Aritma bank integration set up (ARITMASETUP) application

1. To set up the new integration, start with activating the following Company settings (CSV) in RamBase:

Activate Bank Integration – Setting for the bank integration, containing bank statements, incoming payments and remittance. Please note that a valid bank agreement has to be made and that agreement ID is added on relevant bank accounts in the BANK application.

Use production environment – If this setting is activated, the bank integration will use the production environment of the providers. Activate this setting only on production systems!

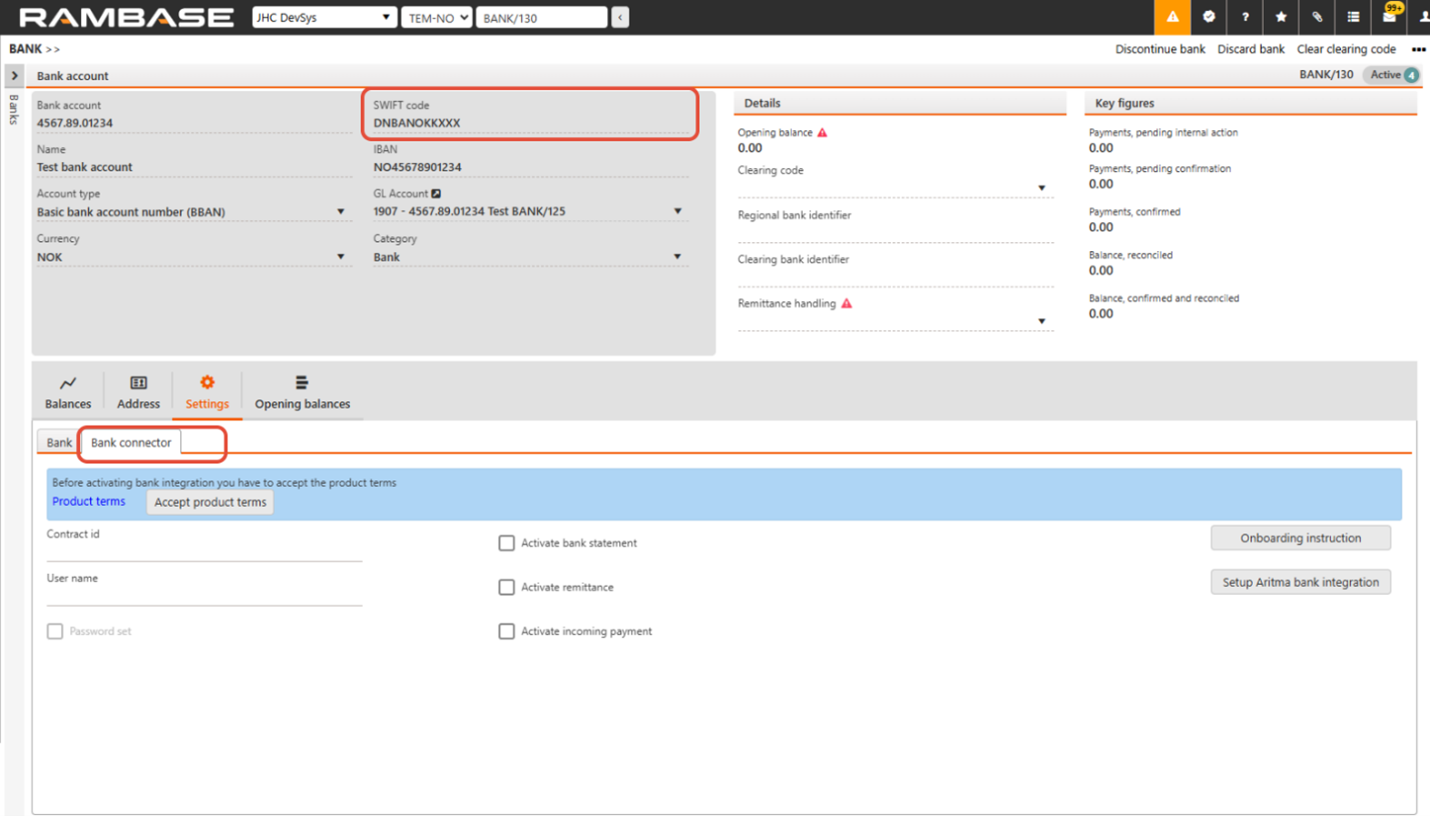

2. Bank integration configuration

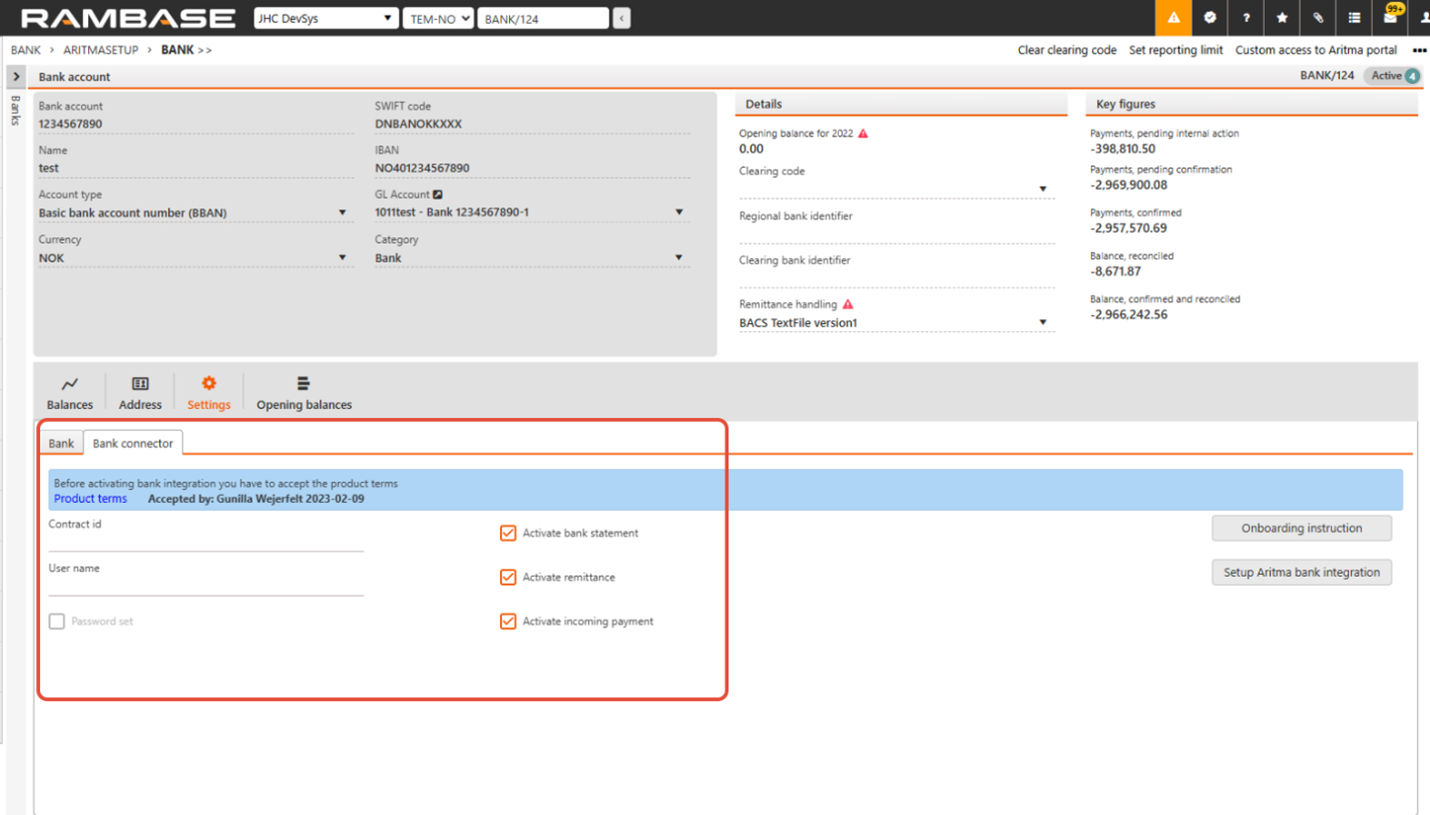

When the Company settings (CSV) in step one is activated, you will see a new sub folder under the Settings folder in the BANK application, Bank connector. SWIFT-code is the key to RamBase/Bankconnector to understand which bank the setup applies to.

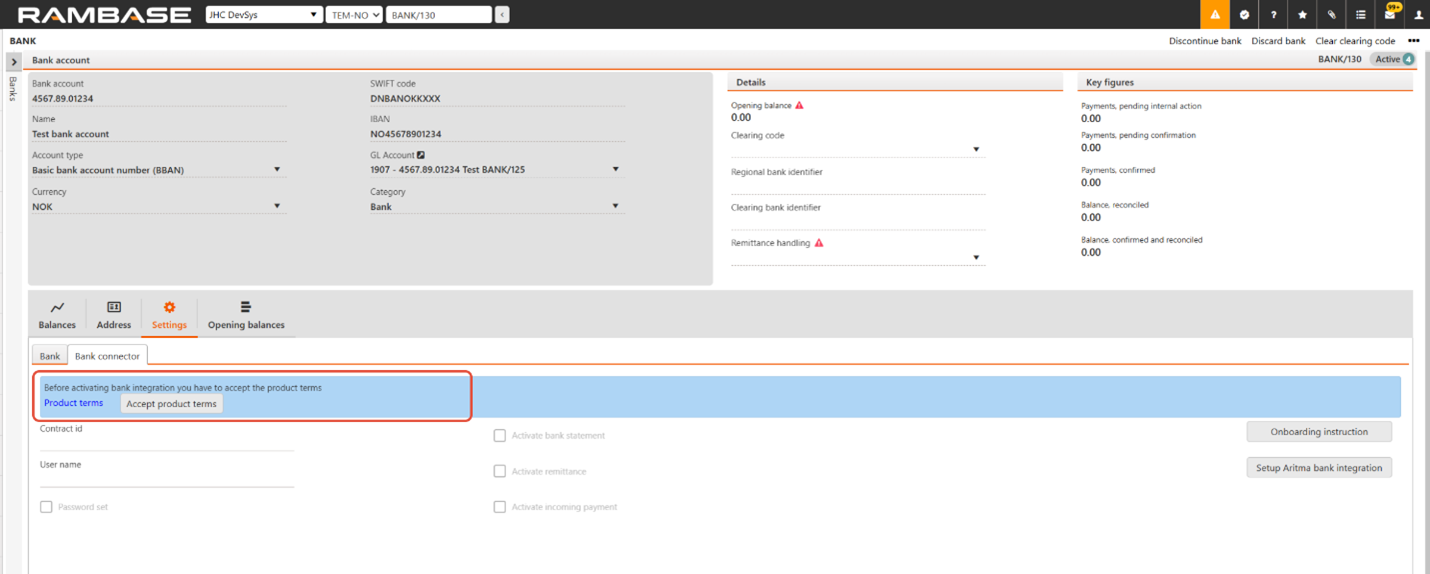

3. Product terms

Note that the customer must accept the product terms. Until the product terms are approved, the fields Contract ID, User name, Password set, Activate bank statement, Activate remittance and Activate incoming payment are inactive.

4. Activating the bank integration

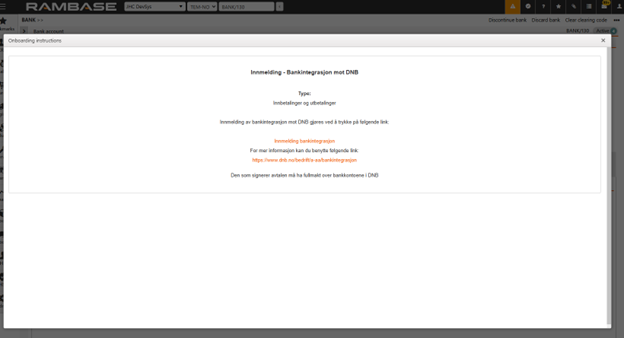

To activate the bank integration, the company must set up a banking agreement between company and bank. The process for this is different depending on the bank. By entering Onboarding instruction, you will see onboarding instructions.

The link which you receive from Onboarding instruction, shall be sent to the customer so that the customer can use this link when logging in to the online bank and apply for the bank integration.

NB: It is important that the customer informs the bank that approval of outgoing payments should be done in the online bank. Approval of outgoing payments is currently not supported by RamBase.

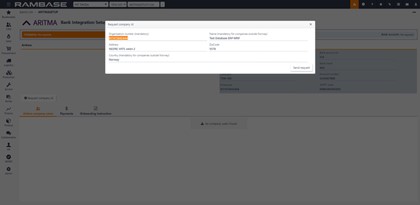

5. Onboarding process

When the customer has ordered the integration at the bank, the consultant can start the onboarding process with Aritma. Enter the Setup Aritma bank integration.

(Request Process):

Request Company ID

Request Service

NB! If the company being set up must approve the payments in the Aritma portal, then Bank approval must NOT be ticked. If Bank Approval is ticked, then approval of the payments must take place in the bank (the user must log in to the bank to approve the payments).

Request Bank Account

Request Company User:

For most banks it is not necessary to request company user. This is only necessary if the customer is using Nordea and don’t have “Corporate nettbank” or if they use some of the Eika banks.

For more information, see Bank specific information in the bottom of the documentation.

If you must create a company user the process for this is:

Add the user that shall send the payment. It is not recommended to fill out password in this step. When the user gets created, that person will get an email from Aritma with a link where the user can create a password.

NB: As mentioned the user will get an email from Aritma that a user has been created, so the user should be informed about this beforehand.

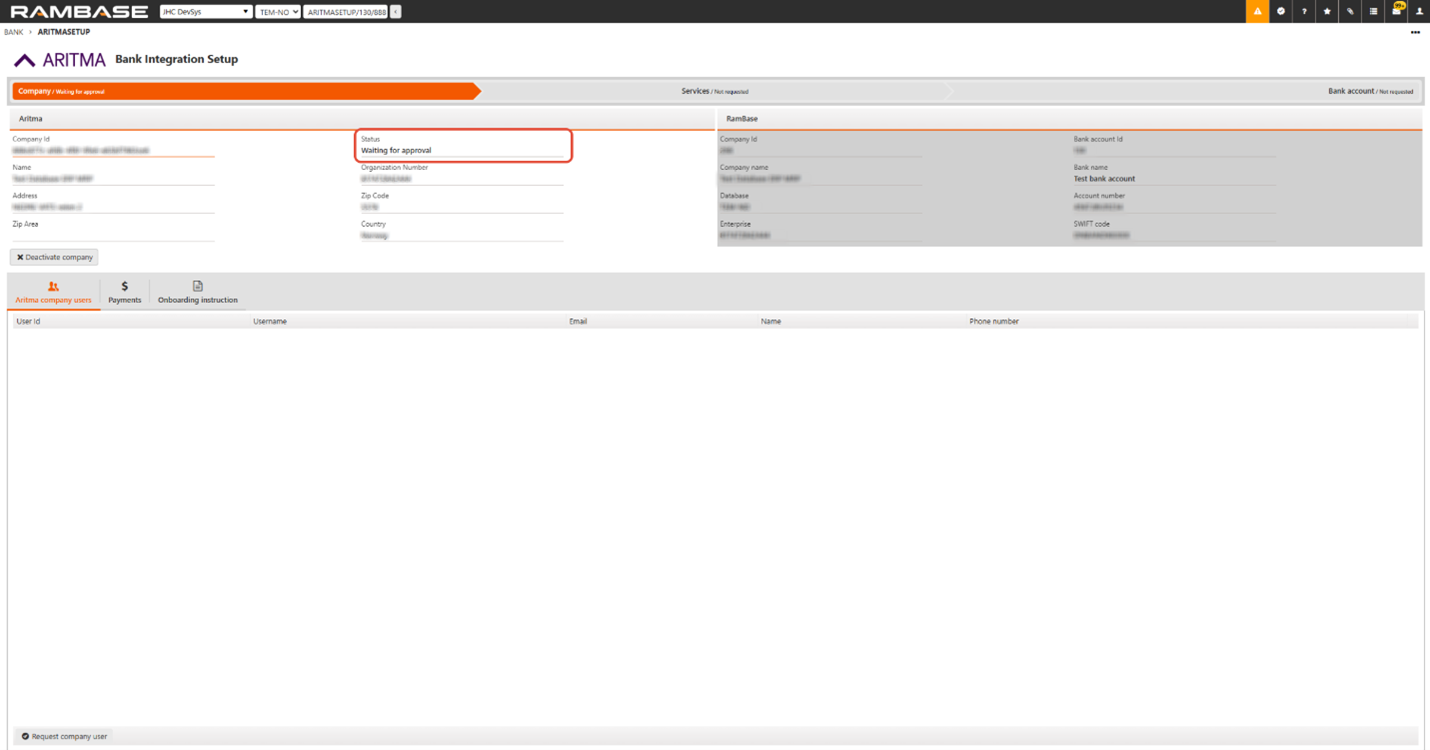

6. Status

Until the bank has finished their setup the status will be «WaitForAritmaApprove».

It is important NOT to tick the boxes for Activate Bank Statements, Activate remittance or Activate Incoming Payments before the status is Active. This will normally be the same day as the bank has finished their setup.

7. Active status

When status is changed to Active you could tick of the 3 boxes in the BANK application. The integrations are activated and ready to use when this is done.

Please note that it is not necessary to fill out Contract Id, User Name or Password.

8. Request process for more bank accounts for the same company

With regards to the request process, it is only necessary to run the Request bank account on the rest of the accounts as long as it is the same bank. If the bank is different, the same setup must be done all over for the new bank, including a new bank agreement with this bank.

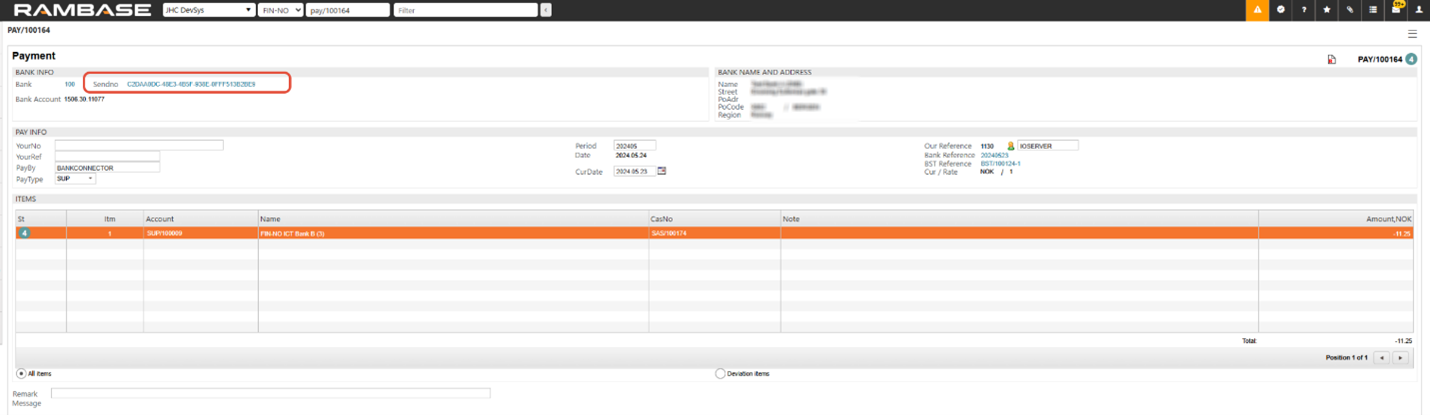

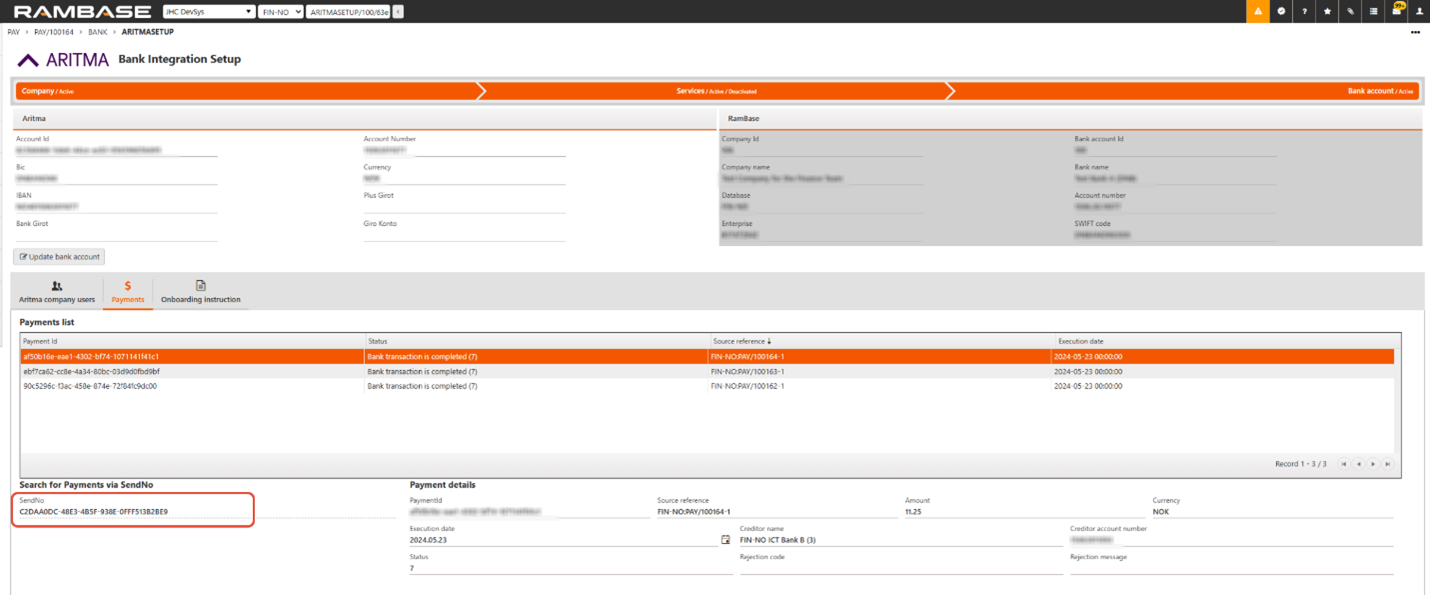

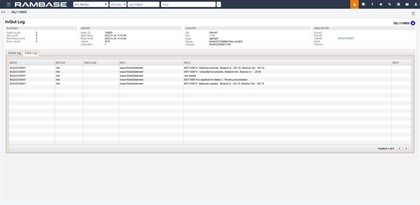

9. Check status on Payments remitted through the bank integration

Mark and copy the Sendno from the PAY you need more detail about:

Enter Setup Aritma bank integration and the Payment tab. In the Sendno field paste the Sendno and press enter

All the payments belonging to this Sendno is presented in the box Payments list. Mark the payment you wish to see more details about. The details are presented in the box Payment details:

10. Bank reconciliation document (BST)

When the first bank reconciliation document (BST) gets imported to RamBase, ingoing balance must match either the last Bank statement (BST) document, the last manual bank reconciliation (RECPAY) or the opening balance set up for the given BANK.

If this does not match, the Bank statement (BST) will stay in Status 2 with an error message.

To correct this, you must reconcile the bank until the date of the first Bank statement (BST) document. The first Bank statement (BST) document from the bank will only contain transactions and closing balance. To find the opening balance, RamBase calculated this by taking closing balance + transactions. It is the calculated opening balance that is controlled against either the last Bank statement (BST) document, the last RECPAY or opening balance setup up for the given BANK

To get this right you must reconcile the bank until the date of the first Bank statement (BST) document. The first Bank statement (BST) document from the bank will only contain transactions and outgoing balance. To find the ingoing balance, RamBase calculated this by taking outgoing balance + transactions. It is the calculated IB that gets controlled against either the last Bank statement (BST) documents, or balance on the given BANK.

To find out what calculated IB is and how big the difference is, you can enter the iol/bankstatement.balances and enter one of the jobs there. You will find one job per bank several times a day.

If you for some reason are missing Bank statement (BST) documents for a given period, it is possible to request historical transactions. In the Bank statement (BST) application user can use menu option Import Bank Statements from Bank Integration. Here you choose the bank account and from/to date. It is possible to request transactions back to the day the integration where activated.

Misc:

Aritma does not need information that a new customer has been onboarded. They receive this information through the API. But, if there is a demand of a specific start date or if they should deliver files from a given date, this must be emailed to them specifically. This information can be sent to: Support@aritma.com.

Bank specific information:

Nordea:

In Nordea you could either have a “Nettbank bedrift” deal or “Corporate Nettbank”. If the company has “Nettbank Bedrift” it is not possible to approve payments in the online bank. This is only possible then using “Corporate nettbank”. For companies with “nettbank bedrift” it is 2 alternatives to get outgoing payments to work using the bank integration:

Create a Corporate nettbank deal with Nordea.

Customer can approve payments on Aritma site by logging into pay.zdata.no with the user that gets created through the APIs by using “Request company user” in step 4.

Eika Banks:

Eika banks does not support approval of outgoing payments in the online bank. To get this to work the customer must approve payments by logging in to pay.zdata.no with the user that gets created through the APIs by using “Request company user” in step 4.

The Aritma bank integration set up must be done by a RamBase consultant or a RamBase partner consultant.