Konfiguracja reguł księgowania

[en] Standard sales and purchase accounts are set up in RamBase with reference to different VAT handling alternatives. The account setup can be overruled from the Product (ART) application.

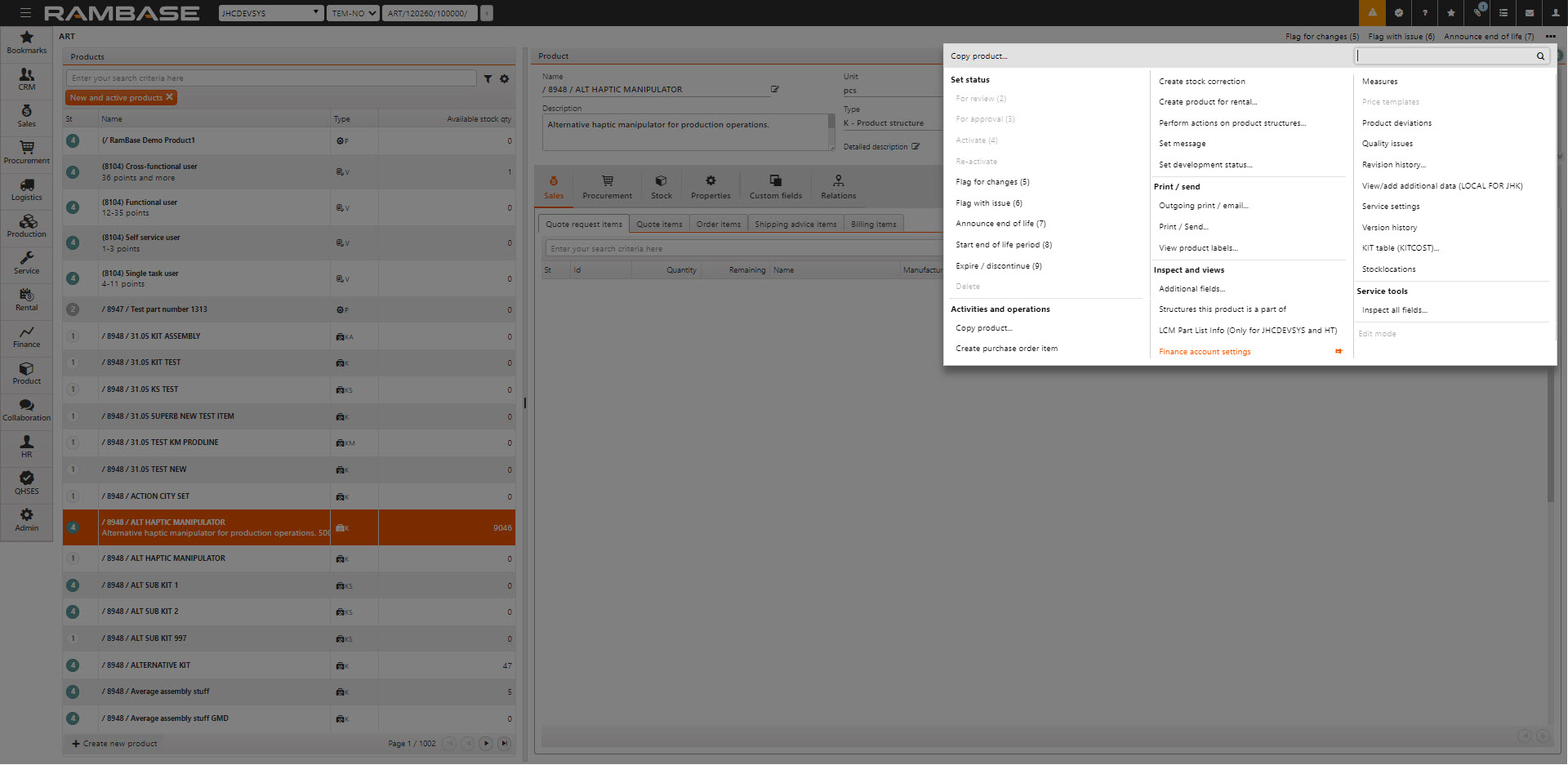

[en] Enter the product you wish to exempt from the VAT rules and select the Finance account settings option in the context menu.

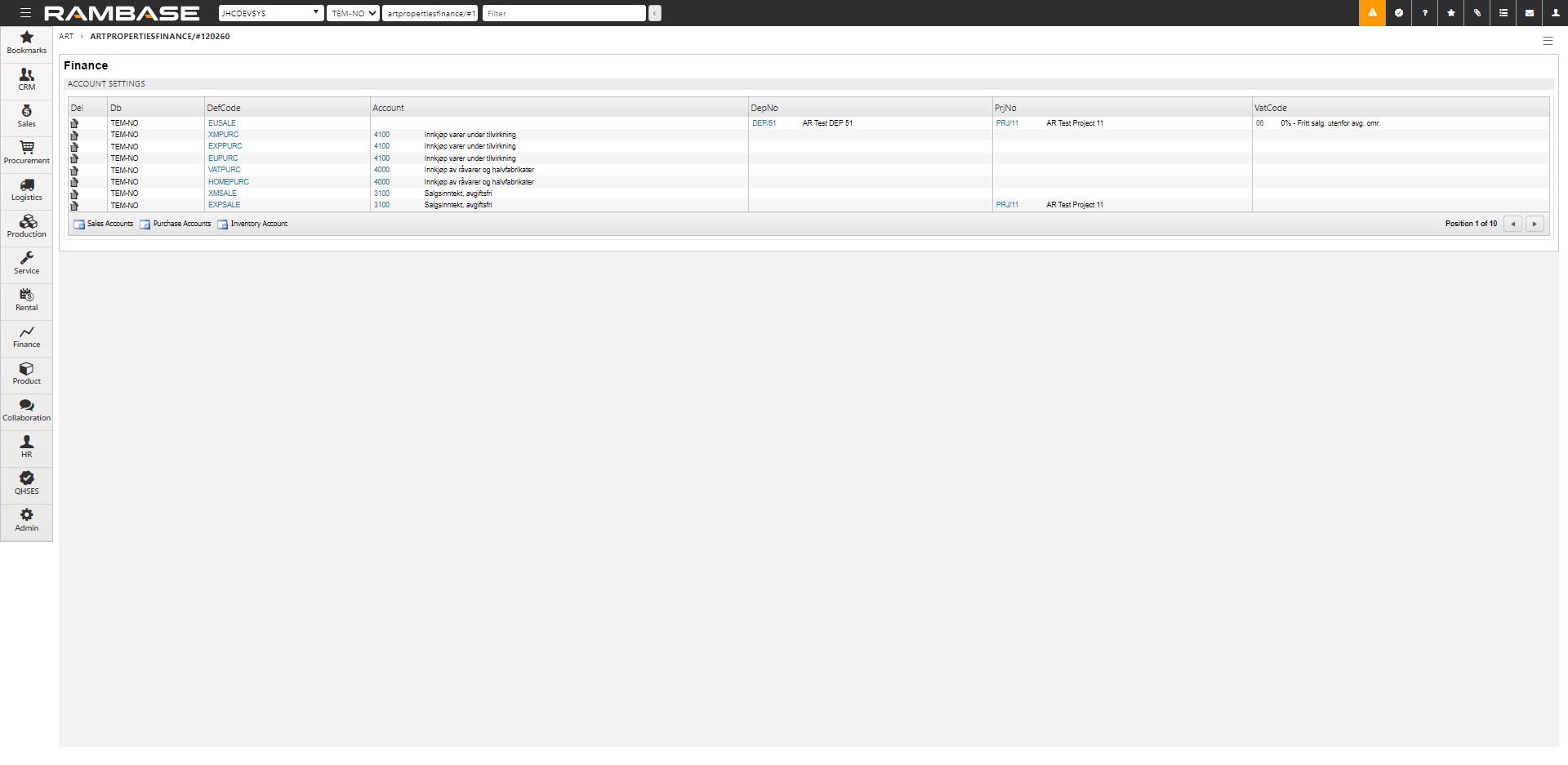

[en] This action will take you to the view below. The lines show the account setting for this product.

[en] To create a new exemption, click the icons in the lower left corner.

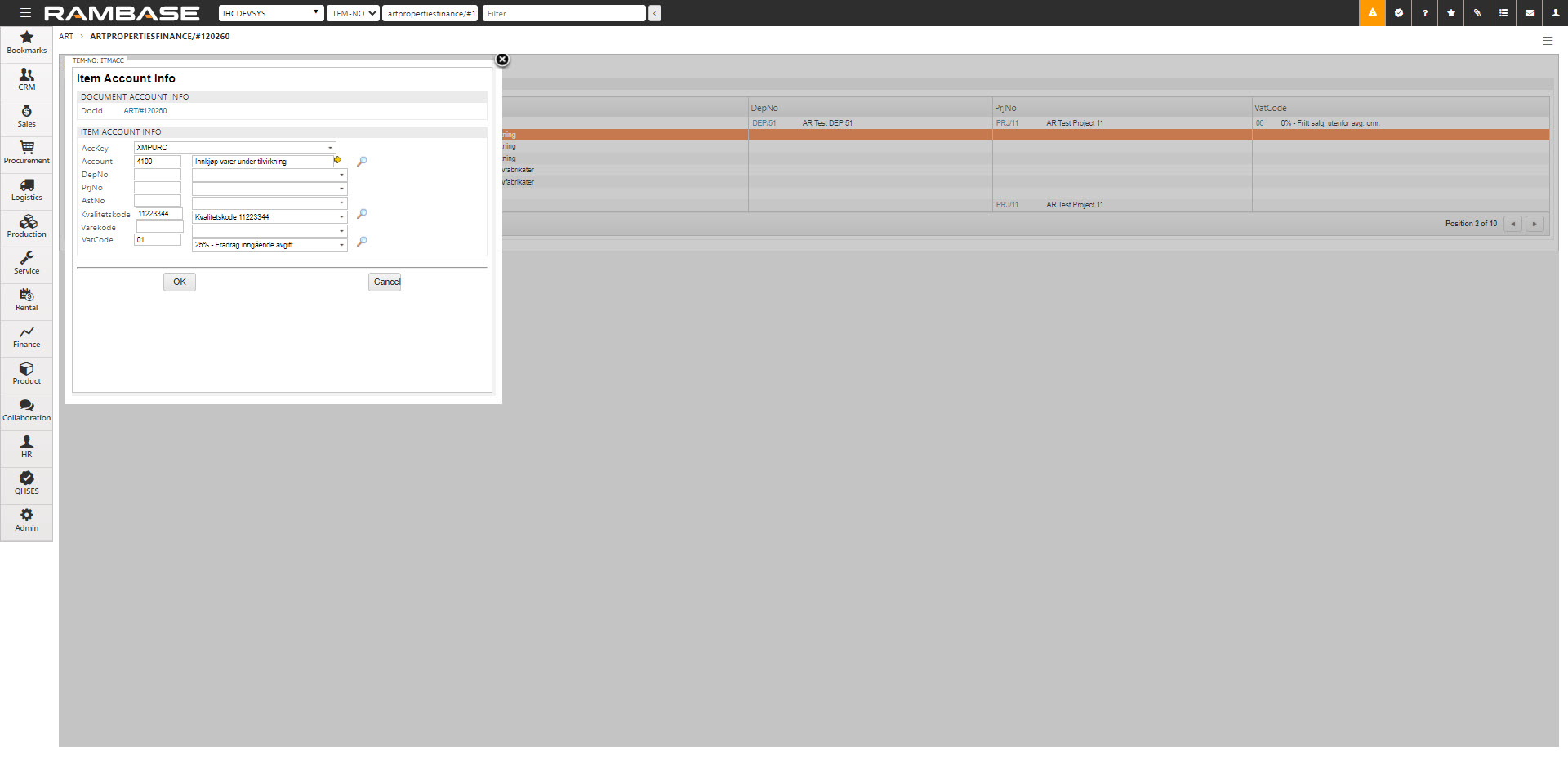

[en] This opens a popup where you can enter the details of the exemption. The rule will make exceptions for all the fields which are filled out in this popup.

[en] The AccKey field list different alternatives already defined in the VATCode setup (usually 5 rules for sale and 5 for purchase for each country).

[en] The Account field controls which account is used.

[en] The DepNo field controls which department is used.

[en] The PrjNo field controls which project is used.

[en] The VatCode field controls which value added tax code is used.

[en] Click OK when you are finished.