[en] Posting an invoice in currency different than local currency where the VAT should be posted in local currency

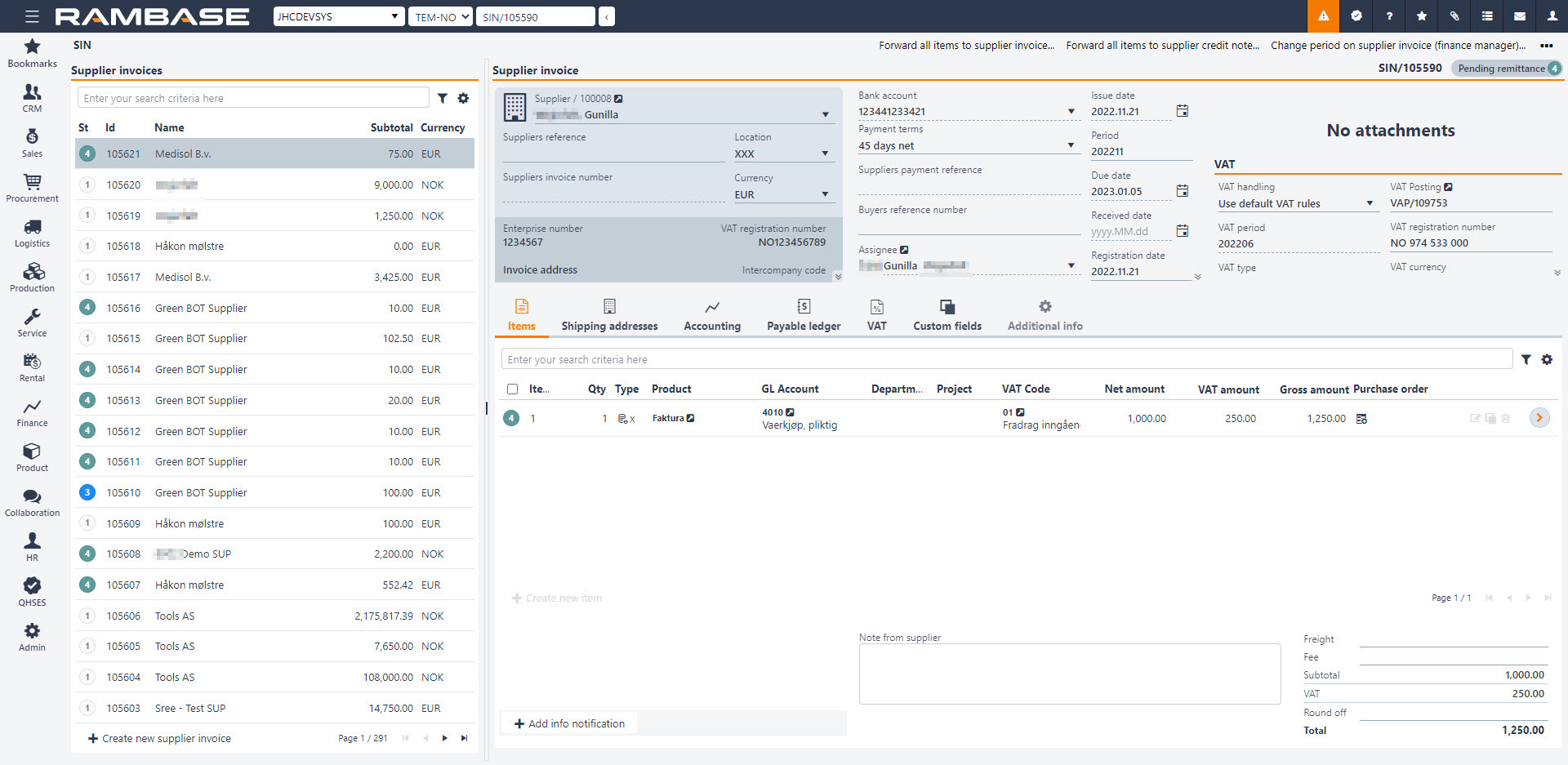

[en] The invoice is in a currency (EUR) other than the local currency (NOK), but the VAT must be entered in local currency (NOK) to a specific amount stated on the invoice. Create the invoice and add the invoice items.

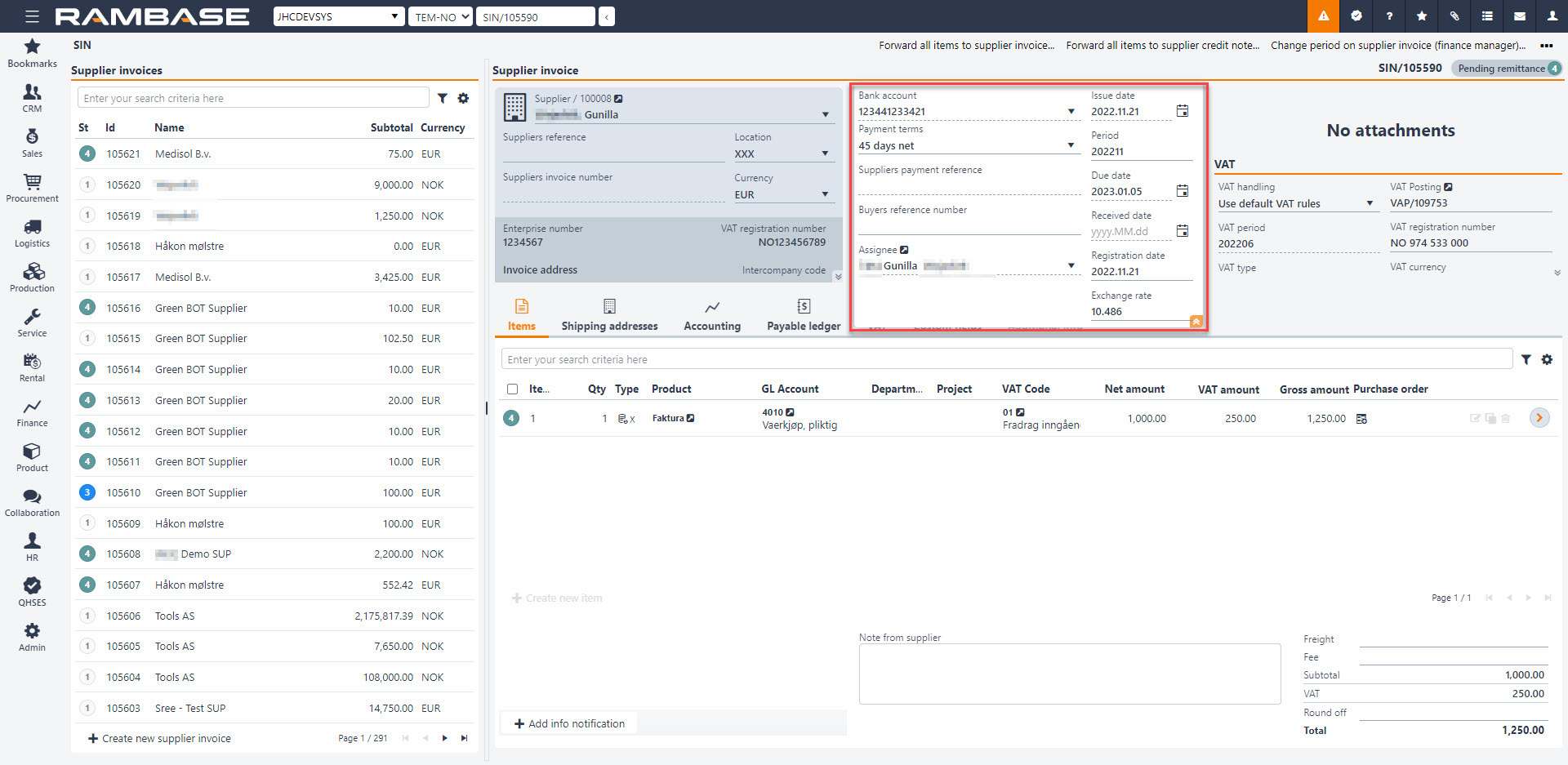

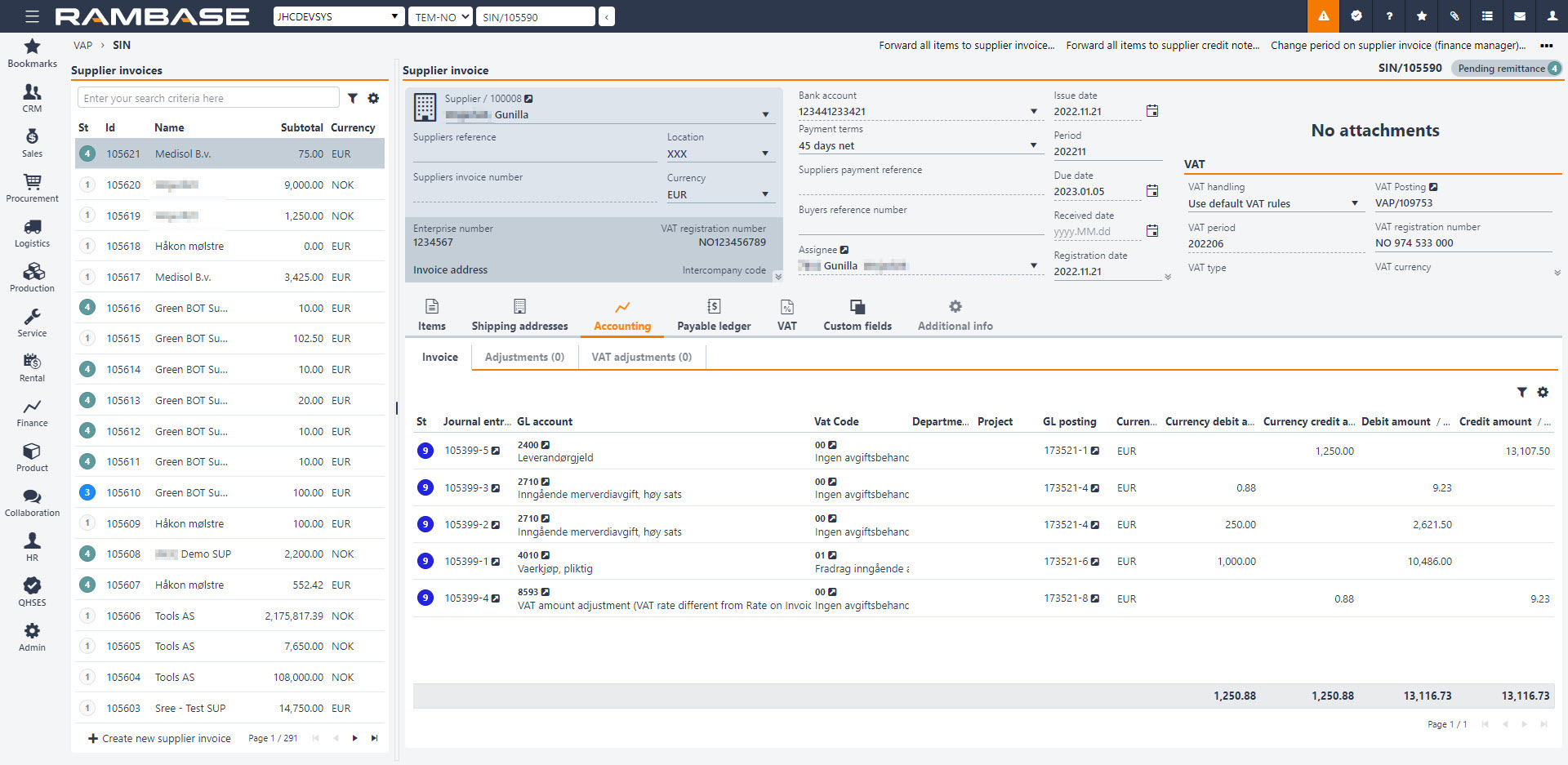

[en] In this example, the Exchange rate is 10.486.

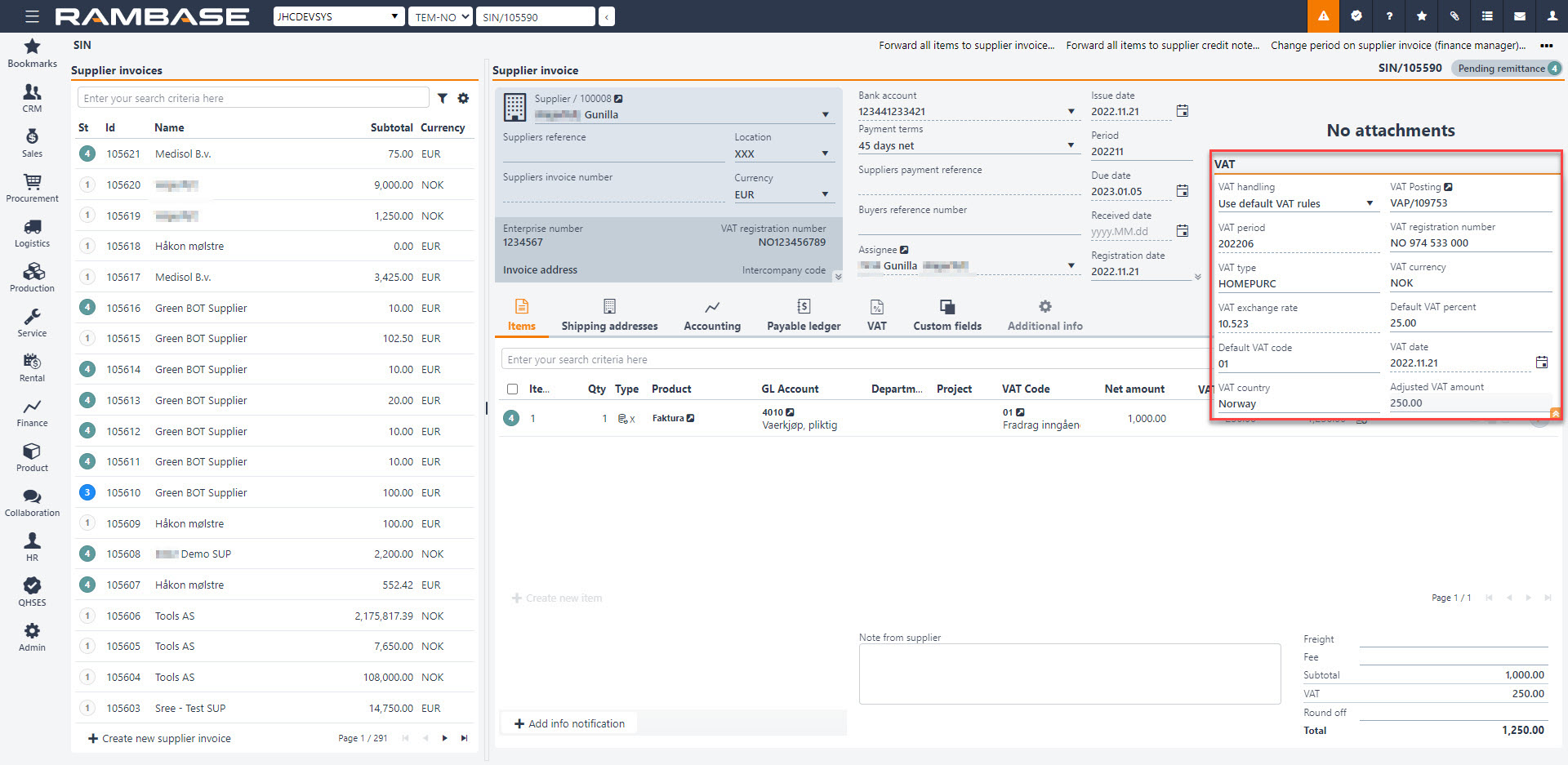

[en] Open fields for VAT and change the VAT exchange rate. In this example to 10.523

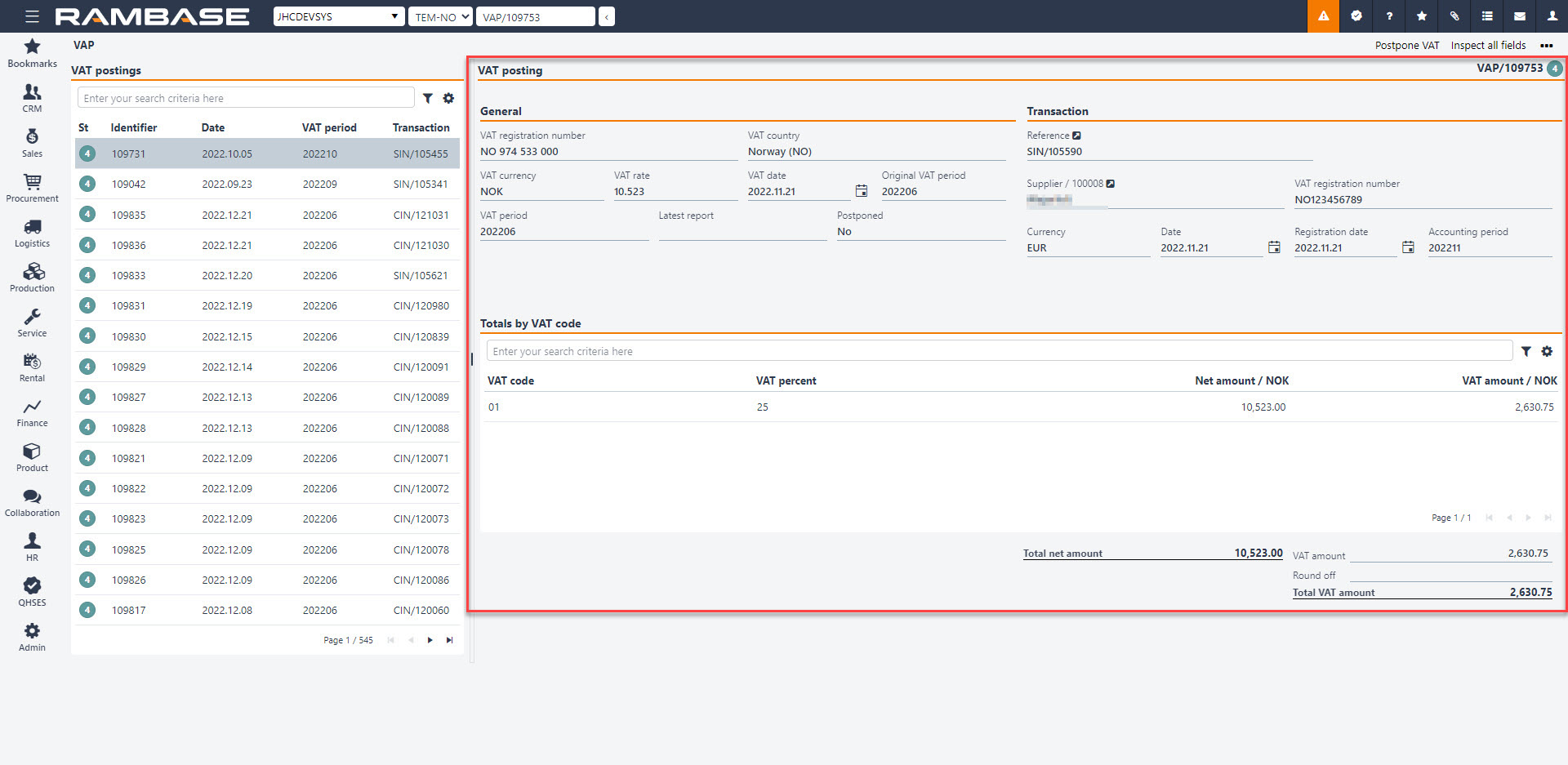

[en] Register the invoice to Status 4. On the VAP document you can see that the VAT rate is 10,523 and the VAT amount in NOK. VAP is the basis for VAT reporting. The VAT amount is registered in VAP in the currency with which the VAT code used is set up in the VAT register (In the VAP document this is stated as VAT currency)

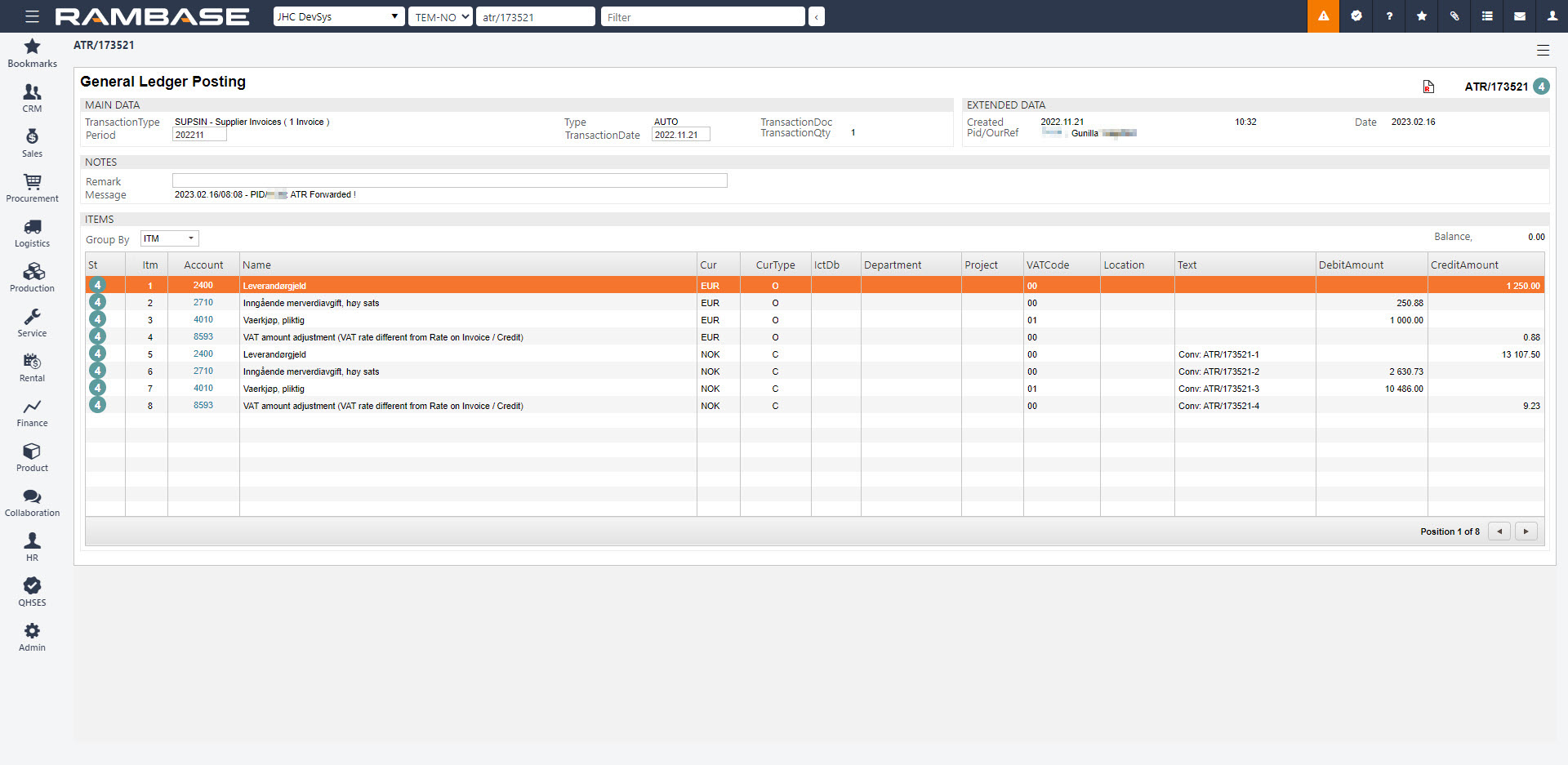

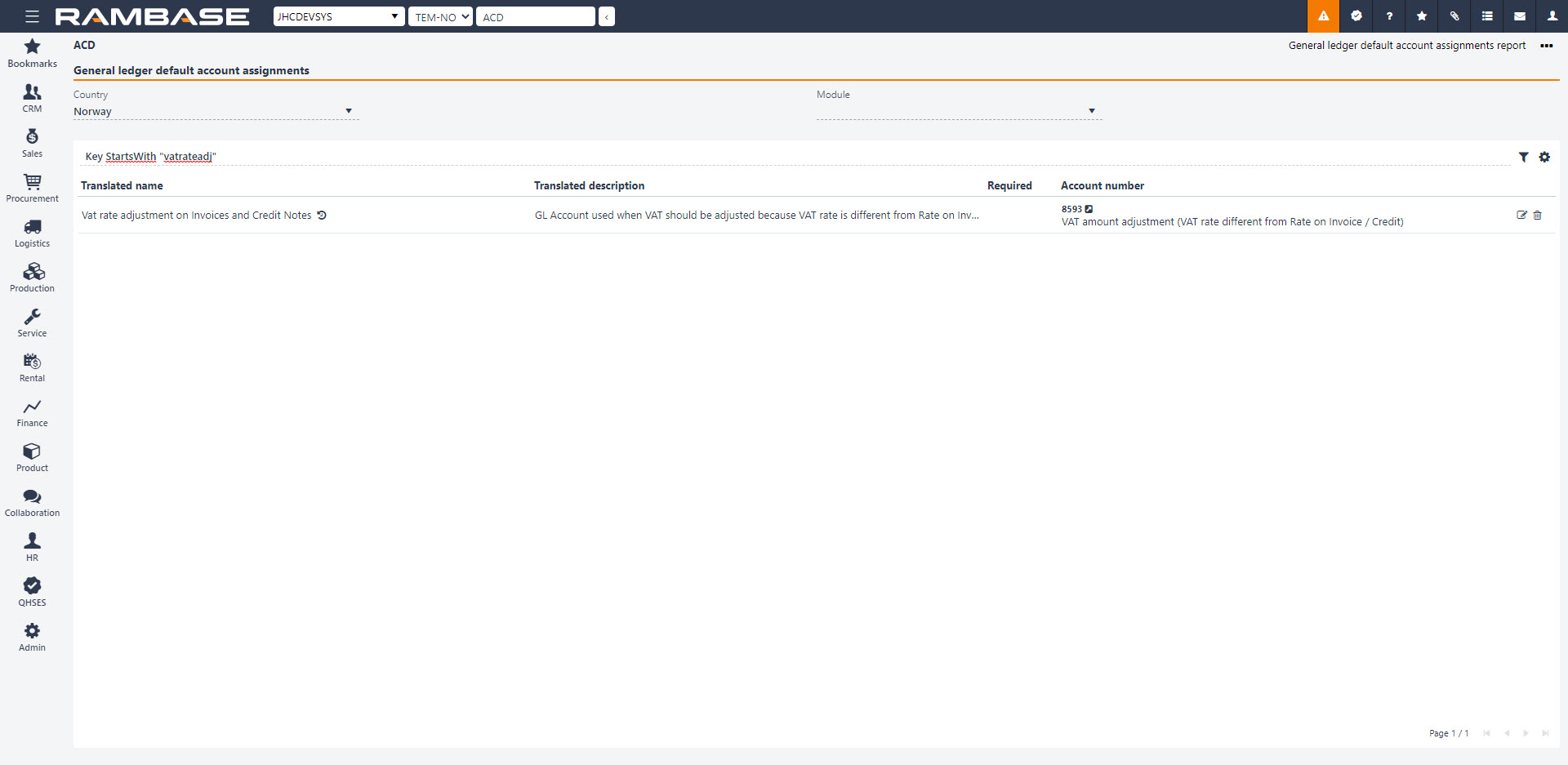

[en] In the journal entry, a separate entry has been created, posting the VAT amount change to the default account in the ACD/VATRATEADJ setup. In this example account 8395.

[en] Image of default account for VATRATEADJ in the general ledger default account assignments (ACD) archive:

[en] The journal entry is loaded to the general ledger.