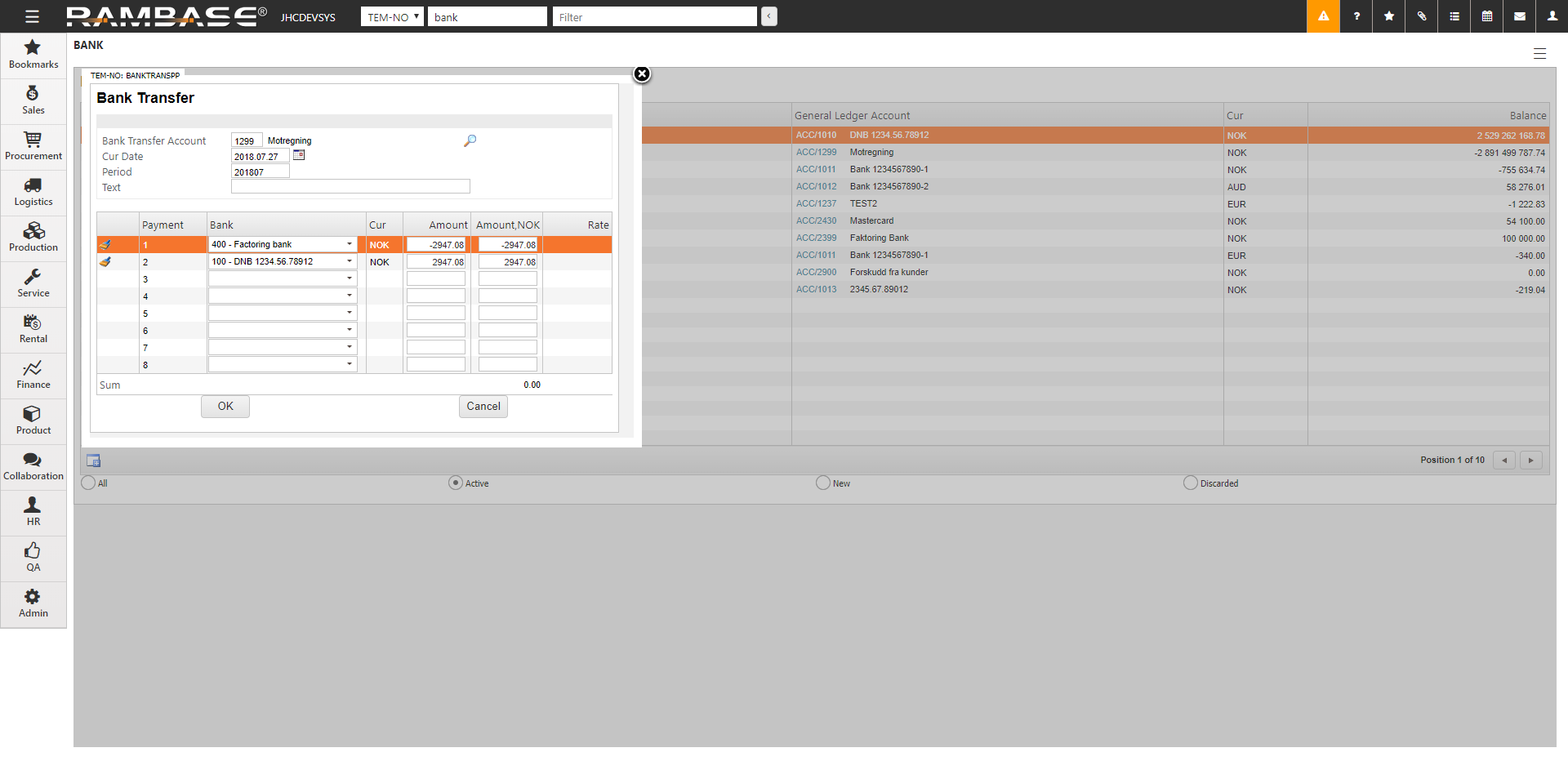

Register the first payment from the factoring company

Register the first payment from the factoring bank when you receive it. In this example it will be 80%.

To open the Bank Accounts (BANK) application, find Finance in the RamBase menu and then Cash management. Click Banks to enter the BANK application.

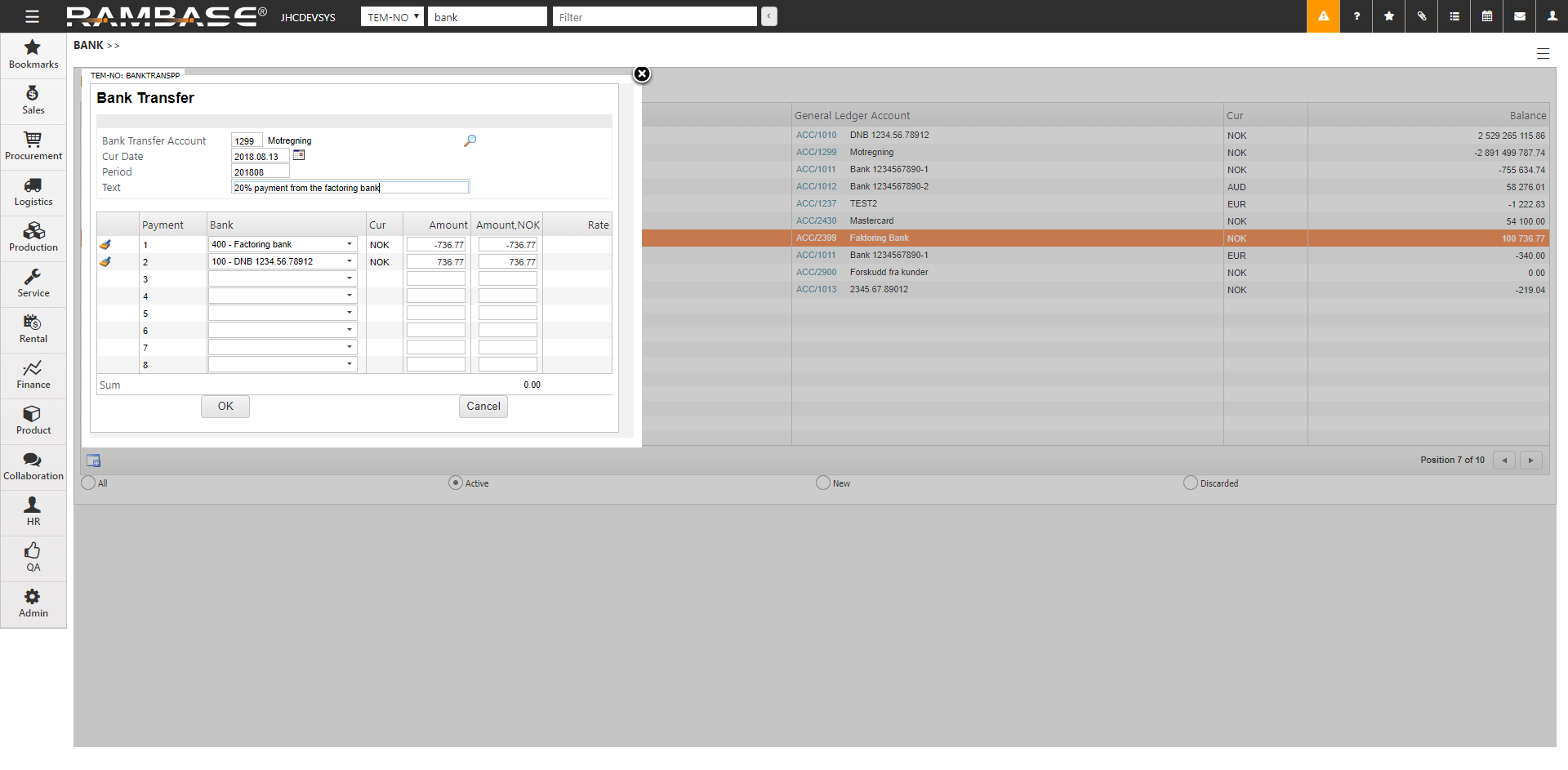

Press F12 to open the action menu and choose the Bank Transfer option.

In the Bank Transfer popup, make a bank transfer from the factoring bank to the bank for the respective currency and click the OK button.

The percentage must be calculated manually.

You will receive equivalent 80% of the invoice amount in debit on the cashier, and correspondingly 80% of the invoice amount in credit on the account of short term loan from the factoring bank.

Register payment from the customer

If your company is running SG Finance, you may receive a file from them. Otherwise, you have to register it manually.

Register the PAY when it is confirmed that the customer has paid the CIN(s) to the factoring bank. It is easiest to do it in PAM.

To open the Pay Management (PAM) application, find Finance in the RamBase menu and then Cash management. Click Inbound payments to enter the PAM application.

Select the Sent to factoring folder.

Use the checkboxes to select the CIN(s) that you want to confirm payment on.

Click the Select Action button.

In the popup, click the Confirm Payment button.

Verify valuation date in the CurDate field.

Click the Start Action button.

The PAY documents is now in ST=4. The balance in the factoring bank account will be the remaining 20% of the invoice amount.

Register the final payment from the factoring company

When you receive the payment for the remaining 20% from the factoring bank, use the bank transfer option to register the payment.

To open the Bank Accounts (BANK) application, find Finance in the RamBase menu and then Cash management. Click Banks to enter the BANK application.

Press F12 to open the Action menu and choose the Bank Transfer option.

In the Bank Transfer popup, make a bank transfer from the factoring bank to the bank for the respective currency and click the OK button.

The percentage must be calculated manually.

The balance of the factoring bank account is now 0% of the invoice amount. Balance on the main account for the regular bank is now equivalent to 100% of the invoice amount.

Follow up on factoring in RamBase

Check the PAYs that are waiting to be confirmed in BANK. You will get a report on PAYs in ST=3.

To open the Bank Accounts (BANK) application, find Finance in the RamBase menu and then Cash management. Click Banks to enter the BANK application.

Highlight the factoring bank and press ENTER.

Click the link for Payments, Waiting to be Confirmed.