[en] Internal invoice in Poland (purchase from an EU country or a country outside the EU)

[en] This is a routine for internal invoice in Poland when the purchase is from an EU country or a country outside the EU.

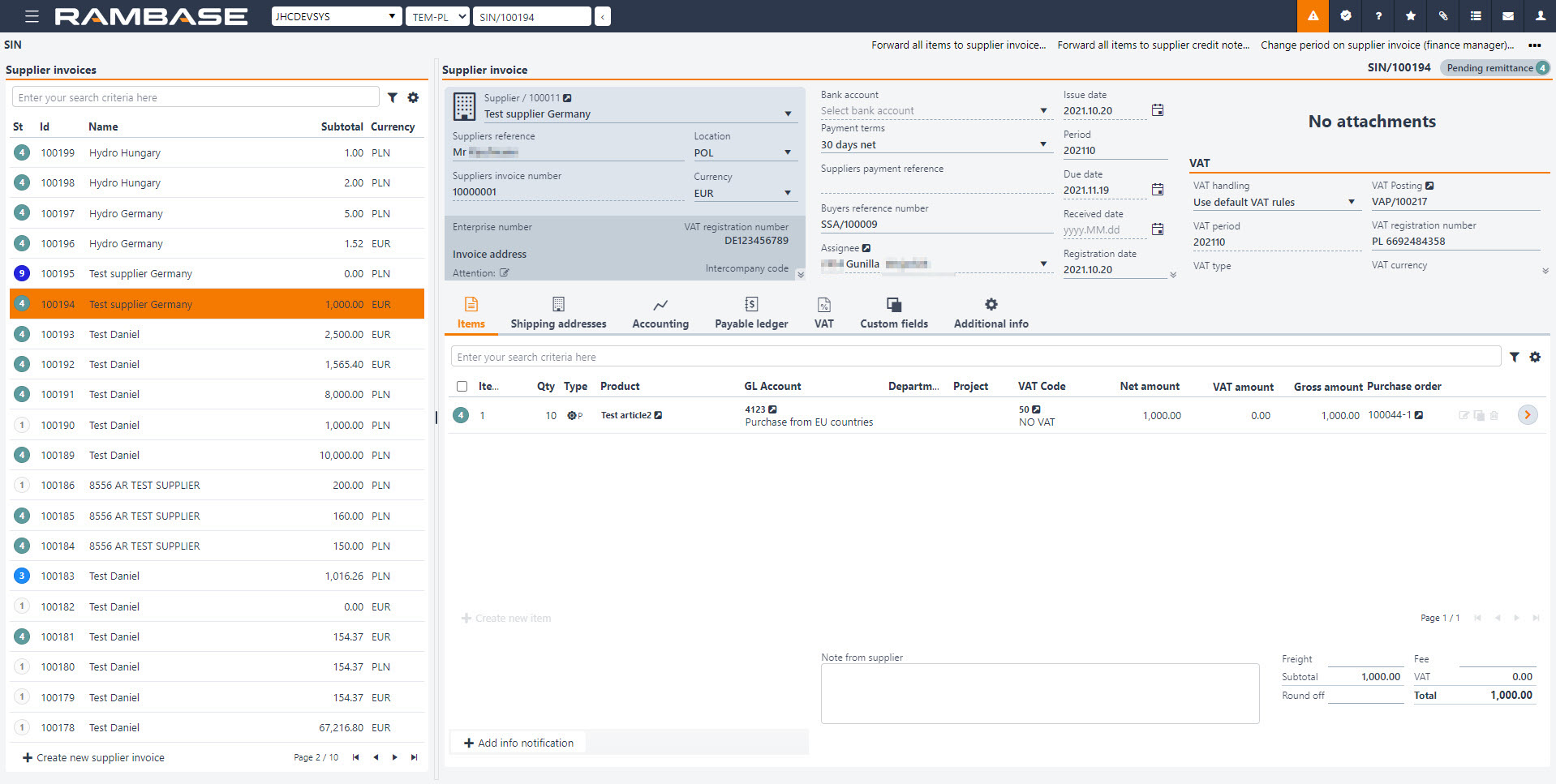

[en] Transport the Purchase order (SPO), Purchase order response (SOA) or Goods reception (SSA) to a Supplier invoice (SIN).

[en] Make sure the Supplier invoice (SIN) is posted against VAT code 50 (No VAT).

[en] Set invoice date, period and other useful information such as suppliers invoice number and more.

[en] Register the Supplier invoice (SIN) to Status 4 (Pending remittance). This invoice is for paying the Supplier (SUP).

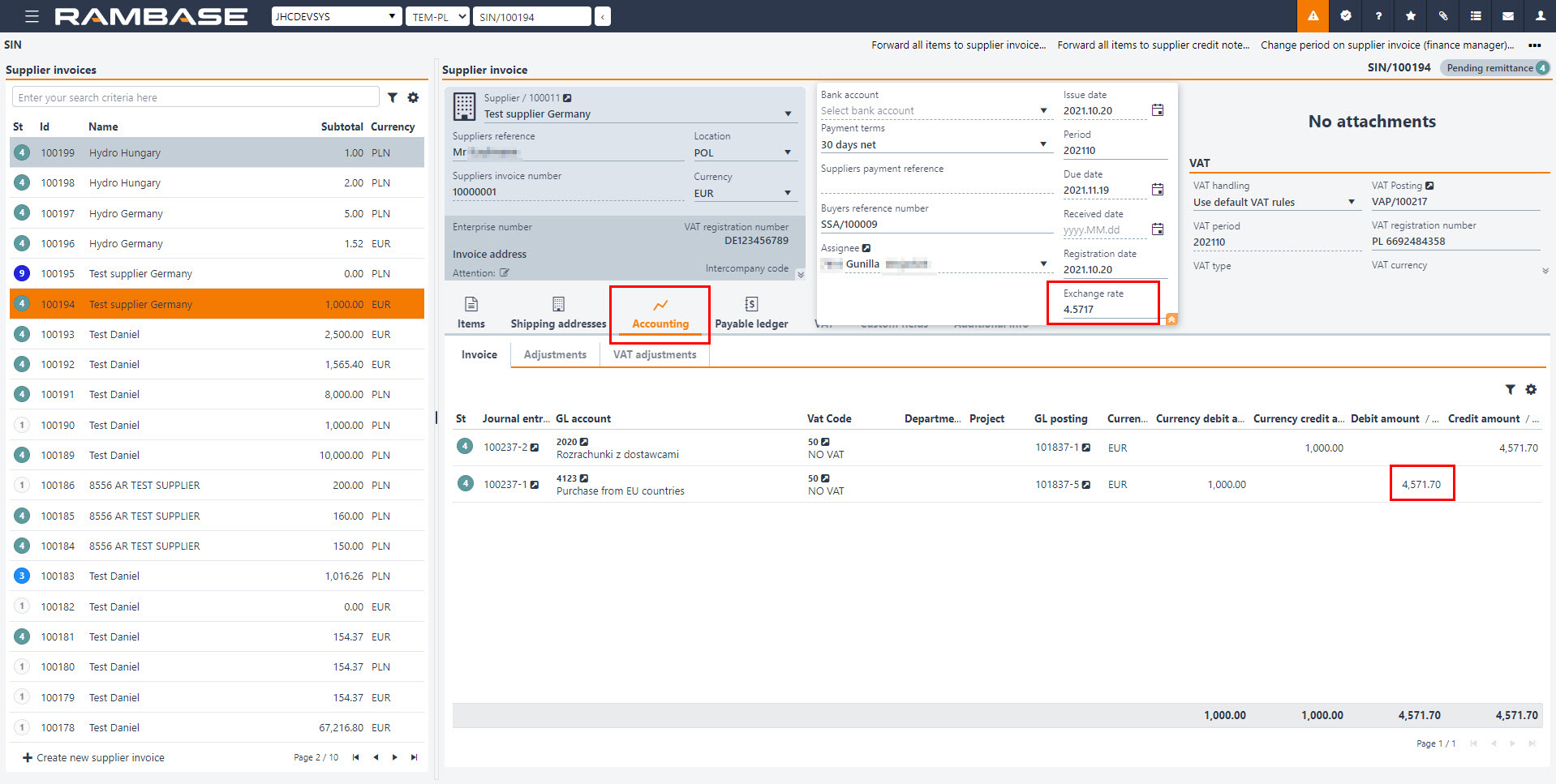

[en] Go to the Accounting tab in the Supplier invoice (SIN) to find the value in PLN, calculated based on the currency used in the Supplier invoice (SIN).

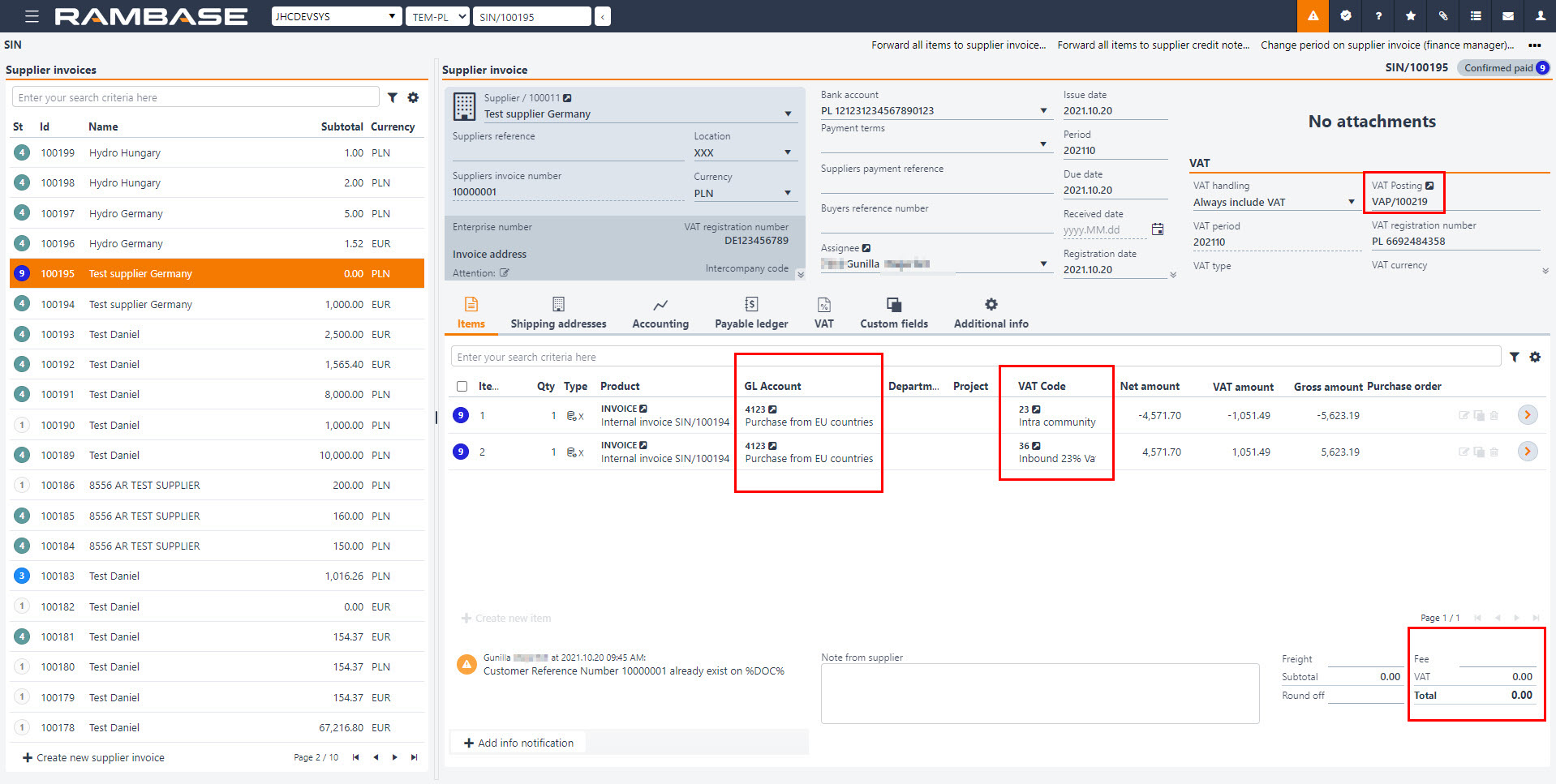

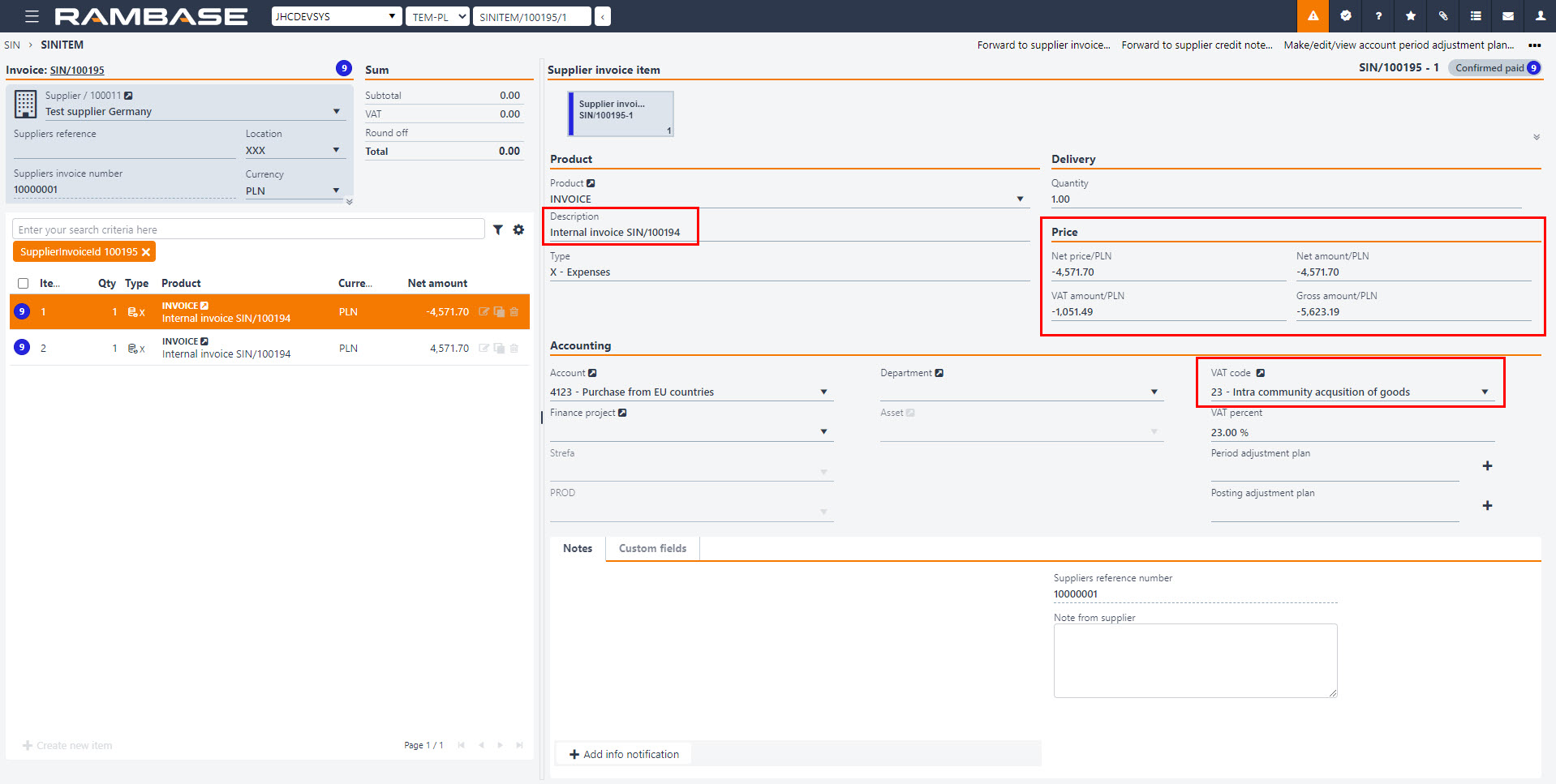

[en] Create a new Supplier invoice (SIN) with the same Supplier (SUP) account, suppliers invoice number, date and period.

[en] This Supplier invoice (SIN) should be in PLN, based on the PLN value of the first invoice.

[en] Set Always include VAT in the VAT handling field.

[en] Create item 1 on the Supplier invoice (SIN) with the Product (ART), INVOICE, or another dedicated Product (ART).

[en] Add explanation/information in the Description field.

[en] The amount on item 1 should be in credit (-).

[en] Choose the same account as the first invoice and VATcode 23, 24, 25 or 26.

[en] Create item 2 on the Supplier invoice (SIN) with the Product (ART), INVOICE, or another dedicated Product (ART).

[en] Add explanation/information in the Text field.

[en] The amount on item 2 should be in debit (+).

[en] Choose the same account as the first invoice and VATcode 36, 37, 38 or 39 for purchases, or 45, 46, 47 or 48 for purchase of fixed assets.

[en] Register the Supplier invoice (SIN) with the Register supplier invoice option in the context menu.

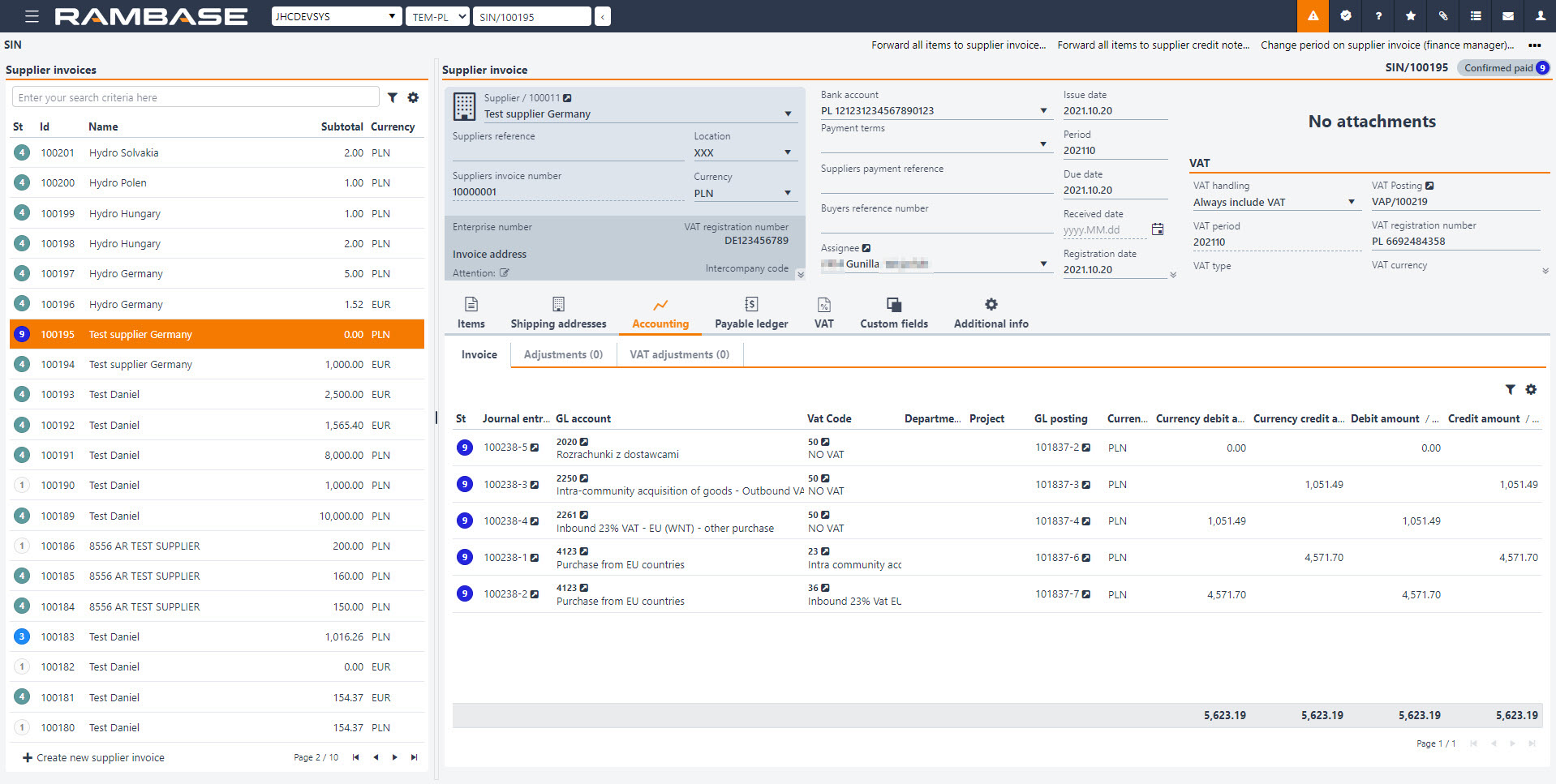

[en] The sum of the second invoice should be 0, therefor the Supplier invoice (SIN) goes to Status 9 (Confirmed paid).

[en] Main level:

[en] Item level:

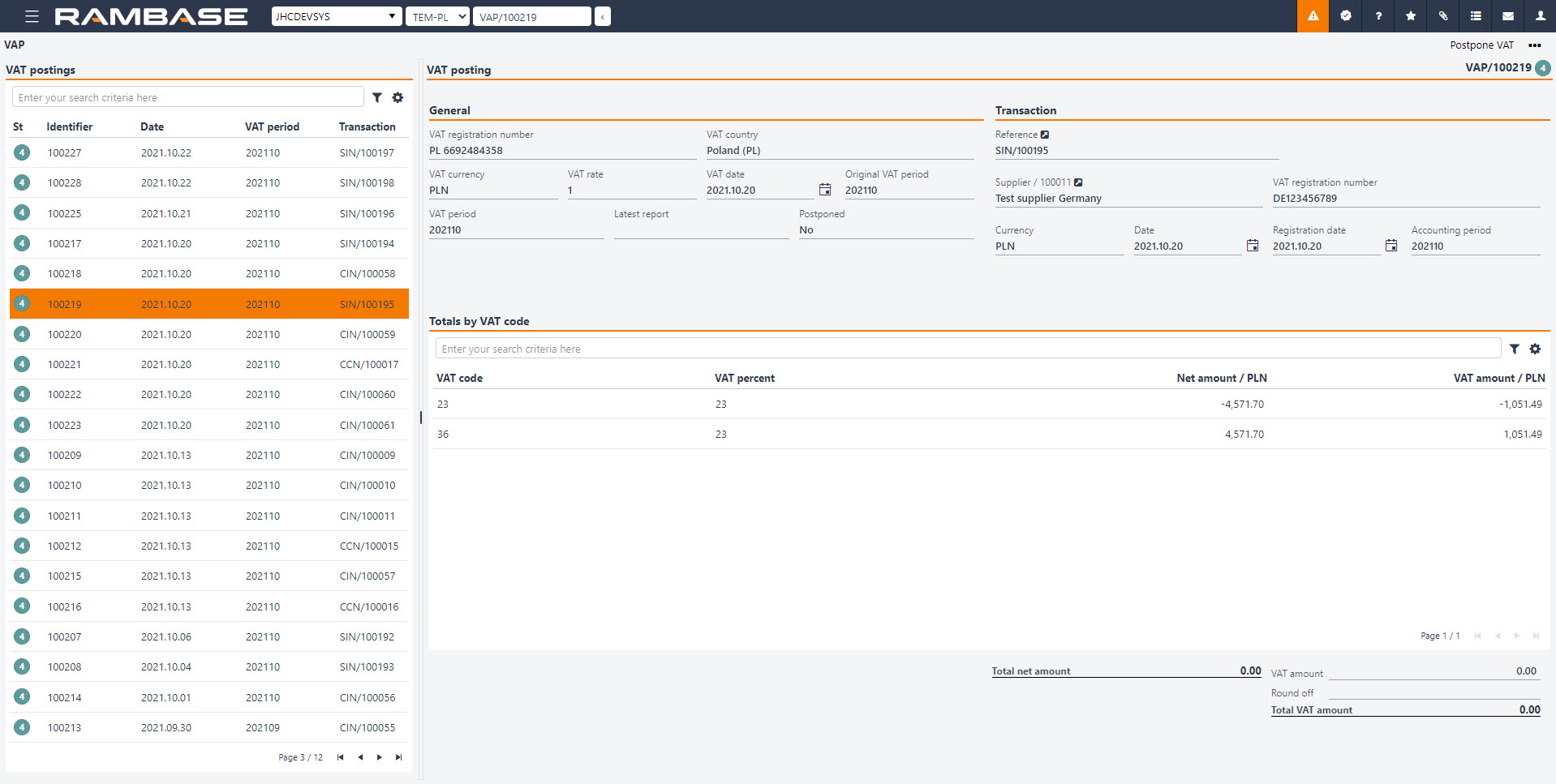

[en] The VAT calculation is done in the VAT posting (VAP) document, but the total VAT amount is 0.

[en] The posting to the general ledger for the internal invoice will look like this: