Calculate the VAT settlement

A company is obligated to do a VAT settlement and report their VAT balance to the authorities.

A company must pay outbound VAT. The outbound VAT amount can be seen upon as a tax collected on behalf of the authorities. Inbound VAT is deducted from the outbound VAT amount. The inbound VAT can be seen upon as a tax the company has to pay, but this amount is reckoned as collected on behalf of the authorities by one of the suppliers.

Calculate the VAT settlement

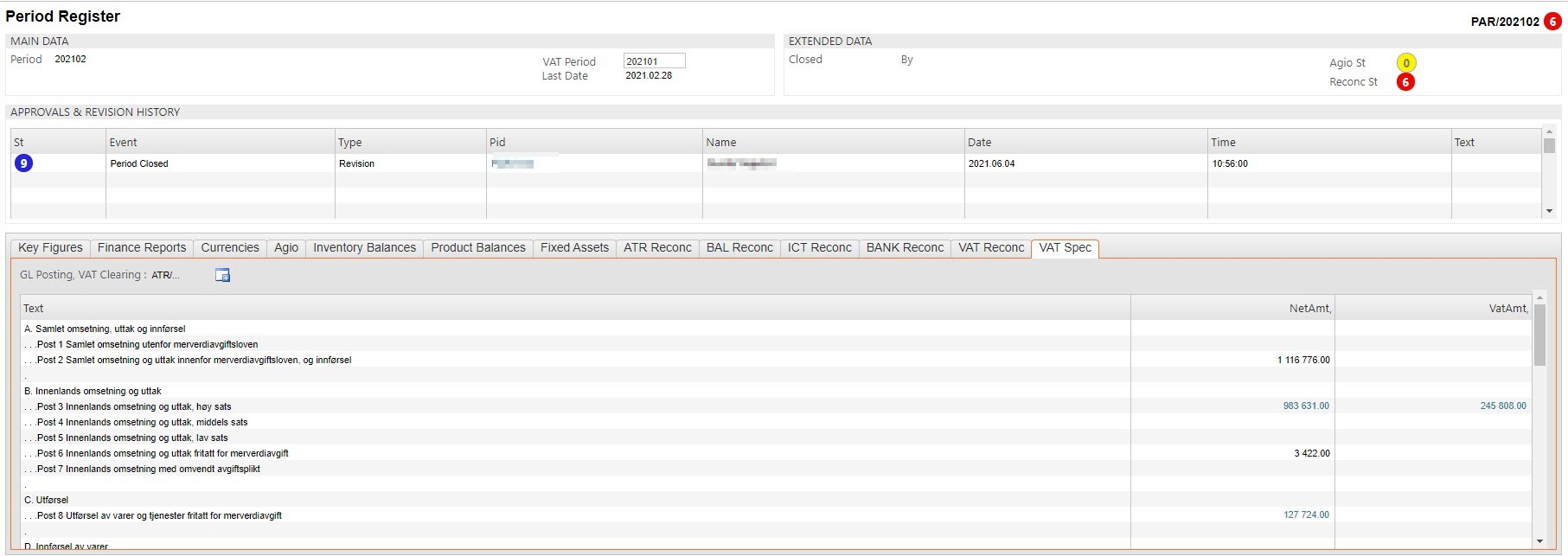

To open the Period Account Register (PAR) application, find Finance in the RamBase menu and then General ledger. Click Accounting periods to enter the PAR application.

Highlight the relevant period and press ENTER.

Select the Vat Spec folder.

In accordance with national Accounting Acts, a VAT period consists of one or more accounting periods. At the end of every VAT period, you must calculate the VAT settlement. The VAT settlement shows the liability or the claim between the company and the authorities.

To calculate the VAT settlement, click the + icon to the mid right. The system transfers the balances from the respective VAT accounts to the VAT settlement account.

Verify that the new balances on the VAT accounts are zero and that the balance on the VAT settlement account is equal to the amount at the bottom of the VatAmt column.