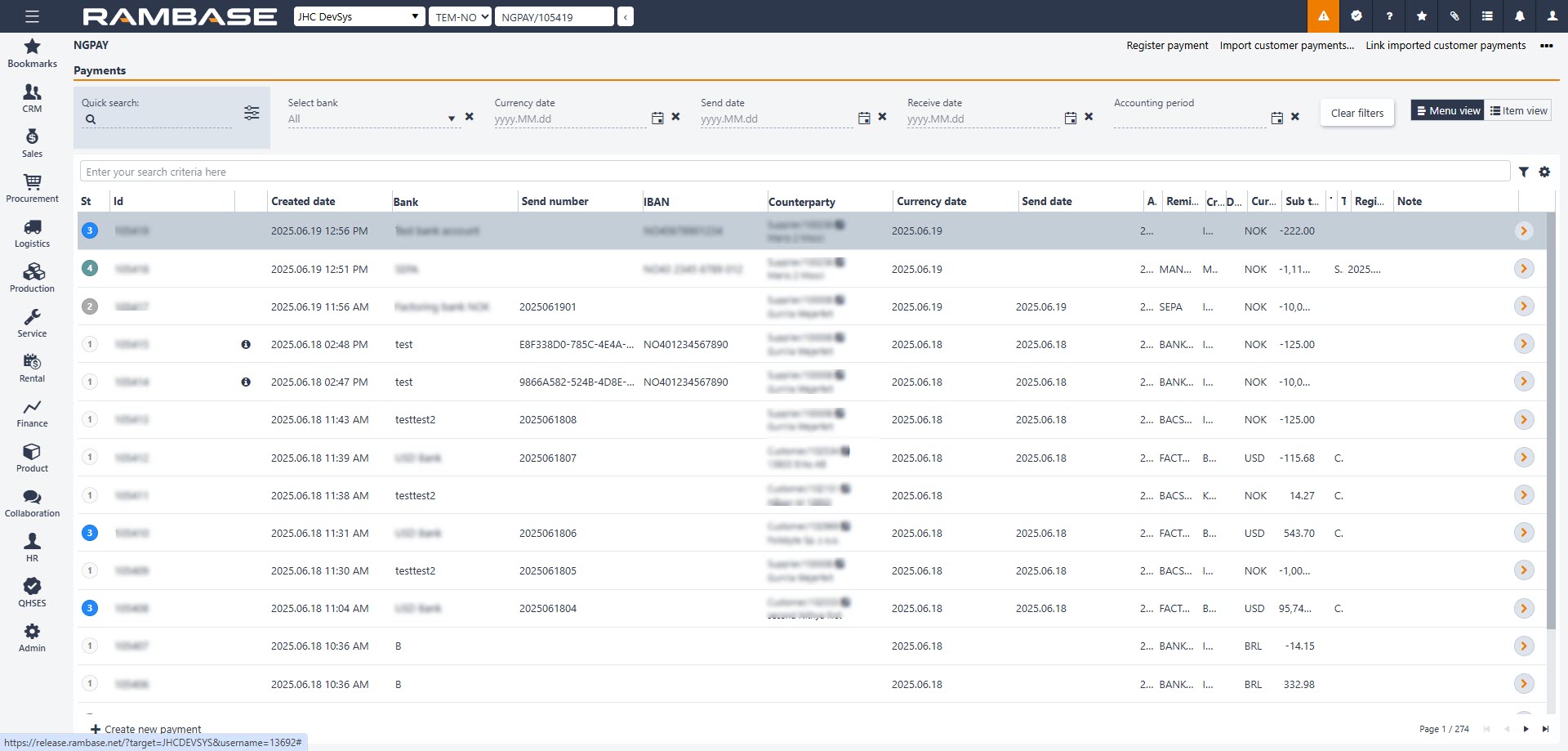

Payments (PAY) application

The Payments (PAY) application displays payment transactions along with all relevant details and information.

There are two ways to navigate to the application:

Option 1: RamBase menu→Finance→Cash management→Payments transactions

Option 2: Click the Program field and type PAY and press ENTER.

Header

After selecting the intended Payment (PAY) in the list, the user can further filter the list by using the options in the header area. The Payments area contains of fields, drop-down menus and buttons to help the user list only the intended Payments (PAY).

Columns | Description |

|---|---|

Quick search | Allows users to rapidly find transactions or data using keywords or filters. |

Select bank | Dropdown or input field to choose the desired bank. |

Currency date | Input field to choose the transaction date. |

Send date | Specifies the date when the transaction or request was initiated. |

Receive date | Indicates the date when the transaction or funds were received. |

Accounting period | Defines the financial period to which the transaction belongs. |

Clear filters | Removes all applied search filters. |

Menu view | Provides information about payments. |

Item view | Provides detailed information about payment items. |

List

The list in the Payments area will list all information for the selected Payments (PAY) based on the selections made in the header. The user can also customize which columns are to be displayed by using the Column settings.

The user can also further filter the Payments (PAY) displayed by using the Filter builder where the user can select from standard filters or even create custom filters. The standard filters and the available columns are described in the tables below.

Filter builder, Column settings and available columns

Search field - The Search filed can be used to search for specific Payments (PAY). Click the Search field and press SPACEBAR to list all the available parameters to search on.

Filter builder - Click the Filter builder icon to open a popup where the user can select filters from the Standard filters area. Selected filters will be visible below the Search field. Active filters are marked orange, inactive are marked gray. The user can also Create custom filters by selecting Field, Operator and Value in the Create custom filters area, and then pressing the Save filter button. Saved filters will be available from the My saved filters area. Click the intended saved filter to add it below the Search field.

Column settings - Click the Column settings icon to:

Export to excel - Will send an .xlsx file by email to user. The email is set up in the Personnel (PER) application.

Reset to default view - Reset all changes to selected columns and resizing of the area. This is useful if encountering unexpected errors.

Columns - Hover over to select which columns should be displayed in the list. The available columns are described in the table below.

Columns | Description |

|---|---|

St | Status of payment. |

Id | Payment identifier. |

Created date | Date and time of creation. |

Bank | Name of bank account. |

Send number | Send number. |

IBAN | The International Bank Account Number (IBAN) is an internationally agreed means of identifying bank accounts across national borders with a reduced risk of transcription errors. |

Counterparty | Identifier of the object. |

Currency date | Currency date of the transaction. |

Send date | Date when the payment was sent to the bank or in PAM the payment created. |

Accounting period | Accounting period. |

Remittance handling | Default value is retrieved from the used Bank. |

Created by | User identifier. |

Deviation | If the payment has items with deviations. |

Currency | Three character code following the ISO 4217 standard. |

Sub total amount | Total amount of the object currency. |

Term | Terms of payment. Default value is retrieved from the customer or supplier. |

Type | Type of counterparty with whom the payment is related. |

Registration date | Date of registration. |

Note | Additional information regarding the object (free text). |

Bank account id | Bank account identifier. |

Bank account | Account number used to identify the bank account. |

Bank currency | Currency used for the bank account. |

SWIFT code | The SWIFT (Society for Worldwide Interbank Financial Telecommunication) Code is a standard format for Business Identifier Codes (BIC) and it is used to uniquely identify banks and financial institutions globally. These codes are used when transferring money between banks, in particular for international wire transfer or SEPA payments. |

Bank phone | Bank phone number. |

Bank address line 1 | First address line. |

Bank address line 2 | Second address line. |

Bank postal code | Postalcode/Postcode/ZIP |

Bank city | City/town/village |

Bank country | English name of country. |

Bank country code | Two-character code identifying the country. |

General ledger account id | General ledger account identifier. |

General ledger account number | The account number of the general ledger account. |

General ledger account name | Name of the general ledger account. |

Bank statement id | Bank statement identifier. |

Bank statement accounting period | Accounting period to which the bank statement is related to. |

Total amount | Total amount. |